Introduction

In the realm of investing, understanding options trading can unlock a world of possibilities. Commodity options trading is a specialized field that presents both opportunities and complexities for those seeking to expand their financial horizons.

Image: hergescapital.com

Navigating the Nuances of Commodity Options Trading

Commodity options trading involves buying or selling contracts that give you the right but not the obligation to trade a specific commodity at a predetermined price, known as the strike price, on a predefined date, called the expiration date. Unlike other types of investments, options allow you to benefit from price fluctuations without the need for ownership.

Understanding the factors that drive commodity prices, such as supply and demand dynamics, economic indicators, and geopolitical events, is crucial for success in this arena. Commodity options trading offers various advantages, including the ability to hedge against risk, increase leverage, and generate income through premium collection.

Latest Trends and Developments in Commodity Options Trading

The commodity options market has witnessed significant advancements in recent years. The advent of electronic trading platforms has streamlined the execution process, enhancing liquidity and transparency. Additionally, the introduction of new financial instruments, including exchange-traded options (ETOs) and customized over-the-counter (OTC) contracts, has broadened the options available to traders.

The rise of automated trading and algorithmic strategies has further transformed the landscape. These technologies empower traders to respond swiftly to market movements and execute complex trading strategies. However, it is essential to approach such technologies with caution, ensuring a thorough understanding of their capabilities and limitations.

Tips for Getting Started with Commodity Options Trading

Stepping into commodity options trading requires careful planning and a solid understanding of the market. Begin by educating yourself on the basics, exploring educational resources, and connecting with experienced traders. It is crucial to define your investment goals, risk tolerance, and trading horizon.

Start small and gradually increase your position size as you gain experience and confidence. Remember that options trading involves leverage, which can magnify both profits and losses. Employ risk management strategies such as stop-loss orders to protect your capital. Seek mentorship from seasoned professionals or subscribe to a reputable commodity options trading newsletter for guidance.

Image: www.higherprobabilitycommoditytradingbook.com

Frequently Asked Questions on Commodity Options Trading

Q: What are the main types of commodity options contracts?

**A:** Call options give you the right to buy an underlying commodity at a specified price, while put options grant you the right to sell.

Q: How do I determine the value of an option contract?

**A:** The value of an option is influenced by factors such as time to expiration, price volatility, and interest rates.

Q: What is the difference between in-the-money and out-of-the-money options?

**A:** In-the-money options are exercisable immediately, while out-of-the-money options become valuable only if the underlying price moves significantly.

Commodity Options Trading Newsletter

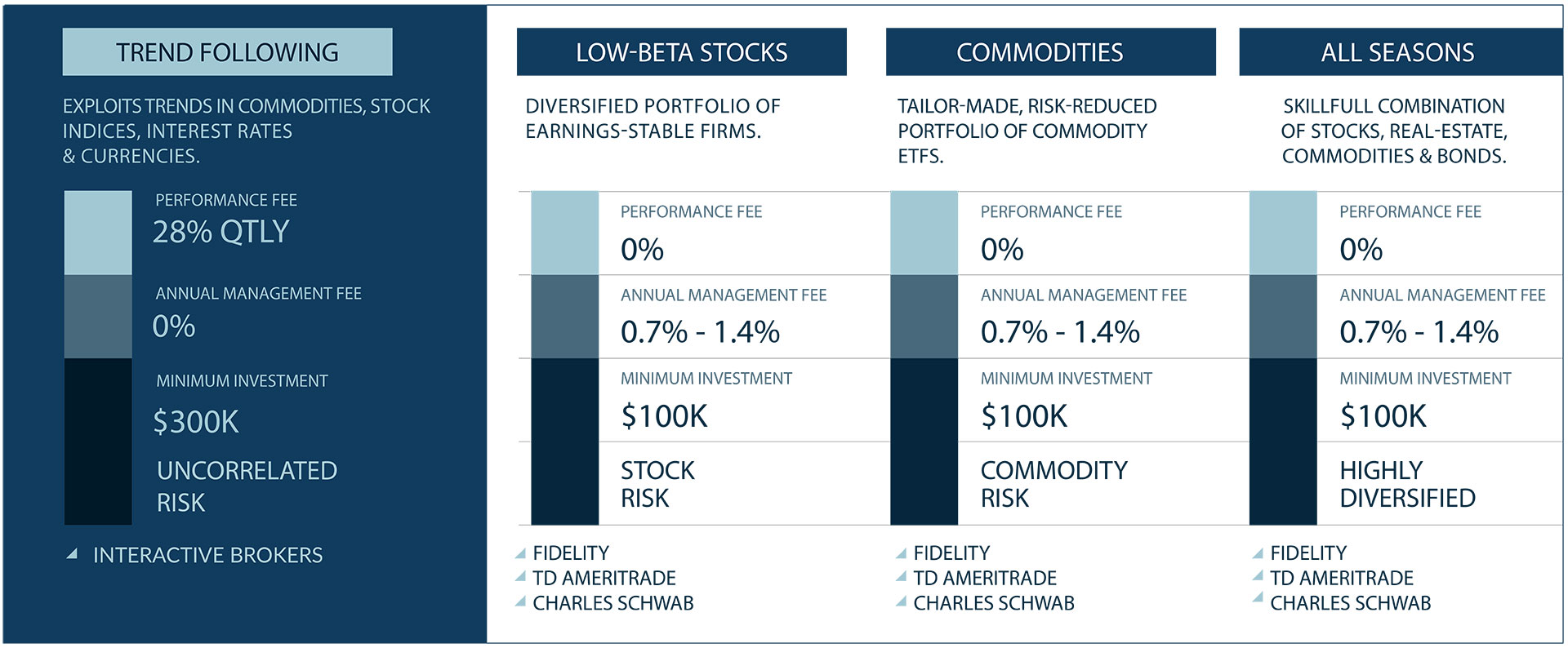

Image: www.westendcapitalmanagement.com

Conclusion

Commodity options trading presents a lucrative avenue for investors seeking to diversify their portfolios and potentially enhance returns. By arming yourself with the necessary knowledge and employing sound trading practices, you can tap into the vast potential of this market. Consider subscribing to a commodity options trading newsletter to stay abreast of industry news, expert insights, and valuable trading strategies. Whether you are an experienced trader or just starting your journey, understanding the intricacies of commodity options trading can empower you to navigate this complex and rewarding financial landscape.

Would you like to learn more about commodity options trading and stay updated on market trends and developments? Subscribe to our exclusive commodity options trading newsletter today!