An Enticing Introduction:

Image: finwingsacademy.com

In the ever-evolving financial landscape, options trading emerges as a tantalizing realm where fortunes can be made and lost. Understanding this enigmatic domain is paramount to maximizing returns and mitigating risks. This comprehensive guide will unveil the secrets of options trading, empowering you to navigate this labyrinthine market with confidence and savvy.

Once confined to seasoned investors, options trading is now accessible to anyone with the desire to explore a world of untapped potential. Whether you’re a seasoned trader or a novice seeking new frontiers, this guide will equip you with the knowledge and skills to embark on this exhilarating journey.

Delving into the World of Options Trading:

An option is a derivative contract that grants the buyer the right, not the obligation, to buy or sell an underlying asset (e.g., stocks, bonds, ETFs) at a predetermined price (strike price) on or before a specific date (expiration date). Options trading offers a myriad of strategies, enabling traders to tailor their investment plans to their risk tolerance and financial goals.

There are two primary types of options: calls and puts. A call option grants the buyer the right to purchase an underlying asset at a specified strike price on or before expiration. Conversely, a put option provides the right to sell an underlying asset at a predetermined strike price.

Understanding the interplay of expiration dates and strike prices is crucial for options trading. Expiration dates range from weeks to months, providing traders with varying timeframes to execute their strategies. Strike prices, on the other hand, determine the specific asset price that the trader is targeting.

Understanding the Language of Options Trading:

Navigating the world of options trading requires fluency in its unique terminology. Terms like “premium,” “in the money,” and “out of the money” play a pivotal role in guiding investment decisions.

“Premium” refers to the upfront cost of purchasing an option contract. It represents the price that the buyer pays to acquire the right to buy or sell an underlying asset at a specified strike price.

An option is said to be “in the money” if the current market price of the underlying asset is favorable to the rights granted by the option. Conversely, an option is “out of the money” when the market price is unfavorable.

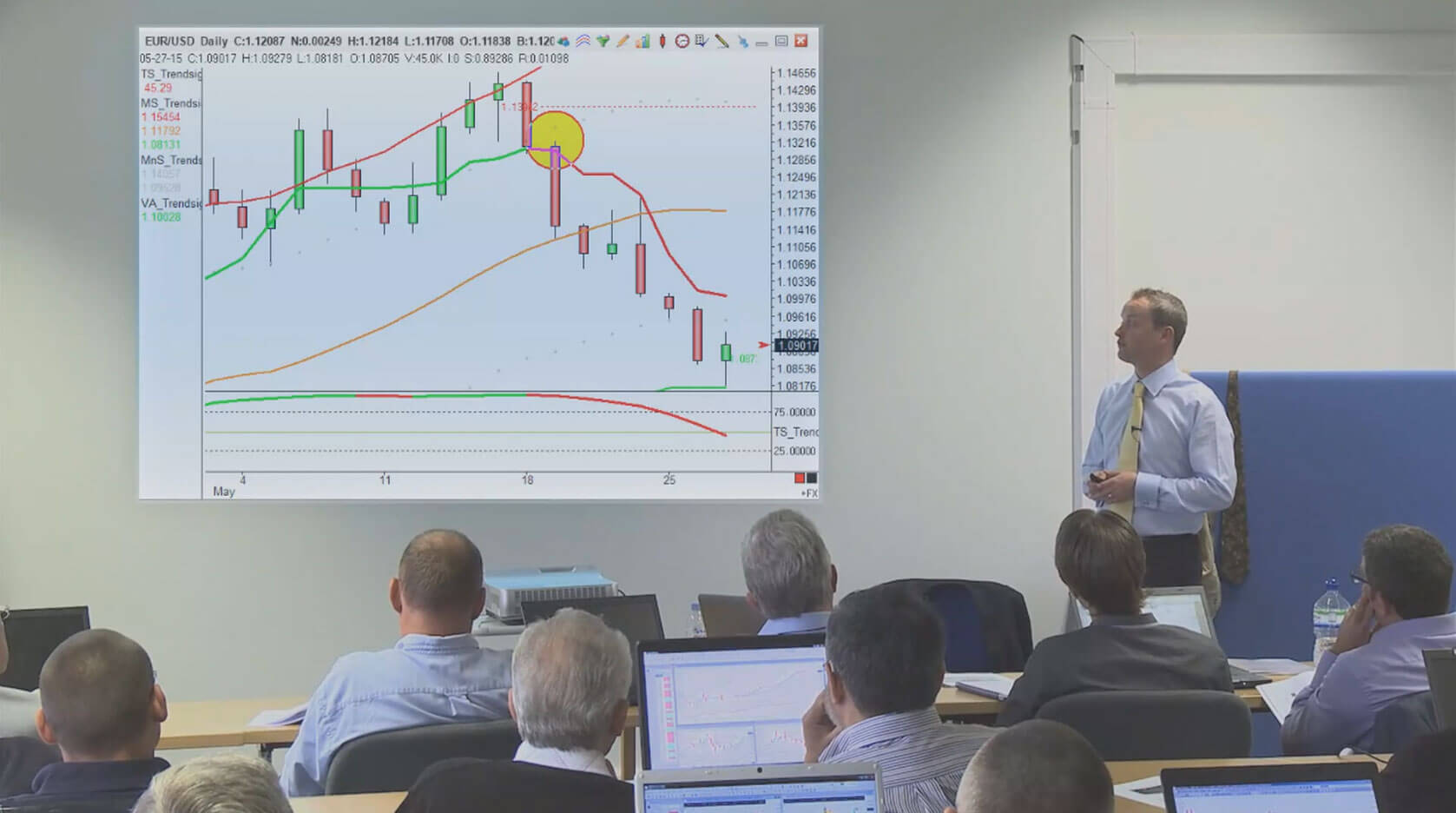

Image: www.trend-signal.com

Courses On Trading Options

Image: www.rajgovt.org