Introduction

The cryptocurrency market has witnessed an unprecedented rise in popularity, with a burgeoning interest in alternative financial instruments such as options trading. Amidst the competitive landscape, Coinbase, the renowned cryptocurrency exchange, has recently launched its own options trading platform, CMC Option Trading. This platform empowers traders with access to a vast selection of cryptocurrencies and a robust suite of trading tools, unlocking new possibilities for strategic investing and profit generation. This comprehensive guide will delve into the fundamentals of CMC Option Trading, providing an in-depth exploration of its key features, advantages, and potential risks. Equipping readers with actionable insights and guidance, this article aims to elevate their understanding of crypto options trading and empower them to harness its potential for financial success.

Image: brokerchooser.com

Understanding Crypto Options Trading: A Primer

Options trading involves the buying and selling of contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined strike price on or before a specific expiry date. Crypto options trading replicates this concept within the cryptocurrency realm, offering traders a powerful tool to speculate on the future price movements of digital assets. Through careful analysis and skillful execution, traders can harness the leverage provided by options trading to magnify their potential returns while managing risks effectively. CMC Option Trading has emerged as a preferred destination for options traders, due in large part to its user-friendly interface, competitive pricing, and extensive educational resources.

CMC Option Trading: A Comprehensive Overview

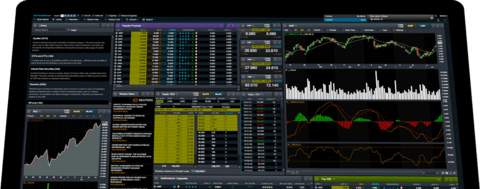

Navigating the CMC Option Trading platform unveils a comprehensive trading ecosystem designed to cater to the diverse needs of traders. At the heart of this platform lies an intuitive interface that streamlines the trading process, rendering it accessible to both novice and experienced traders. Key features include:

-

Customizable Trading Tools: Unleash the power of advanced trading tools tailored to your specific preferences. Customize charts, indicators, and order types to gain a competitive edge and execute trades with precision.

-

Real-Time Market Data: Stay abreast of the ever-changing market landscape with real-time market data that empowers informed decision-making. Monitor price movements, track market depth, and identify potential trading opportunities in real time.

-

Risk Management Tools: Employ sophisticated risk management tools to safeguard your investments and minimize potential losses. Set stop-loss orders to limit downside risk and position yourself for success in volatile market conditions.

-

Educational Resources: Tap into CMC Option Trading’s comprehensive educational resources to enhance your knowledge and sharpen your trading skills. Leverage educational articles, webinars, and detailed guides to become a more informed and capable trader.

Image: www.compareforexbrokers.com

Cmc Option Trading

Image: www.cmcmarkets.com

Leveraging Options Trading Strategies for Success

CMC Option Trading presents a wealth of opportunities for traders to implement a diverse range of options trading strategies, each tailored to specific market conditions and risk tolerance levels. Let’s explore two popular strategies to showcase the versatility of this platform:

1. Covered Call Strategy: This conservative strategy involves selling (or “writing”) a covered call option, which grants the buyer the right to purchase an underlying asset at a predetermined strike price on or before a specific expiry date. In return for selling this option, the seller receives a premium payment. The covered call strategy is ideal for generating income while maintaining exposure to potential upside in the underlying asset, making it suitable for both income-oriented and long-term investors.

2. Bull Call Spread Strategy: This bullish strategy involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price, both with the same expiry date. The trader profits if the underlying asset price rises above the lower strike price but remains below the higher strike price. The bull call spread strategy is suitable for traders who anticipate a moderate increase in the underlying asset’s