Binary options trading, a captivating realm of financial markets, presents an intriguing proposition: wagering on the future direction of an underlying asset within a predefined time frame. Call and put options, cornerstone instruments of binary options trading, offer a tempting opportunity to amplify gains or hedge against potential losses.

Image: smart-trading.ph

Embarking on the binary options trading journey unveils an arena where financial intuition and calculated risk-taking intertwine. Understanding the intricacies of call and put options serves as the compass that guides traders through the volatile waters of market fluctuations.

Call Options: Betting on the Bullish Horizon

In the realm of financial markets, a call option empowers its holder to purchase an underlying asset at a predetermined price (strike price) on or before a specified future date (expiration date). The underlying asset can be diverse, ranging from stocks and currencies to commodities and indices.

Exercising a call option becomes advantageous when the market sentiment turns optimistic, as the underlying asset’s price eclipses the strike price. However, the unpredictable nature of markets can just as easily send prices plummeting, resulting in the call option expiring worthless.

Put Options: Capitalizing on the Bearish Outlook

At the opposite end of the trading spectrum lies the put option, a financial instrument that grants the holder the right to sell an underlying asset at the strike price on or before the expiration date. This option thrives in bearish market conditions, where the underlying asset’s value is projected to decline.

When the underlying asset’s price spirals downward, the put option holder can capitalize on the dwindling value by exercising their right to sell at the strike price, pocketing the difference. Conversely, if the market takes an unexpected turn and prices rebound, the put option becomes worthless.

Navigating the Risk-Reward Binary Landscape

Binary options trading inherently carries a high degree of risk, amplifying the potential for both substantial gains and severe losses. The allure of high returns can often overshadow the substantial risks associated with this speculative endeavor.

Before venturing into binary options trading, it is paramount to conduct thorough research on the intricacies of each option type, its associated risks, and the specific underlying assets being traded. Additionally, a robust understanding of risk management strategies, such as setting clear profit targets and stop-loss limits, is essential for limiting potential losses and preserving trading capital.

Image: knnit.com

Trading Strategies: Unlocking the Elusive Edge

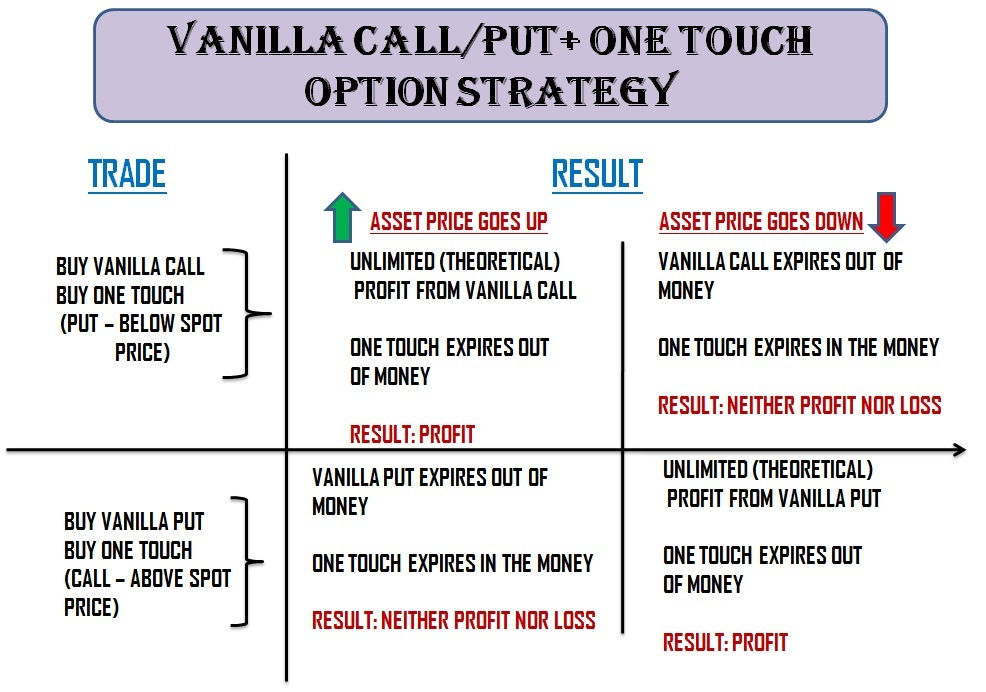

Seasoned binary options traders employ an array of trading strategies to maximize their odds of profitable trades. These strategies may delve into technical analysis, which scrutinizes historical market data to identify potential trading opportunities, or fundamental analysis, which examines the underlying economic and geopolitical factors that influence asset values.

Furthermore, successful traders often diversify their portfolios by trading a range of underlying assets and implementing risk management measures to mitigate the impact of losses, thereby enhancing their overall trading outcomes.

Digitalization: Empowering Binary Options Trading

Technological advancements have revolutionized binary options trading, introducing user-friendly online platforms that streamline the trading process and enhance accessibility. These platforms offer real-time market data, easy order execution, and advanced charting tools, empowering traders with the information and resources they need to make informed decisions.

However, the influx of online platforms has also drawn scrutiny from regulatory authorities, who seek to curb fraudulent practices and protect the interests of investors.

Call And Put Binary Options Trading

Image: cozosen.web.fc2.com

Conclusion: Embracing the Ups and Downs

Call and put binary options trading, while captivating and potentially lucrative, demand a deep understanding of market dynamics, calculated risk-taking, and unwavering discipline. The allure of exponential returns can be intoxicating, but traders must remain cognizant of the substantial risks involved.

As the financial markets continue to evolve, binary options trading will undoubtedly remain a dynamic and exhilarating realm. Those who navigate its complexities with caution, a rigorous approach, and a unwavering commitment to continuous learning are poised to reap its rewards.