In the dynamic and exhilarating world of financial trading, day trading SPX weekly options offers a unique opportunity to tap into the rapid price fluctuations of the S&P 500 index. This article delves deep into the intricacies of this trading strategy, revealing the nuances, techniques, and expert insights for savvy traders seeking to navigate this market with confidence.

Image: www.youtube.com

SPX Weekly Options: An Introduction

Standard & Poor’s 500 (SPX) weekly options are standardized contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) the underlying S&P 500 index (SPX) on or before a specified date. Unlike conventional options that expire on a monthly basis, weekly options offer a shorter-term expiration cycle, typically expiring every Friday.

Advantages of Day Trading SPX Weekly Options

Day trading SPX weekly options offers distinct advantages that set it apart from other trading strategies:

- Shorter Time Horizon: Weekly options allow traders to exploit short-term price movements within a week’s time frame, minimizing the risks associated with longer-term positions.

- Flexibility: Traders can enter and exit positions quickly, allowing them to adapt to rapidly changing market conditions.

- Potential for High Returns: Weekly options can amplify potential profits, enabling skilled traders to capitalize on significant price swings within a short period.

Understanding the Mechanics of Day Trading

Day trading SPX weekly options hinges on an intricate understanding of the underlying mechanics. Here’s a breakdown of key concepts:

Image: www.youtube.com

Time Decay

Options experience a gradual loss of value over time, referred to as time decay. This decay accelerates as the expiration date draws near, making it crucial for day traders to manage their positions accordingly.

Volatility

Volatility measures the magnitude of price fluctuations in the underlying asset. Understanding volatility is essential for pricing options accurately and assessing potential risks.

Liquidity

Liquidity gauges the ease with which options can be traded without significantly impacting their price. SPX weekly options enjoy high liquidity due to their broad acceptance within the trading community.

Profitable Strategies for Day Trading

Mastering day trading SPX weekly options demands a combination of skill, knowledge, and time-tested strategies. Here are some effective approaches:

Momentum Trading

Momentum traders ride the wave of established price trends, buying options that align with the prevailing direction. By capturing the initial momentum, they aim to capitalize on the continuation of the trend.

Range Trading

Range traders identify trading ranges within which the price of the underlying oscillates. They buy and sell options when the price approaches the boundaries of the range, seeking to profit from price rebounds within that predefined zone.

Tips and Expert Advice for Success

In the competitive world of day trading, seasoned traders offer invaluable insights to enhance your chances of success:

Monitor Market Trends

Keep a keen eye on market news, economic indicators, and technical analysis to gauge prevailing trends and anticipate future price movements.

Manage Risk Effectively

Implement prudent risk management strategies, such as setting stop-loss orders and maintaining proper capital allocation to mitigate potential losses.

Educate Yourself

Continuous learning is paramount in day trading. Stay updated with industry publications, attend webinars, and seek mentorship from experienced traders to expand your knowledge.

FAQs on Day Trading SPX Weekly Options

Q: What is the minimum capital required to day trade SPX weekly options?

A: The minimum capital requirements vary depending on the brokerage firm and the strategy employed. However, a starting capital of $1,000 to $5,000 is generally recommended for beginners.

Q: How long does it take to become a successful day trader?

A: Achieving consistency as a day trader takes time, dedication, and continuous learning. It is not uncommon for aspiring traders to endure a learning curve of several months to years.

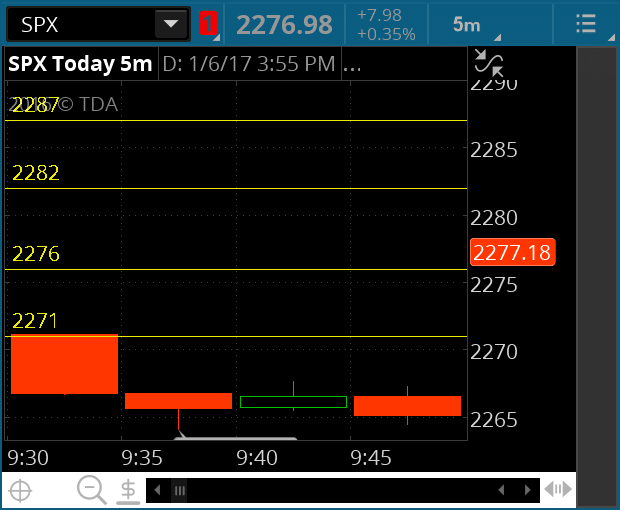

Day Trading Spx Weekly Options

Image: www.spxoptiontrader.com

Conclusion

Day trading SPX weekly options presents an exhilarating and potentially rewarding opportunity to profit from short-term market fluctuations. By mastering the concepts, employing effective strategies, and adhering to sound risk management principles, you can position yourself for success in this dynamic and fast-paced trading environment. Embark on this exciting journey, embrace the challenges, and explore the boundless possibilities of day trading SPX weekly options!

Are you ready to delve into the thrilling world of day trading SPX weekly options? Join the vibrant trading community and unlock the potential for financial success!