Prologue: The Rise of Retail Investors on Wall Street

In recent years, the financial landscape has witnessed an unprecedented surge in retail options trading. Armed with sophisticated trading platforms and a proliferation of financial education resources, individual investors have flocked to the world of derivatives, eager to harness their profit-making potential. As one of the leading players in the derivatives industry, Barclays has devised an innovative US Equity Derivatives strategy to cater to this burgeoning market. In this comprehensive article, we delve into the intricacies of Barclays’ strategy and its implications for the financial sector.

Image: www.ft.com

Barclays’ US Equity Derivatives Strategy: A Comprehensive Overview

Barclays’ US Equity Derivatives strategy is a carefully crafted approach to capitalize on the growing trend of retail options trading. The strategy involves identifying underlying stocks expected to experience significant price movements and offering a range of equity derivatives, including options, futures, and swaps.

By providing retail investors with access to complex financial instruments tailored to their specific needs and risk appetite, Barclays seeks to empower them as sophisticated market participants. This democratization of derivatives trading has leveled the playing field, allowing individual investors to access investment opportunities previously reserved for institutional players.

The strategy’s core tenets revolve around leveraging Barclays’ extensive research and analytics capabilities to pinpoint stocks exhibiting high volatility and growth potential. The firm’s dedicated team of experts employs advanced quantitative models and deep industry knowledge to identify these opportunities, providing retail investors with valuable insights for informed decision-making.

The Impact of Retail Options Trading on the Financial Sector

The surge in retail options trading has had a profound impact on the financial sector, reshaping market dynamics and creating new opportunities. Among the most notable effects are increased market liquidity, heightened volatility, and a democratization of investment strategies.

The increased participation of retail investors has amplified market liquidity, leading to tighter bid-ask spreads and smoother trade execution. This liquidity boost benefits all market participants, including institutional investors, by facilitating efficient price discovery and reducing transaction costs.

Simultaneously, retail options trading has contributed to increased market volatility, particularly for stocks with high short-term interest. As retail investors actively manage their options positions, buying and selling options contracts, they can influence the underlying stock price, leading to price swings and higher market volatility.

Furthermore, the democratization of derivatives trading has empowered individual investors, providing them with access to sophisticated investment strategies previously available only to institutional entities. This has fostered greater financial literacy and allowed retail investors to partake in complex financial markets, potentially enhancing their investment returns.

Tips and Expert Advice for Retail Options Traders

Navigating the world of derivatives trading requires a combination of knowledge, experience, and prudent risk management. To assist retail investors venturing into this realm, seasoned experts offer invaluable tips for success.

-

Thoroughly Research and Understand the Derivatives Markets: Options trading involves intricate financial instruments with unique risks and rewards. Before delving into these markets, it is imperative to acquire a comprehensive understanding of how they operate and the variables influencing their prices.

-

Define a Coherent Trading Strategy and Risk Management Plan: Success in derivatives trading hinges upon having a well-defined strategy that aligns with your financial goals and risk tolerance. Furthermore, a robust risk management plan is essential to mitigate potential losses and protect your capital.

-

Stay Informed with Current Market News and Analysis: Market conditions are constantly evolving, and it is paramount to remain up-to-date with the latest news and market analysis to make informed trading decisions. Monitoring economic indicators, corporate earnings releases, and geopolitical events can provide valuable insights into market trends.

-

Utilize Technology to Your Advantage: Modern technology empowers traders with powerful tools and resources to enhance their trading efficiency. Leverage trading platforms that offer advanced features, such as real-time charting, technical analysis, and automated trading capabilities, to optimize your trading performance.

-

Seek Guidance from Experienced Professionals: If you are a novice in derivatives trading, consider consulting with experienced financial advisors or brokers to guide you through the complexities of the markets and provide tailored advice based on your specific circumstances.

