Embrace the Opportunity with Proficiency

Options trading presents an unparalleled realm of possibilities for investors seeking to harness volatility and amplify returns. Call options, in particular, empower traders to bet on the upward trajectory of an underlying asset. Whether you’re a seasoned veteran or a curious novice, understanding call options trading is paramount to unlocking its profound potential. Immerse yourself in this comprehensive guide to acquire the knowledge and strategies essential for success.

Image: tradingtuitions.com

A Comprehensive Definition: Demystifying Call Options

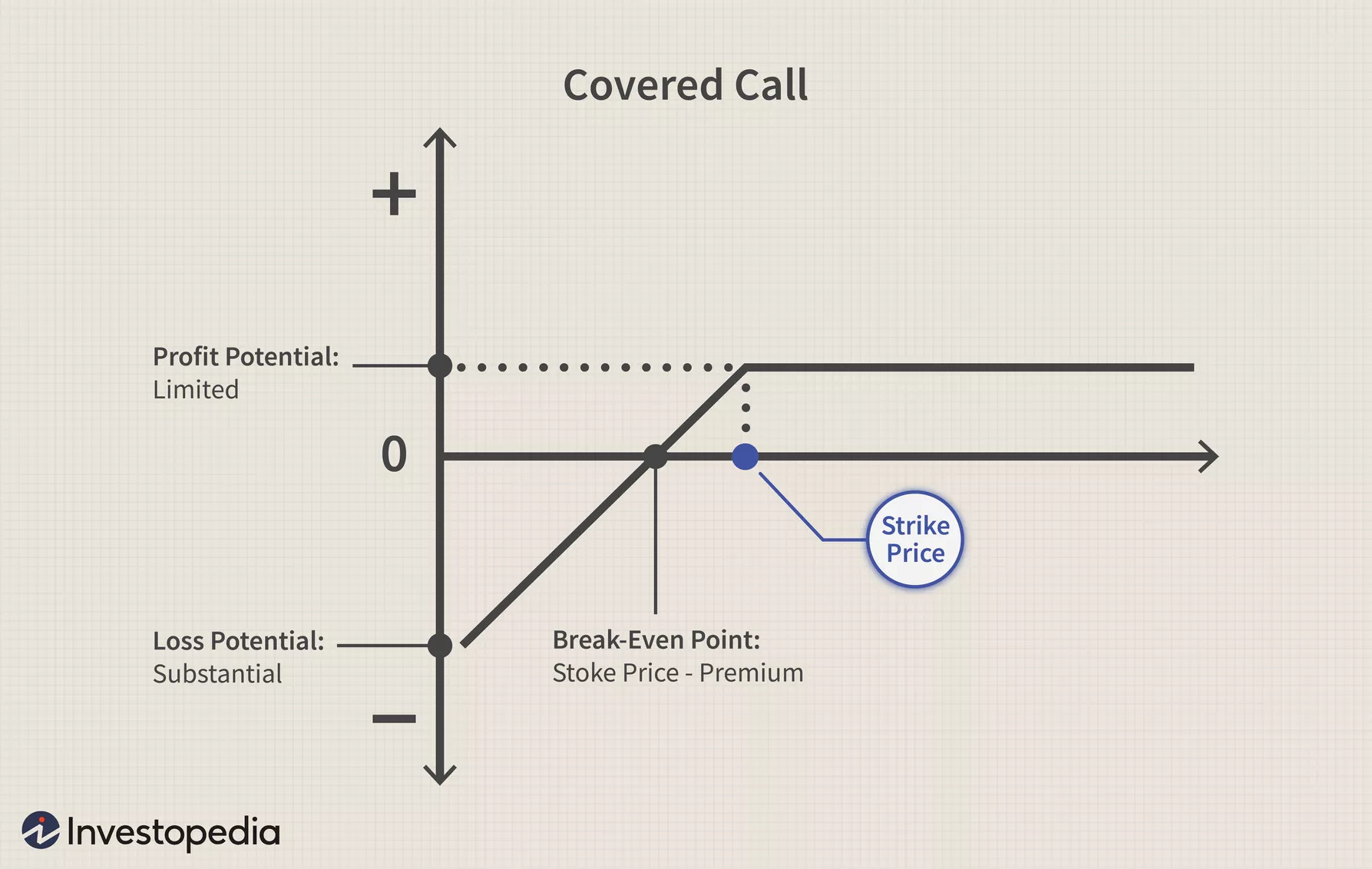

A call option, at its core, confers the right—not an obligation—to purchase a specified number of shares of an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). By acquiring a call option, traders gain exposure to the potential upside of the underlying asset without the upfront capital outlay required to directly purchase the shares.

Essence of Call Options: Unlocking Upside Potential

The essence of call options lies in their ability to amplify gains when the price of the underlying asset surpasses the strike price. Imagine purchasing a call option with a strike price of $100, giving you the right to buy 100 shares of a particular stock at $100 per share on July 15. If, by July 15, the stock price rises to $110, you can exercise your right to purchase the shares at $100 and immediately sell them in the market for $110 per share. This transaction yields a profit of $1,000 (100 shares x ($110 – $100)), excluding brokerage fees.

Leveraging Volatility: A Double-Edged Sword

Call options thrive in volatile markets, where sharp price swings amplify potential gains and losses. While volatility offers the allure of magnified returns, it also intensifies the risks involved. As the underlying asset’s price fluctuates dramatically, call options can swiftly gain or lose value, requiring traders to maintain constant vigilance and employ sound risk management practices.

Image: www.youtube.com

Tips for Success: Navigating the Call Options Landscape

To navigate the call options landscape with finesse, seasoned traders impart invaluable tips:

- Conduct Thorough Research: Familiarize yourself with the underlying asset’s historical performance, market trends, and economic factors that may influence its trajectory.

- Choose Strike Prices Prudently: Selecting appropriate strike prices is crucial. Opt for strike prices slightly above or below the underlying asset’s current price to balance risk and reward.

