Introduction

In the realm of financial trading, defined risk option trading stands as a unique and innovative approach that seeks to mitigate uncertainty and empower traders with precise risk management. Unlike traditional options trading, which involves potentially unlimited risk, defined risk strategies provide a structured framework where the potential loss is firmly capped. To fully grasp the intricacies and advantages of defined risk option trading, let’s delve into its history, mechanics, and real-world applications, embarking on a comprehensive journey through this captivating arena of risk-managed investing.

Image: moneymorning.com

The Evolution of Defined Risk Option Trading

The concept of defined risk option trading has its roots in the pioneering work of Frank J. Fabozzi in the early 1980s. Recognizing the inherent volatility and unpredictability of options markets, Fabozzi sought to develop strategies that would enable traders to profit from directional price movements while mitigating potential losses. Over the years, the techniques he introduced have evolved significantly, leading to the creation of a diverse array of defined risk options strategies tailored to specific market conditions and investment objectives.

Understanding the Mechanics of Defined Risk Options

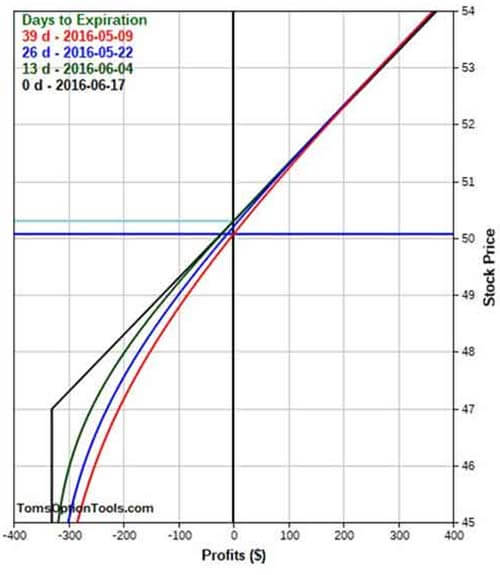

At the core of defined risk option trading lies the concept of leveraging options contracts to create a synthetic position that closely aligns with a desired risk-reward profile. By combining options with different strike prices and expiration dates, traders can define their maximum potential loss upfront, hence the term “defined risk.” Unlike traditional options strategies, where losses can escalate indefinitely, defined risk options strategies cap the potential downside, providing a level of protection against adverse market movements.

Real-World Applications of Defined Risk Options

In the practical world of investing, defined risk option trading finds widespread application across various asset classes and financial markets. For instance, income-oriented investors may utilize covered call strategies to generate additional yield from their stock portfolios while limiting their downside exposure. Speculators, on the other hand, may employ more aggressive strategies, such as spreads and iron condors, to capitalize on market volatility while maintaining a predetermined cap on potential losses.

Image: www.youtube.com

Exploring Different Defined Risk Options Strategies

The realm of defined risk options encompasses a diverse range of strategies, each tailored to specific market conditions and investment objectives. Some of the most widely recognized strategies include:

- Spreads: Involving the simultaneous purchase and sale of options with different strike prices, spreads seek to profit from the divergence between implied volatility and actual price movements.

- Iron Condors: This neutral strategy involves the sale of both a call spread and a put spread, creating a profit zone within a defined price range.

- Covered Calls: This income-generating strategy combines the purchase of a stock with the sale of a call option that gives the buyer the right to purchase the stock at a specified price.

Managing Risk with Defined Risk Option Trading

One of the primary advantages of defined risk option trading is its inherent risk management capabilities. By defining the maximum potential loss in advance, traders can effectively mitigate the potentially catastrophic consequences that can arise in traditional options trading. This controlled risk approach allows investors to participate in market movements with greater confidence, knowing that their downside is inherently limited.

Defined Risk Option Trading

Image: www.youtube.com

Conclusion

Defined risk option trading has emerged as a powerful and versatile tool in the arsenal of modern investors, providing a unique blend of profit potential and risk management. By harnessing options contracts in strategic combinations, traders can tailor their investment strategies to specific risk-reward profiles, unlocking opportunities for income generation, speculation, and hedging against adverse market conditions. Whether you’re an experienced options trader or just starting your financial journey, the principles of defined risk option trading offer valuable insights into the realm of risk-managed investing, empowering you to navigate market uncertainties with greater confidence and precision.