Embarking on the thrilling realm of options trading can be both exhilarating and daunting. As a seasoned trader myself, I’ve navigated the intricacies of dough options and witnessed firsthand their transformative power. In this comprehensive review, I’ll delve into the essence of dough options, unravel their benefits, and arm you with the knowledge to unlock market dominance. So, fasten your seatbelts, dear traders, as we embark on a journey that will redefine your trading prowess.

Image: download.cnet.com

Dough Options: Unveiling the Enigma

Dough options, an innovative spin-off of traditional options, offer traders an unparalleled opportunity to amplify their profit potential while mitigating risks. At their core, dough options represent contracts that grant holders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. This unique structure empowers traders to speculate on price movements, hedge existing positions, and generate income through premium returns.

Navigating the Facets of Dough Options

- Underlying Asset: Dough options can be linked to a plethora of underlying assets, including stocks, commodities, indices, and currencies.

- Strike Price: This refers to the price at which the underlying asset can be bought or sold.

- Expiration Date: Determine the date on which the option contract expires and becomes worthless.

- Option Premium: Represents the cost incurred by the buyer to acquire the option contract.

- Call Option: Grants the holder the right to purchase the underlying asset at the strike price before or on the expiration date.

- Put Option: Bestows upon the holder the right to sell the underlying asset at the strike price before or on the expiration date.

Exploring the Benefits of Dough Options

Dough options have a myriad of advantages that set them apart in the options trading arena.

- Enhanced Profit Potential: Leverage is a key feature of dough options, allowing traders to amplify their potential returns with limited capital investments.

- Risk Management: Traders can employ dough options to hedge against adverse price movements and safeguard their portfolios from losses.

- Income Generation: Selling dough options premiums can provide steady streams of income regardless of market conditions.

- Flexibility: The customizable nature of dough options allows traders to tailor strategies to suit their risk appetite and market outlook.

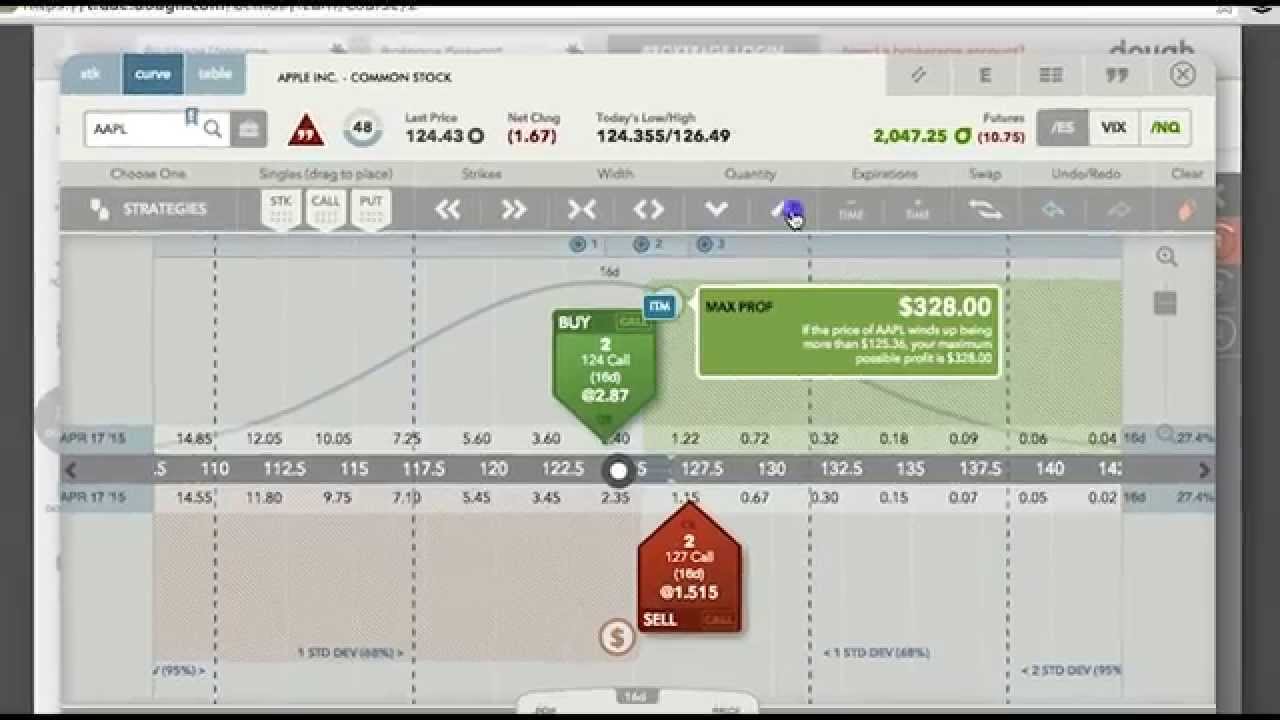

Image: www.youtube.com

Tips and Expert Advice for Dough Trading Dominance

Mastering dough options trading demands a strategic approach and informed decision-making. Here are some priceless tips and expert advice to elevate your trading performance:

- Research and Education: Educate yourself thoroughly on dough options mechanics, market dynamics, and trading techniques.

- Risk Management: Establish robust risk management protocols to safeguard your capital and mitigate potential losses.

- Technical Analysis: Utilize technical indicators and charting techniques to identify optimal entry and exit points for trades.

- Monitor Market Conditions: Keep abreast of economic indicators, news events, and market sentiment to gauge market trends and adjust strategies accordingly.

FAQ on Dough Options: Empowering Your Knowledge

To further solidify your understanding of dough options, here are some frequently asked questions with concise answers:

Q: What are the main differences between dough options and regular options?

A: Dough options offer customizable contract terms, including flexible expiration dates and strike prices, providing traders with greater flexibility.

Q: Is dough options trading suitable for beginners?

A: While dough options offer significant potential, they are recommended for experienced traders who possess a deep understanding of options trading and risk management techniques.

Q: Can I lose more than my initial investment with dough options?

A: Yes, due to the leveraged nature of dough options, losses can potentially exceed the initial investment amount. Careful risk management is crucial to mitigate this risk.

Dough Options Trading Review

Image: www.reddit.com

Conclusion: The Path to Trading Success

Dough options, with their unparalleled flexibility and profit-generating capabilities, empower traders to navigate the ever-changing market landscape and achieve their financial aspirations. By embracing the tips, expert advice, and knowledge presented in this comprehensive guide, you can unlock the gateway to dough options trading success and experience the exhilarating rush of market dominance. Are you ready to embark on this transformative journey and unleash the boundless possibilities of dough options trading?