In a bustling financial landscape, the allure of exponential growth captivates investors seeking to outpace traditional returns. Enter the enigmatic world of compounding trading options, where the power of time and leverage converge to unlock extraordinary wealth-building potential.

Image: messots.blogspot.com

Harnessing the Exponential Power of Compounding

Compounding is an investment strategy that reinvests earnings, leading to accelerated growth. In the context of options trading, compounding involves using profits generated from successful trades to purchase additional options contracts. This exponential snowball effect amplifies returns, potentially transforming modest investments into substantial gains over time.

Navigating the Landscape of Compounding Options Trading

Defining Options Contracts

Options contracts grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date).

Image: breakingintowallstreet.com

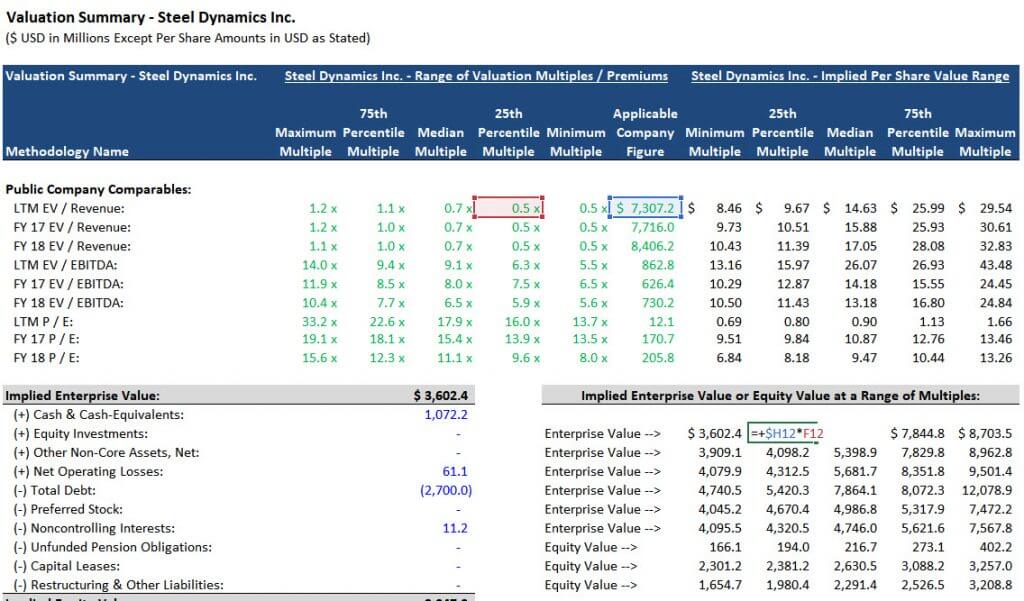

Understanding Option Pricing

Option prices are influenced by a myriad of factors, including the underlying asset’s price, volatility, interest rates, and time to expiration. By skillfully assessing these factors, traders can gauge potential profit margins and capitalize on market inefficiencies.

Strategies for Compounding Option Returns

Compounding option returns requires a strategic approach. Some popular techniques include:

- Time decay: Options lose value over time, so executing trades closer to expiration can amplify gains.

- Leverage: Options provide significant leverage, allowing traders to control large amounts of assets with a relatively small investment.

- Volatility premium: Options with higher implied volatility offer greater profit potential, but also come with increased risk.

Expert Insights and Tips

Mastering compounding trading options requires a combination of knowledge, experience, and calculated risk-taking. Experts recommend:

- Thorough research: Meticulously analyze underlying assets, market trends, and option pricing to identify high-probability opportunities.

- Risk management: Employ prudent capital management and hedging techniques to mitigate potential losses.

- Patience and discipline: Compounding yields its true power over time, so investors should prioritize consistency and long-term goals.

Common FAQs on Compounding Options Trading

- What is the minimum investment required?

There is no definitive minimum investment; however, sufficient capital is crucial to take advantage of compounding.

- Is compounding a guaranteed way to generate profits?

While compounding can enhance profit potential, it does not guarantee success. Options trading is inherently risky, and investors should proceed with caution.

- How can I learn more about compounding options trading?

Numerous resources are available, including books, online courses, and forums. Seeking guidance from experienced traders can also be beneficial.

Compouding Trading Options

Image: thepipside.mykajabi.com

Conclusion: Embracing the Path to Exponential Growth

Compounding trading options presents a tantalizing opportunity for investors seeking exponential growth. By harnessing the power of leverage, volatility, and the time-tested principle of compounding, traders can potentially elevate their financial aspirations to new heights. Are you ready to embark on this compelling journey of wealth creation?