An Insider’s Guide to Harnessing the Power of Compounding

Image: forums.babypips.com

Have you ever wondered how some investors seem to exponentially grow their wealth, while others seem to stagnate? The secret lies in the power of compounding – a simple yet transformative concept that can revolutionize your financial trajectory. In this article, we will delve into the world of compounding trading options, exploring its intricacies, potential rewards, and the expert strategies you can employ to maximize your returns.

Compound interest is a phenomenon where interest earned on an initial investment is added back to the principal, resulting in exponential growth. Over time, this snowball effect can accumulate significant wealth. Similarly, in the realm of options trading, compounding techniques can amplify your profits, especially when combined with the inherent leverage of options contracts.

Understanding Options Basics

Before delving into the nuances of compounding, it’s essential to grasp the basics of options trading. Options provide the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset like a stock or currency at a predefined price (strike price) until a specified date (expiration date). This flexibility allows traders to speculate on price movements, hedge against risk, or generate income from premiums.

The Art of Compounding Trading Options

Compounding options trading involves strategically trading multiple options contracts consecutively, each time using the profits from a successful trade as the premium for the subsequent trade. This cascading effect creates exponential income growth, similar to the snowball effect of compound interest.

One popular compounding strategy is the “Wheel Strategy.” This involves selling out-of-the-money (OTM) cash-secured puts or calls to collect premiums. If the underlying asset price remains stable or moves in your favor, you profit from the premium collected. If the price moves significantly against you, you are obligated to buy (in the case of calls) or sell (in the case of puts) the underlying asset at the strike price. However, this can provide an opportunity to acquire the asset at a discounted price and hold it for potential appreciation.

Expert Insights and Actionable Tips

To succeed in compounding options trading, seek guidance from respected market professionals and implement proven strategies:

- Choose high-probability trades: Focus on options with a high likelihood of profitability based on technical analysis and market fundamentals.

- Manage risk carefully: Utilize risk management techniques like stop-loss orders, margin monitoring, and multiple option spreads to protect against losses.

- Consider the Greek effects: Understand the Greek letters (Delta, Gamma, Theta, etc.) that influence option pricing and how they impact your trades.

Conclusion

Compounding trading options is a powerful wealth-building technique that can turbocharge your portfolio growth. By understanding the basics, embracing proven strategies, and continuously refining your skills, you can harness the exponential power of compounding and achieve financial success beyond your wildest dreams. Remember, patience, discipline, and a relentless pursuit of knowledge are the essential ingredients for mastering this transformative art.

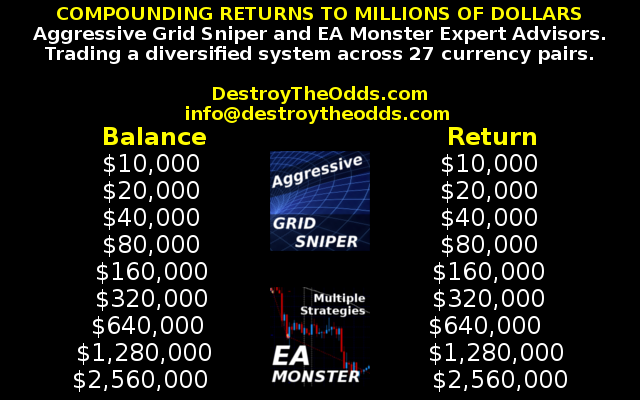

Image: www.mql5.com

Compounding Trading Options

Image: www.wallstreetprep.com