- Set Realistic Expiration Dates: Determine expiration dates that align with your trading strategy and market outlook. Longer-term options offer more time for the underlying asset to appreciate but also expose you to greater price fluctuations.

- Monitor Market Conditions Closely: Keep a watchful eye on real-time market news, earnings reports, and economic data that may impact the underlying asset’s performance.

Expert Advice: Embracing Market Wisdom

Renowned investment professionals emphasize the following pearls of wisdom:

- “Before trading call options, comprehend the mechanics, risks, and potential rewards involved. Education empowers informed decision-making.” – Warren Buffett

- “Successful call option trading requires patience and discipline. Avoid emotional decision-making and adhere to a well-defined trading strategy.” – George Soros

- “Managing risk is paramount in call options trading. Use stop-loss orders to limit potential losses and protect your capital.” – Peter Lynch

FAQ: Answers to Common Queries

Q: What are the primary risks associated with call options trading?

A: The main risks include the potential loss of premium paid for the option if the underlying asset price doesn’t rise above the strike price, as well as the risk of the underlying asset price falling significantly below the strike price.

Q: Can I lose more money than I invest in call options?

A: No, the most you can lose is the premium paid for the option, which is typically a fraction of the underlying asset’s price.

Q: What factors influence call option prices?

A: Call option prices are influenced by various factors, including the underlying asset’s price, time to expiration, interest rates, volatility, and market demand and supply.

Call In Options Trading

Image: economictimes.indiatimes.com

Conclusion: Embark on the Call Options Journey

Call options trading presents a unique opportunity for investors to amplify gains and potentially generate substantial returns. However, mastering this dynamic financial instrument demands a comprehensive understanding of its mechanics, risks, and potential rewards. Embark on the call options trading journey with a solid foundation in the topic, and harness the power of informed decision-making. As you delve deeper into this intriguing realm, don’t hesitate to reach out to experts and seasoned traders to glean their insights and wisdom. By doing so, you will equip yourself to navigate the complexities of call options and harness their potential to enhance your financial prowess.