The world of financial trading is vast and exhilarating, with options trading standing out as a potent strategy for savvy traders. However, venturing into this arena demands a sound understanding of the intricate mechanisms at play. In this comprehensive guide, we will unlock the secrets to practicing option trading effectively, guiding you towards informed decisions and maximizing your chances of success.

Image: tradeproacademy.com

Understanding the Basics of Option Trading

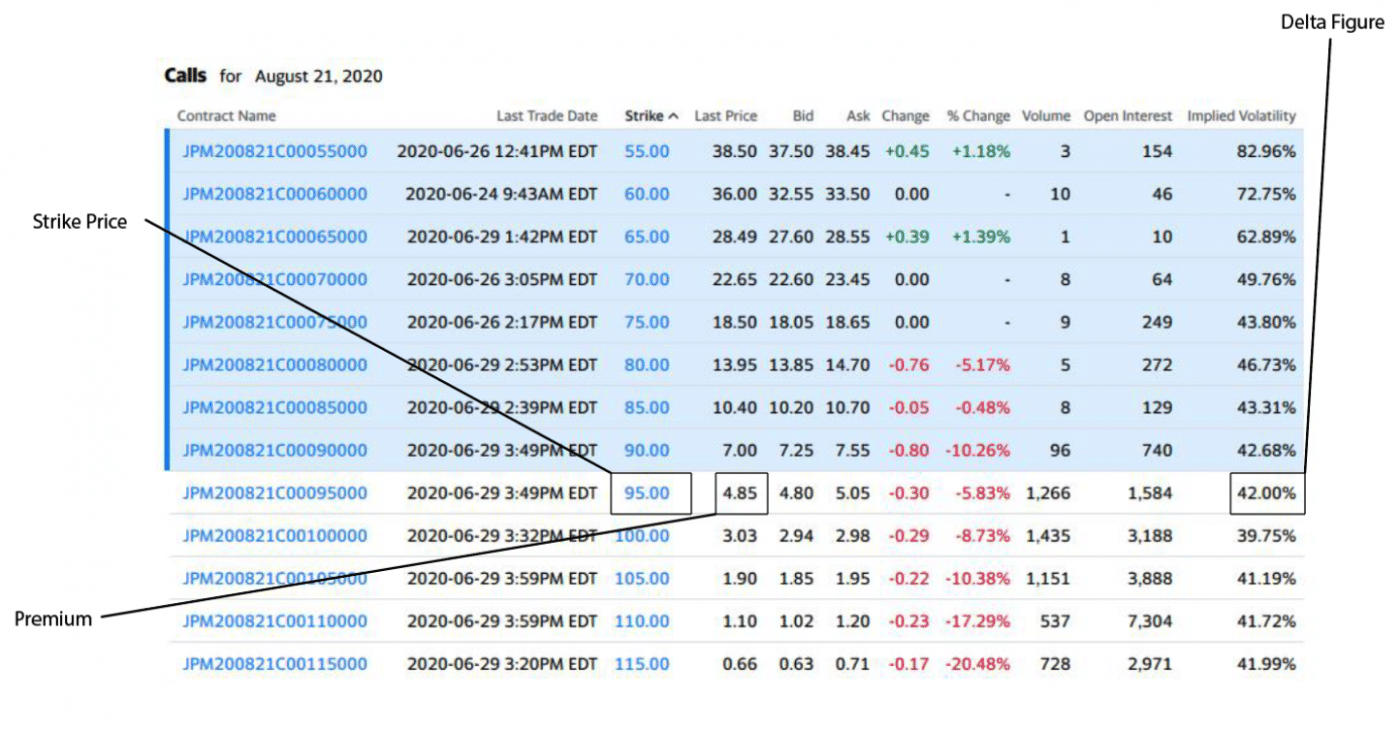

At its core, an option is a contract between two parties that grants the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (put option) an underlying asset at a predetermined price and time. This unique characteristic sets options apart from stocks, endowing traders with the flexibility to capitalize on market trends without committing to an actual trade.

Options trading offers ample opportunities for generating income, whether you anticipate upward or downward price fluctuations. Skilled traders often employ options to enhance their portfolio returns, hedge against risks, and speculate on market movements.

However, it’s crucial to approach option trading with caution and a deep understanding of the risks involved. Options are complex financial instruments, and their value can fluctuate significantly, leading to substantial losses if not traded prudently.

The Art of Practicing Option Trading

Before stepping into the live trading arena, it’s imperative to hone your skills through diligent practice. This preparatory phase will empower you with the confidence and expertise to navigate market complexities and make informed decisions.

Virtual Trading Simulations

Numerous online platforms provide virtual trading simulators that replicate real-world trading environments without exposing you to financial risk. These simulations allow you to trade in a controlled setting, experiment with different strategies, and test your understanding of option pricing and market dynamics.

Image: club.ino.com

Paper Trading

Paper trading takes practice a step further by simulating trades using hypothetical funds, mimicking the experience of actual trading. This intermediate step bridges the gap between virtual simulations and live trading, enabling you to refine your techniques while familiarizing yourself with the psychological aspects of trading.

Educational Resources

Immerse yourself in the wealth of educational materials available online, from articles and videos to webinars and courses. Leverage reputable sources to grasp key concepts, technical analysis techniques, and risk management principles. Workshops and seminars led by experienced traders can also provide invaluable insights and practical guidance.

Mastering Option Trading: Expert Insights and Strategies

Once you’ve laid a solid foundation, it’s time to elevate your option trading prowess by tapping into the wisdom of industry experts.

Leveraging Fundamental Analysis

Fundamental analysis delves into company-specific factors and broader economic conditions to assess the intrinsic value of an underlying asset. By understanding the health of the company, its position within the industry, and macroeconomic influences, you can make informed decisions about which options to trade and when to enter or exit positions.

Technical Analysis Mastery

Technical analysis is the art of deciphering market trends and price patterns on charts. By studying historical price data, moving averages, support and resistance levels, and chart formations, you can predict future price movements with greater accuracy. This skillset is indispensable for identifying lucrative trading opportunities and setting optimal entry and exit points.

Risk Management Strategies

Risk management is the cornerstone of successful option trading. It entails implementing strategies to minimize losses and preserve capital. Employ option strategies like spreads, collars, and straddles to offset risks, diversify your portfolio, and enhance your overall trading performance.

Best Way To Practice Option Trading

Image: www.youtube.com

Conclusion: Embarking on Your Option Trading Journey

The world of option trading is brimming with possibilities for those who approach it with diligence, knowledge, and a strategic mindset. Embarking on this journey requires a commitment to ongoing learning, skillful practice, and a disciplined approach to risk management. By embracing the insights shared in this guide and seeking mentorship from experienced traders, you can unlock the full potential of option trading and achieve your financial aspirations.