The world of finance has recently witnessed a surge in interest surrounding options trading, a sophisticated yet potentially rewarding investment strategy. In the bustling landscape of India, where the stock market has been experiencing unprecedented growth, options trading has emerged as an exciting avenue for discerning investors seeking to enhance their returns. In this comprehensive guide, we will delve into the intricacies of options trading in India, empowering you with the knowledge to navigate this dynamic market.

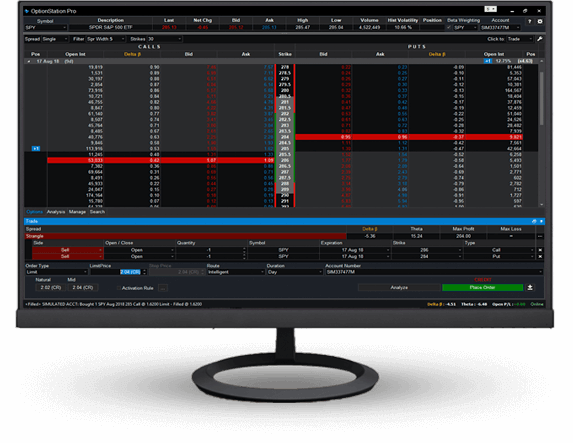

Image: www.tradestation.io

Understanding the Nuances of Options Trading

Options trading involves contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). These contracts offer investors a range of opportunities to enhance their portfolio’s performance, hedge against risk, and even speculate on the future direction of the market.

The Indian Options Trading Landscape

India’s options trading market has undergone remarkable growth in recent years, primarily driven by the introduction of new derivative products, increased awareness among investors, and the expansion of trading platforms. The National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE) are the two primary exchanges where options contracts are traded in the country.

A Beginner’s Guide to Options Strategies

Options trading offers a wide range of strategies suitable for different levels of risk tolerance and investment goals. Some of the most common strategies include:

- Covered Call: Selling a call option against an existing long position in the underlying asset.

- Cash-Secured Put: Selling a put option after depositing the required cash to purchase the underlying asset if the option is exercised.

- Bull Call Spread: Simultaneous purchase and sale of call options with different strike prices to profit from a moderate rise in the underlying asset’s price.

- Bear Put Spread: Simultaneous purchase and sale of put options with different strike prices to profit from a moderate decline in the underlying asset’s price.

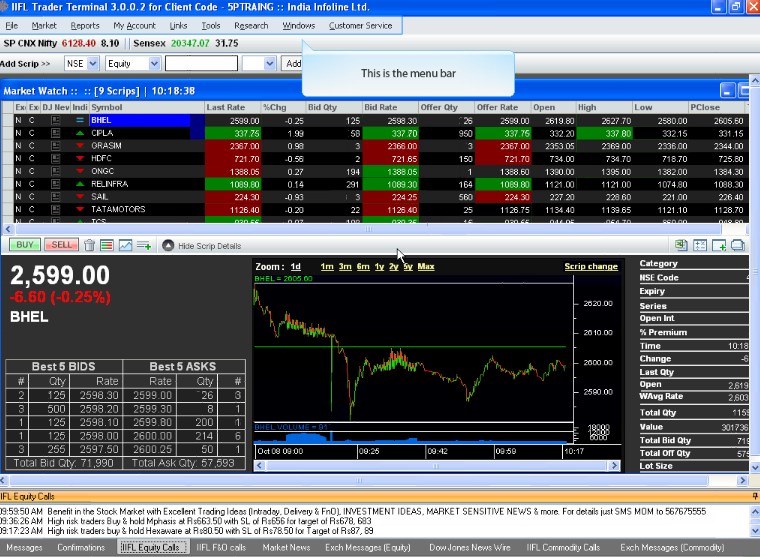

Image: www.adigitalblogger.com

The Art of Risk Management

Options trading, like any investment strategy, carries inherent risks. Understanding and managing these risks is crucial to maximizing your chances of success. Key risk management techniques include:

- Hedging: Using an opposite position in the underlying asset or a different option to offset potential losses.

- Position Sizing: Trading only the amount of capital you can afford to lose.

- Setting Stop-Loss Orders: Automatically closing positions when market conditions move against you, limiting losses.

Expert Insights on Options Trading in India

“Options trading offers a versatile tool for investors to capitalize on market fluctuations,” says Mr. Amit Saxena, an experienced options trader. “However, it’s essential to tread cautiously, conduct thorough research, and maintain a disciplined approach.”

Enhancing Your Earnings Potential

Options trading presents a unique opportunity to enhance your portfolio’s earnings potential. By strategically combining different options strategies and managing risks effectively, you can generate substantial returns even in volatile markets. Remember, the key lies in developing a sound trading plan and continuously educating yourself about the intricacies of options trading.

Options Trading Platform India

Image: binary.mxzim.com

Conclusion: Embarking on Your Options Trading Journey

Options trading in India holds immense potential for both seasoned investors and aspiring enthusiasts. Arm yourself with knowledge, embrace risk management, and begin your journey into the exhilarating world of options trading today. With determination and a strategic mindset, you can conquer this dynamic market and achieve your financial aspirations.