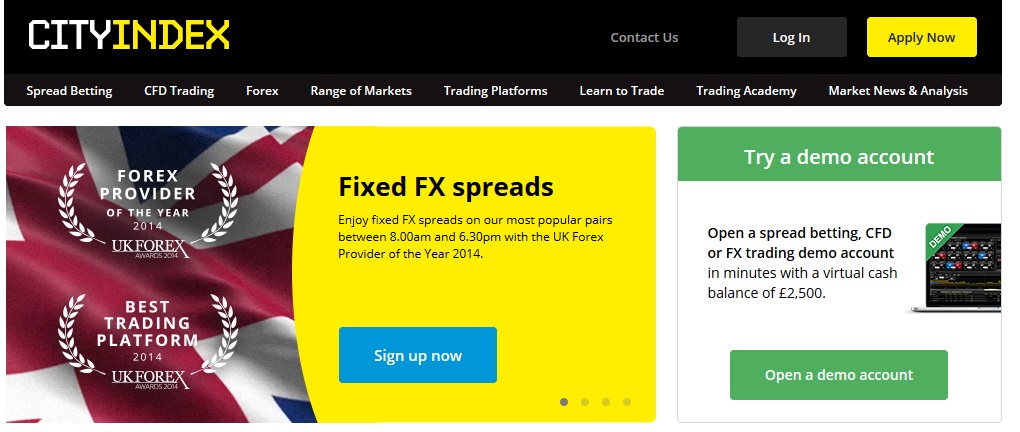

In today’s rapidly evolving financial landscape, options trading stands out as a transformative tool with the potential to amplify your wealth-building capabilities. Among the reputable brokers, City Index shines as a beacon of trust and innovation, empowering traders with the knowledge and tools needed to navigate the world of options.

Image: topforexbrokers.net

Options trading, while seemingly complex, can be demystified with the right guidance. Simply put, it involves the selling or buying of contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset (such as stocks, indices, commodities) at a predefined price and date in the future. This flexibility makes options a powerful instrument for both hedging strategies and speculative investing.

Delving into the Mechanics of City Index Options Trading

City Index offers a user-friendly platform specifically designed to cater to the needs of options traders. Its intuitive interface provides real-time market data, robust charting tools, and an array of order types to suit different trading styles. The platform’s versatility empowers traders to customize their strategies and execute trades with precision and ease.

At the core of options trading lies the concept of premiums. These premiums represent the price one pays to acquire the contract. They fluctuate based on factors such as the underlying asset’s price, time to expiration, and volatility. Options traders leverage these premiums to craft strategies that align with their risk tolerance and profit objectives.

Unveiling the Spectrum of Options Trading Strategies

Options trading grants access to a wide array of strategies, each with its unique risk-reward profile. Some of the most popular include:

Call Options:

Traders who anticipate the underlying asset’s price to rise purchase call options. If their prediction materializes, they profit by exercising the option to buy the asset at a below-market price.

Image: tradingbrokers.com

Put Options:

Conversely, put options are utilized when traders expect the underlying asset’s price to decline. They profit by exercising the option to sell the asset at a price higher than the market rate.

Bull Call Spreads:

This strategy involves simultaneously buying a lower strike call option and selling a higher strike call option. It offers limited profit potential but hedges against significant losses.

Bear Put Spreads:

Traders who anticipate a decline in the underlying asset’s price can execute a bear put spread. They purchase a lower strike put option and sell a higher strike put option.

Beyond these fundamental strategies, City Index provides access to advanced trading tools, such as options chains and option Greeks, enabling traders to fine-tune their strategies and mitigate risks. By embracing the versatility of City Index’s platform, traders can harness the power of options to enhance their financial prospects.

Gaining an Edge with Expert Insights from City Index

To further empower its traders, City Index offers a wealth of educational resources, research materials, and expert guidance. Its dedicated team of analysts provides regular market updates, in-depth analysis, and trading recommendations, enabling traders to make informed decisions. The platform also hosts webinars, seminars, and workshops that delve into advanced topics and strategies, equipping traders with the knowledge needed to excel in the options market.

City Index Options Trading

Image: finapress.com

Embark on Your Options Trading Journey with City Index

Whether you’re a seasoned trader or venturing into the world of options for the first time, City Index stands as your trusted partner, guiding you every step of the way. Its commitment to providing a secure, transparent, and user-centric trading environment ensures that your financial journey is marked by both confidence and success. Unlock the transformative power of options trading today with City Index and take control of your financial future.