In today’s rapidly evolving financial landscape, options trading has emerged as a sophisticated and lucrative investment strategy for both experienced traders and aspiring market enthusiasts. However, navigating the diverse range of option trading platforms can be a daunting task. To guide you through this complex landscape, we present a comprehensive analysis of the best accounts for options trading, empowering you with the knowledge to make informed decisions and maximize your trading potential.

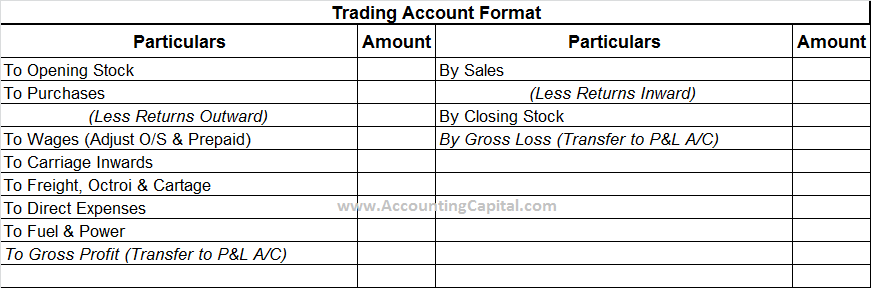

Image: www.accountingcapital.com

Defining Options Trading: A Gateway to Enhanced Investment Opportunities

Options trading involves the purchase or sale of contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) within a predefined time frame (expiration date). Unlike stock trading, options contracts provide the flexibility to speculate on an asset’s price movement without the direct ownership of the asset itself. This unique characteristic of options trading offers a multitude of strategic opportunities for investors looking to enhance their portfolios.

Image: www.accountancyknowledge.com

Best Accounts For Options Trading

https://youtube.com/watch?v=QhIJfYUwA_w

Essential Features of Top-Tier Options Trading Platforms

To thrive in the competitive landscape of options trading, it is imperative to choose a platform that aligns with your trading style and objectives. Leading platforms offer a range of essential features, including:

- User-friendly Interface: A well-designed platform provides an intuitive and seamless trading experience, maximizing efficiency and reducing friction.

- Advanced Charting Capabilities: In-depth charting tools empower traders to analyze price patterns, identify trends, and make informed decisions.

- Real-time market data: Access to accurate and timely market data is crucial for making effective trades and capturing market opportunities.

- Risk Management Tools: Robust risk management features, such as stop-loss orders and position monitoring tools, help traders mitigate potential losses and preserve capital.

- Educational Resources: Comprehensive educational materials, including tutorials, webinars, and market analysis, equip traders with the knowledge they need to navigate the intricacies of options trading.