Getting Started with Options

Options trading, a sophisticated realm of financial markets, presents both opportunities and risks for those seeking financial growth. Options, as financial instruments, empower traders with the potential to reap substantial rewards and manage risk effectively. However, navigating the complexities of options trading requires a prudent approach and thorough understanding to maximize returns and minimize losses. Understanding the fundamental principles and strategies will lay a solid foundation for successful options trading.

Image: castu.org

A Deep Dive into the World of Options

Options are financial contracts that convey the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predefined price (strike price) on or before a specific date (expiration date). These contracts grant traders flexibility in transitioning between market positions, allowing them to adapt to varying market conditions and capitalize on potential profit scenarios. Options trading enables three primary strategies: buying, selling, and writing. Understanding the nuances of each strategy is fundamental to effective options trading.

1. Call Options

Call options provide the right to buy an underlying asset at a specified price within a given time frame. The profit potential of call options lies in anticipating price increases in the underlying asset. As the price of the underlying asset rises, the call option’s value correspondingly increases, providing substantial returns to the holder. However, if the underlying asset’s price declines, the call option loses value, potentially resulting in losses for the trader.

2. Put Options

In contrast to call options, put options bestow the right to sell an underlying asset at a particular price before a set expiration date. Put options are ideal for profiting from anticipated price declines in the underlying asset. As the price of the underlying asset falls, the value of put options increases, offering opportunities for profitable outcomes. However, similar to call options, put options lose value if the underlying asset’s price increases, potentially leading to losses.

Image: blog.seedly.sg

3. Option Premiums

Traders need to consider option premiums, which represent the cost of purchasing an option contract. This premium is paid upfront and is dependent on factors such as the underlying asset’s price, time to expiration, strike price, interest rates, and volatility. Understanding premium pricing dynamics will enable traders to assess the potential profit and loss with greater accuracy.

Choosing the Right Options Strategy

Selecting the appropriate options strategy aligns with individual risk tolerance, financial goals, and market outlook. Options strategies range from simple to complex and can be tailored to personal preferences and trading objectives. Common options strategies include:

1. Covered Call

The covered call strategy involves holding an underlying asset while simultaneously selling (writing) a call option against that asset. This strategy aims to secure partial profit through the premium received for selling the call option while retaining the underlying asset for potential further value appreciation.

2. Protective Put

A protective put strategy combines owning an underlying asset with buying a put option on the same asset. This strategy seeks to hedge against the risk of potential asset price declines. The put option acts as an insurance policy for the underlying asset, safeguarding a portion of its value.

3. Naked Put

The naked put strategy consists of selling a put option without possessing the corresponding underlying asset. This approach inherently carries significant risk and thus is often employed by experienced traders with a higher risk appetite. Profits stem from correctly predicting the underlying asset’s price to either remain above a certain level or rise sufficiently to cover the premium received.

Tips for Successful Options Trading

Embarking on options trading requires prudent risk management practices to protect against potential losses. Here are essential tips for successful options trading:

1. Understand the risks involved

Understand the inherent risks associated with options trading. Options trading involves the potential for significant losses, even total loss of invested capital. Avoid investing more than one can afford to lose.

2. Educate and Practice

Acquire a strong foundational understanding of options trading through thorough research and education. Seek guidance from reputable sources, including books, articles, and online resources dedicated to options trading. Consider practicing various strategies using paper trading or virtual trading platforms before transitioning to live market trading.

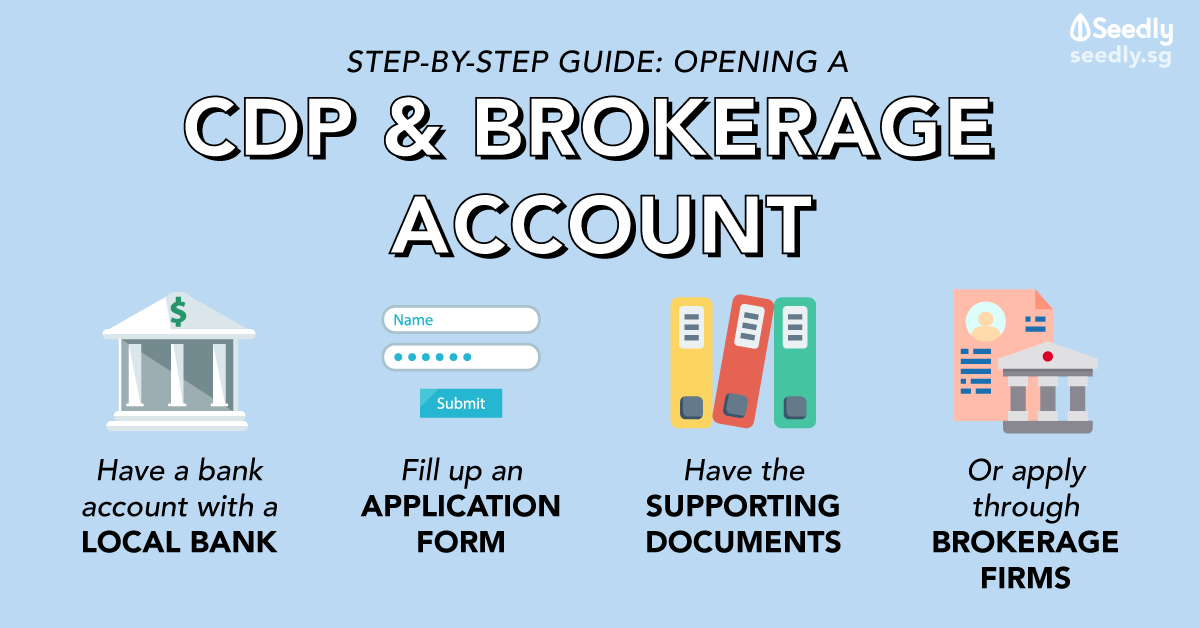

Brokerage Account Options Trading

Image: blog.seedly.sg

3. Disciplined Trading

Establish a structured approach and adhere to predefined trading strategies. Avoid making impulsive decisions driven by emotions or uninformed speculation.