Unlimited option trading, a tantalizing realm where potentially boundless profits await, has captured the imagination of countless traders. Unlike traditional trading, where profits are capped by the value of the underlying asset, unlimited option trading offers the tantalizing prospect of unconstrained gains, limited only by market volatility and one’s risk appetite. Yet, this enigmatic world is also fraught with perils, where fortunes can be made and lost in the blink of an eye.

Image: moneypip.com

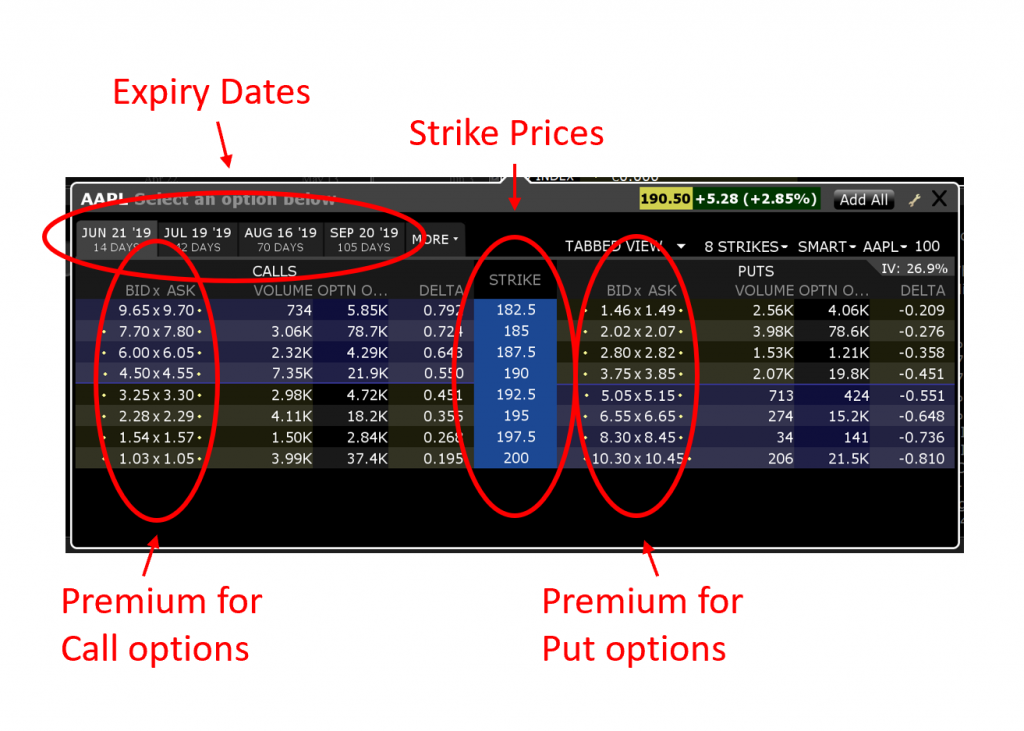

In the realm of options trading, the uncapped nature of unlimited option trading sets it apart. Options, financial instruments that grant the buyer the right but not the obligation to buy or sell an underlying asset at a specified price on a specified date, typically come with predefined profit limits. However, unlimited options break free from this convention, allowing the profit potential to soar as high as market conditions allow.

The allure of unlimited option trading is undeniable. The prospect of amassing substantial wealth from a single trade has lured many into this exhilarating yet potentially perilous arena. However, it is crucial to approach unlimited option trading with a clear understanding of the risks involved. The uncapped profit potential comes at a steep cost: unlimited risk. Unlike traditional option strategies, where losses are limited to the premium paid, unlimited option trading exposes traders to the full force of market fluctuations.

Understanding the Mechanics of Unlimited Option Trading

Unlimited option trading, also known as naked option trading, involves selling an option without owning or controlling the underlying asset. The seller of an unlimited option assumes the obligation to buy or sell the underlying asset at a specified price if the option is exercised by the buyer. In return for taking on this unlimited risk, the seller receives an upfront premium payment from the buyer.

Strategies for Success in Unlimited Option Trading

Success in unlimited option trading requires a disciplined approach, thorough market analysis, and astute risk management. Traders must carefully assess market conditions, including volatility, liquidity, and any upcoming economic or geopolitical events that could impact the value of the underlying asset. Selecting options with favorable risk-reward ratios is crucial, and traders must be prepared to adjust their positions or exit trades promptly if market conditions turn adverse.

The Pitfalls of Unlimited Option Trading

While the lure of unlimited profits is enticing, traders must be aware of the significant risks associated with unlimited option trading. The potential for substantial losses is ever-present, and traders should only venture into this arena with adequate capital and a comprehensive understanding of the risks involved. Without proper risk management strategies, unlimited option trading can lead to catastrophic financial losses.

Image: algotrading101.com

Unlimited Option Trading

Image: www.reddit.com

Conclusion

Unlimited option trading remains a captivating yet contentious trading strategy. Its potential for boundless profits has made it a favorite among risk-tolerant traders seeking extraordinary returns, but the uncapped risk exposure demands a profound understanding of market dynamics and astute risk management. By carefully weighing the potential rewards against the inherent risks, traders can make informed decisions about whether unlimited option trading aligns with their financial goals and risk tolerance.