Introduction: Embarking on a Strategic Trading Journey

In the dynamic financial landscape, harnessing directional option trading holds immense potential for investors seeking to amplify their returns. Directional option trades allow traders to capitalize on anticipated price movements of an underlying asset, such as the popular QQQ ETF, which tracks the Nasdaq 100 Index. By understanding the fundamentals and nuances of directional option trading, investors can equip themselves to navigate market fluctuations effectively. This comprehensive guide will delve into the intricate details of directional option trading with the QQQ, providing a roadmap for informed decision-making.

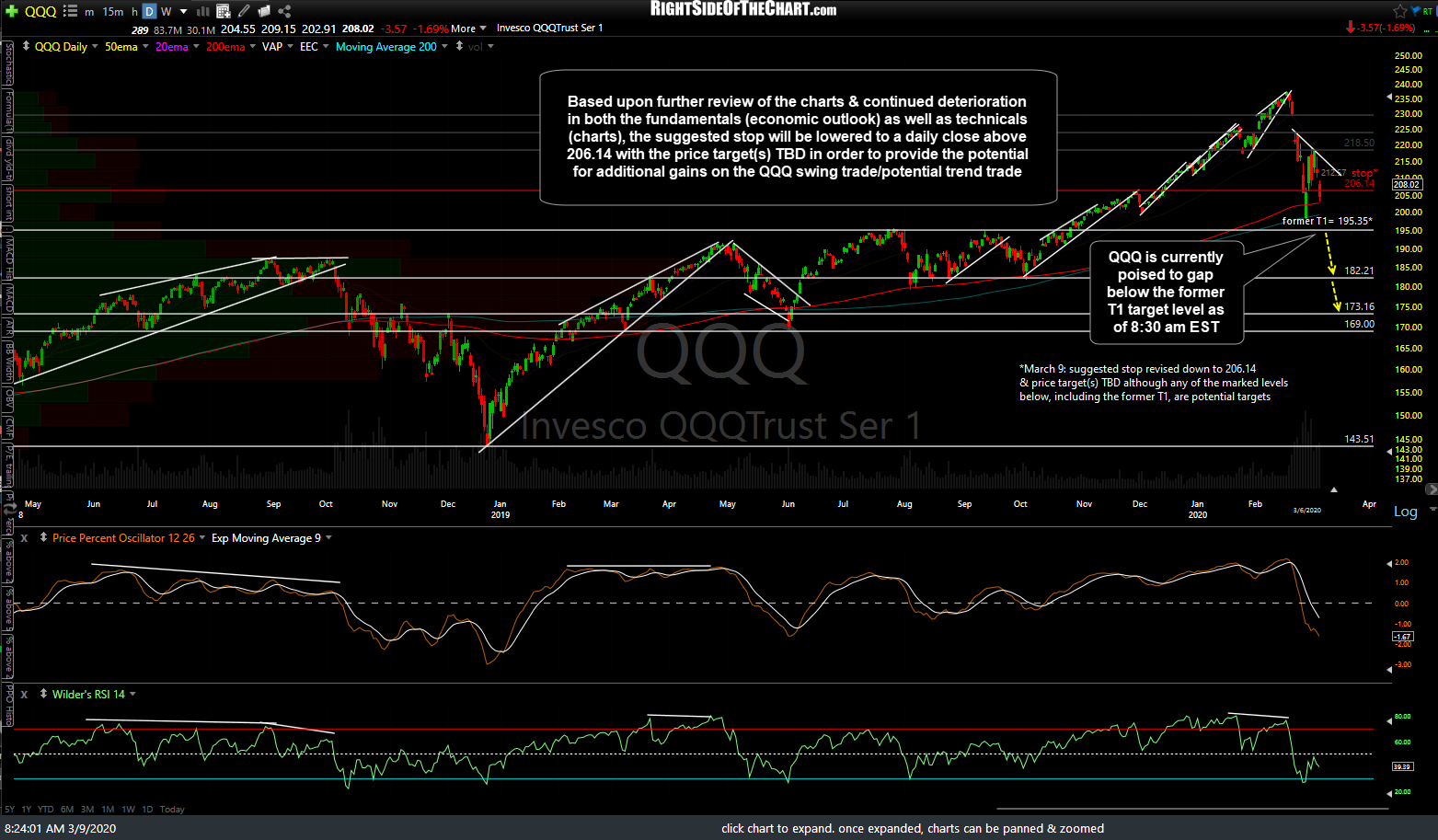

Image: rightsideofthechart.com

Unveiling the Basics: Understanding Directional Option Trading

Directional option trading involves speculating on the future price direction of an underlying asset through the use of options contracts. Options provide traders with the flexibility to express their directional views while mitigating potential risks compared to directly purchasing or selling the underlying asset. In essence, directional option traders seek to profit from correctly predicting whether the QQQ will trend upwards or downwards within a defined time horizon.

Selecting the Right Options: Navigating the Contract Landscape

The QQQ options market offers a wide range of contracts with varying strike prices and expiration dates. Choosing the appropriate option contracts is crucial for optimizing returns and managing risk. Strike price represents the pre-agreed price at which the option can be exercised, while expiration date determines the timeframe for executing the trade. By selecting contracts that align with their market outlook and risk tolerance, traders can tailor their strategies for specific market conditions.

Deciphering Option Greeks: Unlocking a Wealth of Information

Understanding option Greeks, which are numerical values derived from the option’s price, provides invaluable insights into the potential risks and rewards of directional option trading. Delta measures an option’s price sensitivity to changes in the underlying asset’s price, indicating the potential profit or loss for each dollar move in the QQQ. Theta, on the other hand, gauges the time decay of an option’s value, highlighting the impact of time passage on the option’s premium. These Greeks, among others, empower traders to make informed decisions and refine their trading strategies.

Image: www.signalsolver.com

Executing Directional Trades: Positioning for Profit

Executing directional option trades involves buying or selling call and put options to express bullish or bearish views, respectively. Call options confer the right to buy the QQQ at the strike price, while put options grant the right to sell. By carefully considering market conditions, strike prices, and expiration dates, traders can position themselves to capture profits from rising or falling QQQ prices.

Risk Management: The Cornerstone of Successful Trading

Risk management is paramount in directional option trading to preserve capital and manage downside risk. Stop-loss orders can be employed to automatically exit trades when the market moves against the trader’s position, limiting potential losses. Additionally, traders can utilize hedging strategies, such as protective puts or covered calls, to reduce the overall risk exposure of their portfolios.

Monitoring and Adjusting: Embracing Market Dynamics

Continuous monitoring of directional option trades is essential to respond to changing market conditions. By tracking the performance of the QQQ and relevant option Greeks, traders can make necessary adjustments to their positions to maximize profits and manage risks. Adjusting positions may involve rolling over contracts to extend expiration dates, adjusting strike prices to capitalize on market trends, or exiting trades prematurely if market conditions warrant it.

Directional Option Trading The Qqq

Image: topbinaryoptionsbrokers.logdown.com

Conclusion: Unlocking the Power of Directional Option Trading

Directional option trading with the QQQ presents a powerful tool for investors to profit from both bullish and bearish market movements. By comprehending the concepts, strategies, and risk management techniques outlined in this guide, traders can navigate the intricacies of directional option trading and enhance their financial decision-making. Whether seeking to generate additional income, hedge against market downturns, or capitalize on market volatility, directional option trading offers a versatile avenue for experienced traders to pursue their financial goals.