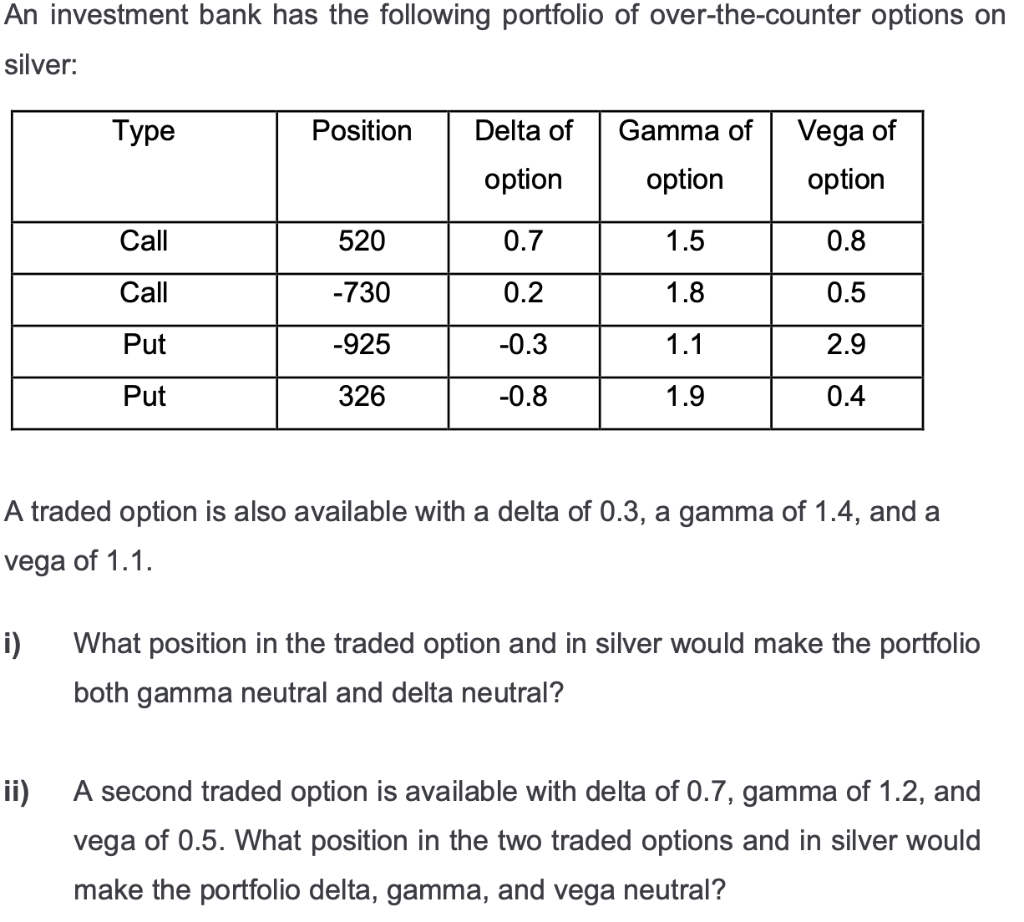

Image: www.chegg.com

Frequently Asked Questions (FAQs) on Retail Options Trading

Q: What are the potential benefits of retail options trading?

A: Retail options trading offers several potential benefits, including the ability to leverage price fluctuations, generate income through premium collection, and hedge against downside risk in investment portfolios.

Q: How can I mitigate the risks associated with options trading?

A: Effective risk management is crucial in options trading. Implement strategies such as position sizing, stop-loss orders, and diversification to minimize potential losses and protect your capital.

Q: What is the minimum capital required to start trading options?

A: The minimum capital required varies based on the specific options contracts you trade and your trading strategy. It is advisable to start with a small amount of capital and gradually increase it as you gain experience and knowledge.

Barclays-Us-Equity-Derivatives-Strategy-Impact-Of-Retail-Options-Trading

Conclusion: The Future of Options Trading and Investment

The rise of retail options trading has transformed the financial landscape, providing individual investors with unprecedented access to complex investment instruments. Barclays’ US Equity Derivatives strategy harnesses this trend, empowering retail investors with the tools and insights to navigate the markets effectively. As the industry continues to evolve, it is crucial to stay informed, embrace technology, and seek professional guidance to maximize your potential for success in this dynamic realm.

Are you an avid options trader seeking in-depth knowledge and actionable insights? Subscribe to our newsletter and join our community of engaged traders for exclusive content and expert perspectives on the latest market trends and strategies.