In the realm of options trading, call options stand out as a powerful tool for investors seeking to capitalize on bullish market sentiments. These contracts grant the holder the right, but not the obligation, to purchase a specific underlying asset at a predefined price (the strike price) on or before the expiration date. Understanding the different call options trading strategies can empower traders to navigate market uncertainties and potentially enhance their returns.

Image: s3.amazonaws.com

Delving into Call Options Trading Strategies

The versatile nature of call options opens the door to a range of strategic approaches tailored to individual risk appetites and market expectations:

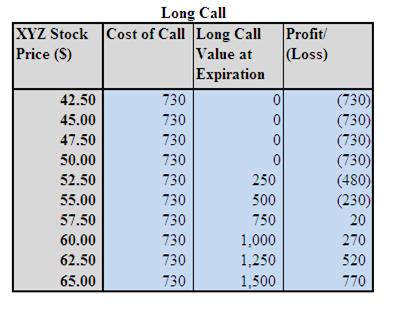

Buy and Hold: The Long Call Strategy

This strategy involves purchasing a call option with an expiration date that aligns with the anticipated duration of the underlying asset’s price appreciation. The buyer benefits fully from any upside movement in the stock price beyond the strike price. However, the downside risk is limited to the premium paid for the call.

Covered Call: Hedging with Call Options

The covered call strategy combines selling a call option against an existing holding of the underlying asset. This approach aims to generate additional income from the premium received for selling the option while capping potential gains on the underlying asset. It is particularly suitable for investors seeking to mitigate risk and maintain stable returns.

Image: www.trade-stock-option.com

Bull Call Spread: Defined Risk, Limited Profit

Bull call spreads involve buying a call option at a lower strike price while simultaneously selling a call option at a higher strike price, both with the same expiration date. This strategy allows investors to benefit from a moderate increase in the underlying asset’s price, but it also limits potential profits due to the sale of the second call option. However, the predefined risk profile makes it an attractive option for conservative traders.

Navigating Recent Trends and Developments

The call options trading landscape is constantly evolving. Recent advancements in technology, data analysis, and social media platforms have significantly impacted how traders approach these strategies.

Artificial intelligence (AI) and machine learning (ML) algorithms have enhanced the accuracy of market predictions, leading to more sophisticated trading models. Social media platforms have emerged as a valuable source of real-time market sentiment and news updates, providing traders with an edge.

Expert Tips for Successful Call Options Trading

Seasoned traders offer invaluable insights to maximize returns and minimize losses in call options trading:

Define Clear Objectives and Risk Tolerance:

Determine your investment goals and risk tolerance before entering any trade. Call options carry inherent risks, so it is crucial to understand your risk appetite and adjust your strategies accordingly.

Conduct Thorough Research:

Meticulously analyze the underlying asset, market conditions, and option pricing models before making informed trading decisions. Consider historical price trends, analyst reports, and industry news.

Common Questions Answered (FAQ)

Q: What is the primary advantage of trading call options?

A: Call options offer the potential for higher returns compared to simply buying the underlying asset. They also provide leverage, allowing traders to gain substantial exposure with a relatively small investment.

Q: What factors influence the pricing of call options?

A: Option pricing models consider variables such as the underlying asset price, strike price, time to expiration, volatility, and interest rates.

Call Options Trading Strategies

Image: www.pinterest.com

Conclusion

Call options trading strategies empower investors to navigate the ever-changing market landscape and potentially enhance their financial outcomes. While these strategies offer immense flexibility, they also carry inherent risks. By understanding the nuances of call options trading, applying expert advice, and adapting to the latest trends, traders can position themselves for success in this dynamic and rewarding market.

Are you ready to explore the world of call options trading and unlock its potential?