Introduction

Image: www.youtube.com

The world of trading options can be both exhilarating and daunting, inviting you to venture into a realm where financial possibilities unfold. Whether you’re a seasoned trader or just starting your journey, this comprehensive guide will lead you through the labyrinth of options trading, empowering you with insights, strategies, and techniques to navigate the market’s enigmatic depths.

Options, financial instruments with immense versatility, present traders with the power to navigate market uncertainties, hedge risks, and potentially generate significant returns. Understanding the intrinsic nuances of these multifaceted instruments is paramount for anyone seeking financial success.

Understanding Options: A Foundation of Knowledge

Before embarking on your options trading odyssey, it is essential to grasp the core concepts that govern these intricate instruments. An option, simply put, bestows upon its holder the right, but not the obligation, to either buy (in the case of a call option) or sell (in the case of a put option) a predetermined underlying asset at a fixed price. This right comes at a cost known as the option premium, the price paid to acquire this valuable contractual agreement.

The underlying asset can be diverse, encompassing stocks, bonds, commodities, or even other options. The strike price, another crucial element, represents the price at which the holder may exercise their option. Exercise, the act of converting the option into a purchase or sale of the underlying asset, occurs when the option is “in the money,” meaning the underlying asset’s market price aligns favorably with the strike price.

Exploring the Options Market: Strategies for Success

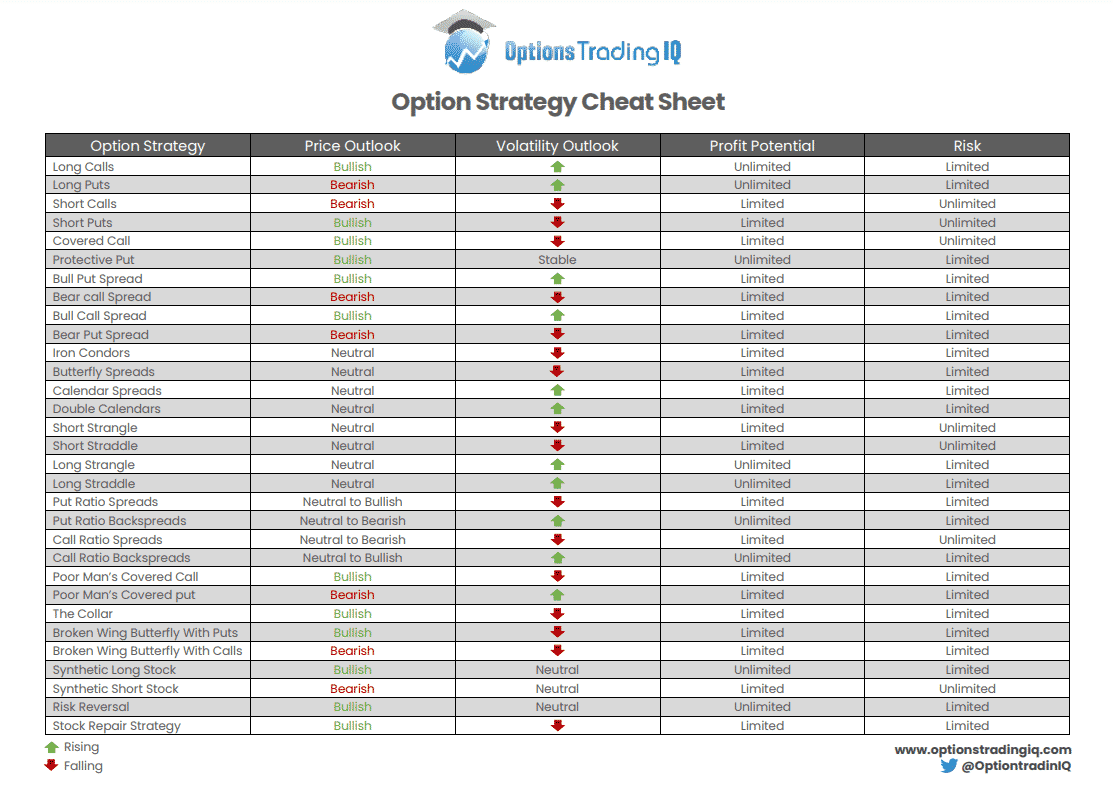

The options market offers a vast array of strategies, each tailored to specific market conditions and risk appetites. Understanding these strategies will bolster your preparedness as you navigate the market’s evolving landscape.

Covered Call: This time-honored strategy involves selling a call option while simultaneously owning the underlying asset. By selling the option, you receive the premium, potentially generating income while retaining ownership of the underlying asset. However, you relinquish the right to sell the underlying asset above the strike price.

Protective Put: Seeking to safeguard your portfolio against potential declines? Employ a protective put strategy, where you purchase a put option while owning the underlying asset. This defensive tactic provides a safety net, ensuring that if the underlying asset’s value plummets, you have the option to sell at the predetermined strike price.

Bull Call Spread: When you anticipate a rise in the underlying asset’s value, consider implementing a bull call spread. This entails purchasing a call option with a lower strike price and simultaneously selling a call option with a higher strike price. This strategy allows you to profit from a moderate increase in the underlying asset’s price while limiting your risk.

Bear Put Spread: Conversely, if you foresee a decline in the underlying asset’s value, a bear put spread is your ally. This strategy involves selling a put option with a lower strike price while simultaneously purchasing a put option with a higher strike price. This strategic positioning enables you to capitalize on a moderate decrease in the underlying asset’s price.

Conclusion

The realm of options trading, brimming with challenges and opportunities alike, demands a discerning approach from its participants. A thorough understanding of the core concepts, coupled with a mastery of diverse trading strategies, will guide you toward successful navigation of this intricate market.

Embark on your options trading journey with confidence, embracing the knowledge imparted in this comprehensive guide. May it serve as your compass, leading you through the complexities of the options market, unlocking its potential for financial growth and market dominance.

Image: optionstradingiq.com

Trading Options Strategy