In the ever-evolving landscape of financial markets, CBA options trading has emerged as a formidable force, beckoning both seasoned investors and aspiring traders alike. This intricate yet rewarding financial instrument offers a gateway to potentially lucrative returns and the ability to navigate market volatility with precision.

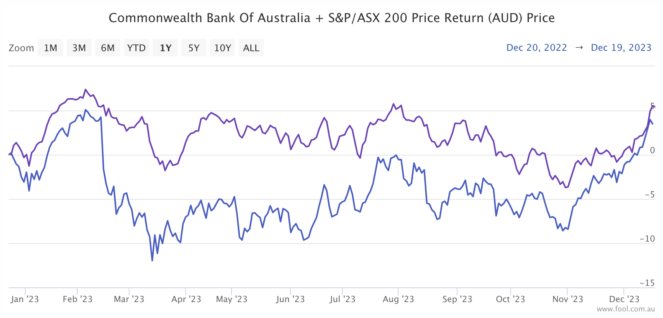

Image: www.fool.com.au

Decoding CBA Options Trading

At its core, a call-buy-ask (CBA) option is a customizable financial contract that grants the buyer the right, but not the obligation, to acquire a certain number of assets at a specific price (the strike price) on or before a predetermined date. By combining a call option and a buy-write (naked put) option strategy, CBA traders can potentially lock in profits while managing risk.

The Allure of CBA Options Trading

The appeal of CBA options trading lies in its versatility and potential profitability. Here’s what makes this strategy alluring:

-

Flexibility: CBA options provide traders with immense flexibility, allowing them to customize their positions to match their individual risk tolerance and return objectives.

-

Income Generation: The strategy offers lucrative opportunities to generate income through option premiums and potential asset appreciation.

-

Hedging: CBA options can serve as a powerful hedging tool, helping traders mitigate exposure to market risk and protect their portfolio’s value.

Harnessing the Expertise of Trading Gurus

To delve deeper into the complexities of CBA options trading, let’s tap into the wisdom of seasoned experts:

-

Michael Harris, Trading Coach: Emphasizes the importance of understanding market dynamics, risk management, and emotional control for successful trading.

-

Mark Douglas, Author and Trader: Advocates for developing a strong trading mindset, focusing on discipline, patience, and adhering to a well-defined trading plan.

Empowering You with Actionable Insights

Empowering you with actionable tips, here are some smart strategies to optimize your CBA options trading endeavors:

-

Due Diligence: Conduct thorough market research, analyze historical data, and stay abreast of economic events that may influence asset prices.

-

Trade Planning: Establish a clear trading plan, defining your goals, risk parameters, and exit strategy.

-

Risk Management: Employ sound risk management practices, such as position sizing and hedging mechanisms, to mitigate potential losses.

Embracing the Transformative Power of CBA Options Trading

As you embark on your CBA options trading journey, remember these invaluable lessons:

-

Seek Knowledge: Continuously expand your knowledge and refine your trading skills through research, webinars, and mentorship programs.

-

Manage Emotions: Discipline and emotional control are vital for long-term trading success.

-

Embrace Risk: Understand and accept that trading involves inherent risk, and develop a strategy that aligns with your risk tolerance.

A Call to Action for Financial Empowerment

CBA options trading opens doors to boundless financial opportunities. Dive into the world of options and arm yourself with the knowledge, strategies, and mindset necessary to harness the power of this transformative financial instrument.

Image: franklinsrmolina.blogspot.com

Cba Options Trading

Image: www.fool.com.au