Navigating the complex world of financial trading can be daunting. Two prominent investment avenues that have gained immense popularity are cryptocurrencies and options trading. This blog post aims to shed light on the nuances of each approach, offering a comprehensive comparison that will empower you to make informed trading decisions.

Image: www.sglombard.com

Understanding Cryptocurrencies

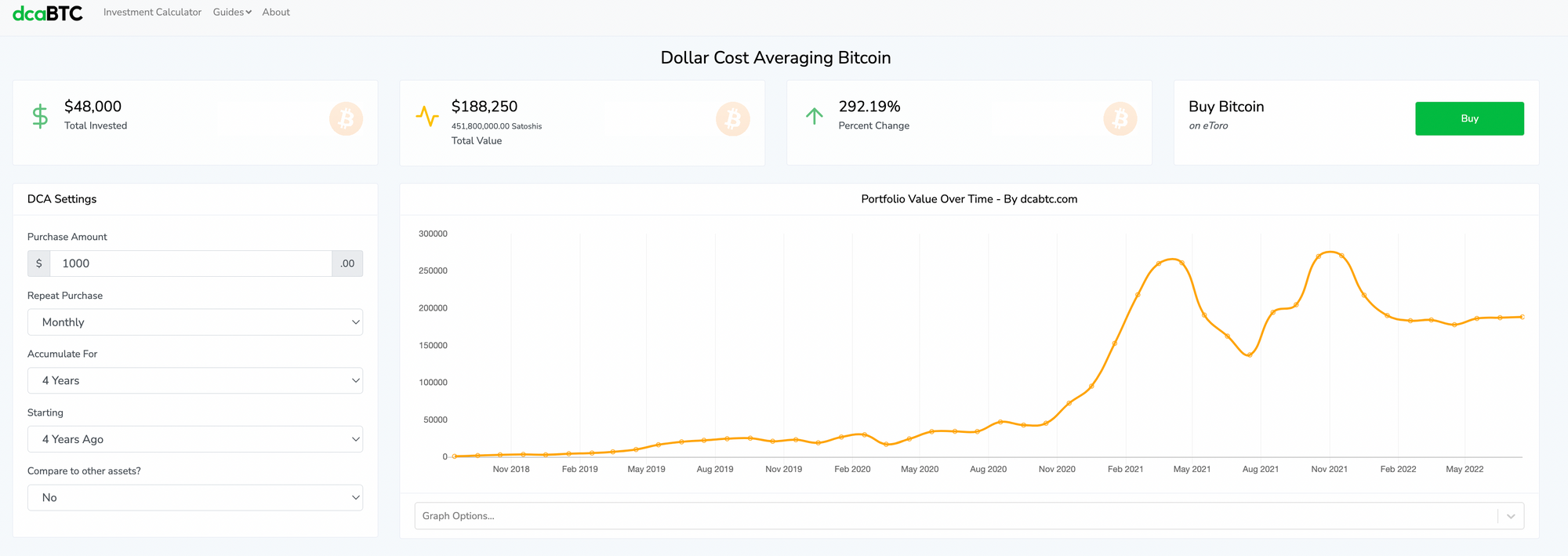

Cryptocurrencies, such as Bitcoin and Ethereum, are digital currencies that leverage blockchain technology to provide secure and transparent transactions. They are decentralized, meaning they operate without the governance of central banks or financial institutions, offering unique advantages like anonymity and global accessibility.

Deciphering Options Trading

Options trading, on the other hand, involves contracts that provide the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price, known as the strike price, on or before a specific date, called the expiration date. This approach offers flexibility and the potential for leveraging gains while limiting risk.

Defining Similarities and Distinctions

Cryptocurrencies and options trading share some similarities. Both involve the buying and selling of assets with the potential for profit. However, they differ significantly in underlying assets, risk profiles, regulation, and liquidity.

Image: learn.bybit.com

Pros and Cons: A Comparative Perspective

Cryptocurrencies offer the allure of high returns but carry substantial volatility and regulatory uncertainty. Options trading allows for tailored risk management and the potential for income generation through premium collection but requires a deep understanding of market dynamics and option strategies.

Tips and Expert Advice for Enhanced Trading

- Diversify your portfolio: Allocate investments across multiple asset classes to minimize risk.

- Monitor market trends: Stay informed about economic indicators, news events, and industry updates.

- Seek professional guidance: Consult with a financial advisor for personalized advice and tailored investment plans.

Frequently Asked Questions (FAQs)

- What are the key risks associated with cryptocurrencies?

- How do I determine the right strike price and expiration date for options?

- What are the tax implications of cryptocurrency and options trading?

- Answers to FAQs: Provide clear and concise answers to the above questions, incorporating expert insights and relevant resources.

Crypto Vs Options Trading

Image: blog.switcheo.com

Conclusion: Embracing Informed Decision-Making

Whether you venture into cryptocurrencies or options trading, it’s crucial to approach these investments with a comprehensive understanding of the mechanics, risks, and potential rewards. By evaluating your financial goals, risk tolerance, and investment horizon, you can make informed decisions that align with your specific circumstances. Are you ready to explore the dynamic realm of these investment avenues?