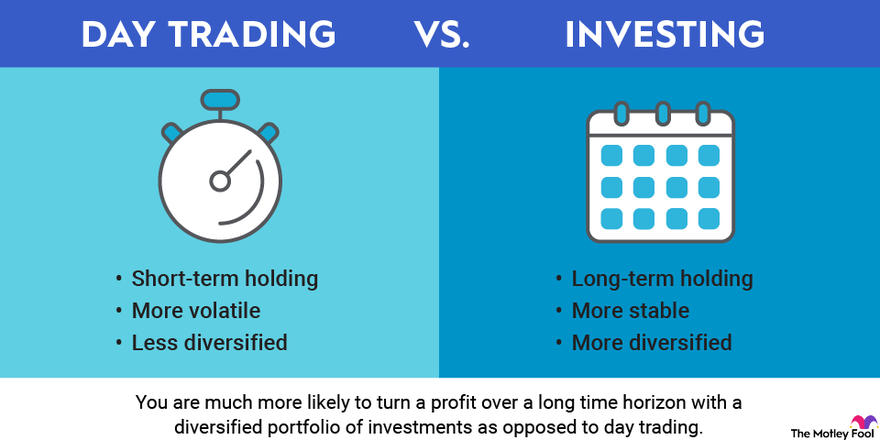

In the tumultuous realm of financial markets, where fortunes are won and lost in the blink of an eye, day trading stands out as a captivating blend of thrill and risk. As an enticing proposition for those seeking rapid financial gains, day trading involves buying and selling financial instruments within a single trading day, leveraging small price movements to generate profits. However, for the uninitiated, navigating the intricacies of day trading can be akin to venturing into uncharted territory. Among the many questions that arise for aspiring day traders, one that frequently surfaces is whether day trading encompasses the realm of options trading.

Image: www.fool.com

Unveiling the Nature of Options Trading

To fully grasp the relationship between day trading and options trading, it is essential to first delve into the fundamentals of options trading. Options, in their essence, are financial contracts that grant the holder the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price, known as the strike price, at or before a specified expiration date. Unlike stocks, which represent an ownership interest in a company, options provide the holder with the flexibility to speculate on the price movement of an underlying asset without the need for direct ownership.

The Incursion of Options into the Day Trading Arena

Day trading and options trading, while distinct concepts, often intertwine in the hands of adept traders. Day traders who incorporate options into their strategies leverage the unique characteristics of this financial instrument to amplify potential profits and tailor their risk exposure. A common practice among day traders is to purchase short-term options with expiration dates within the same trading day, enabling them to profit from intraday price fluctuations. This strategy provides greater flexibility and leverage compared to trading the underlying asset directly.

Unveiling the Synergies and Divergences of Day Trading and Options Trading

The synergistic embrace of day trading and options trading stems from the ability of options to offer a multitude of strategies that cater to diverse market scenarios. Day traders can employ options to capitalize on price movements, regardless of market direction. For instance, a trader anticipating an uptrend in the stock market can opt for a call option, whereas a trader foreseeing a downtrend can choose a put option.

In contrast, there are also notable divergences between day trading and options trading. Unlike traditional day trading, which involves buying and selling stocks within a single trading session, options trading introduces the element of time, as options contracts typically have predefined expiration dates. Moreover, options trading requires an in-depth understanding of the intricacies of options pricing, option Greeks, and implied volatility, which adds a layer of complexity that novice traders may find challenging.

Image: tradebrigade.co

Navigating the Perils and Rewards of Options Day Trading

While options trading can be an alluring path for experienced day traders seeking to enhance their profit potential, it is imperative to recognize the inherent risks associated with this endeavor. Options are highly leveraged instruments, meaning they offer the potential for both substantial gains and losses, amplifying the risk factor. Moreover, the time decay associated with options requires day traders to possess a heightened sense of market timing and discipline to mitigate potential losses.

Embarking on Options Day Trading with a Strategic Mindset

For those captivated by the allure of options day trading, adopting a strategic approach is paramount. Seasoned traders emphasize the importance of meticulous research, comprehensive understanding of options pricing, and the ability to manage risk effectively. Moreover, it is crucial to develop a robust trading plan that outlines entry and exit points, risk tolerance, and predefined profit targets.

Does Day Trading Include Options

Image: tradeproacademy.com

Attaining Proficiency in Options Day Trading: A Journey of Learning and Execution

Excelling in options day trading requires a continuous commitment to learning and refining one’s skills. Aspiring traders are well-advised to familiarize themselves with comprehensive educational resources, engage in simulated trading environments, and seek mentorship from experienced practitioners to enhance their knowledge and confidence.

In conclusion, the world of day trading encompasses a spectrum of strategies that includes options trading, offering day traders an expanded arsenal to navigate the financial markets. While options trading can provide opportunities for enhanced gains, it is crucial to approach this endeavor with a discerning eye, acknowledging the inherent risks and the need for a strategic mindset. Through meticulous research, continuous learning, and disciplined execution, aspiring options day traders can unlock the potential to make informed decisions in the fast-paced world of day trading.