Introduction

Options trading, a complex yet captivating realm of the financial markets, has intrigued investors seeking to amplify their returns. However, understanding the potential rewards requires a thorough exploration of the average return on investment (ROI) in this dynamic arena. In this comprehensive guide, we will delve into the intricacies of option trading, analyze the historical ROI data, and provide valuable tips to enhance your strategies.

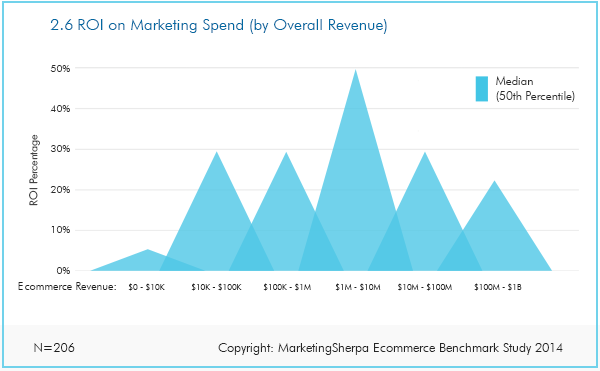

Image: www.marketingsherpa.com

Options are financial contracts that grant buyers the **right** (but not the obligation) to **buy** or **sell** an underlying asset (e.g., stocks, commodities) at a predetermined **strike price** on or before a specific **expiration date**. This contractual flexibility allows investors to speculate on future price movements, hedge risks, or generate income without directly owning the underlying asset.

Historical ROI and Performance Metrics

Determining the average ROI in option trading is not straightforward due to various factors, including the option’s type, underlying asset, market conditions, and trading strategies employed. However, historical data provides valuable insights into the potential returns and risks involved.

According to the **Options Clearing Corporation (OCC)**, the average annualized ROI for S&P 500 index options over the past decade was approximately 15%. However, individual option strategies can yield significantly higher or lower returns depending on market conditions and risk tolerance.

Understanding Option Strategies and Risk-Reward Dynamics

Option trading encompasses a diverse range of strategies, each with its unique risk-reward profile. Call options grant the buyer the right to purchase, while put options provide the right to sell the underlying asset. The type of strategy employed (e.g., covered call, naked put, strangle) significantly impacts the potential returns and risks involved.

Option traders must carefully consider the **implied volatility (IV)**, a key metric that gauges the market’s expectation of future price fluctuations. High IV often indicates potential for higher returns, but it also amplifies the risk of loss. Conversely, low IV suggests a more stable market environment, potentially resulting in lower returns but reduced risk exposure.

Tips for Maximizing ROI in Option Trading

Maximizing ROI in option trading requires a combination of knowledge, skill, and strategic execution. Consider incorporating the following tips into your trading approach:

- Define your trading goals. Clarify your objectives (e.g., income generation, risk management) before entering any trades.

- Research and analyze the underlying asset. Conduct thorough research to understand the fundamental and technical factors influencing its price movements.

- Choose appropriate option strategies. Select strategies that align with your risk tolerance and trading goals.

- Manage risk effectively. Implement stop-loss orders to limit potential losses and consider hedging strategies to mitigate market downturns.

- Trade within your means. Avoid risking more capital than you can afford to lose.

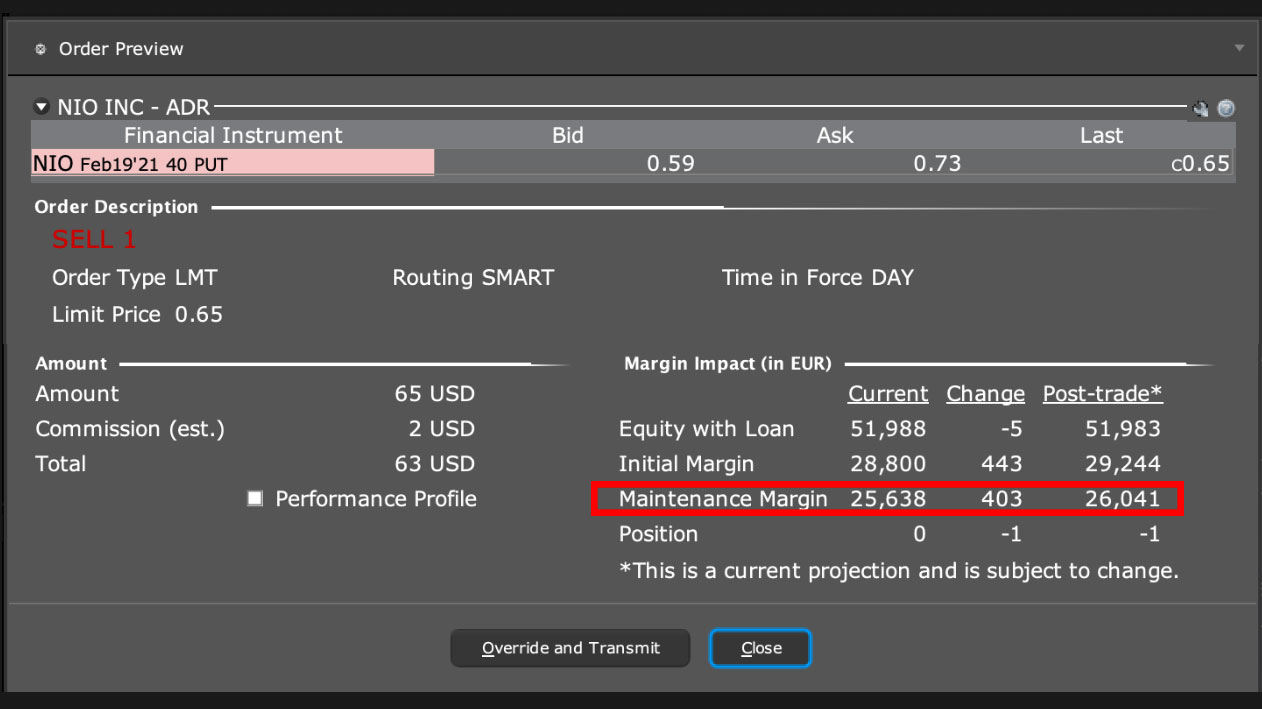

Image: www.tradingoptionscashflow.com

Frequently Asked Questions

To enhance your understanding of option trading further, here are answers to some commonly asked questions:

- Q: What is the best option trading strategy?

A: The best strategy depends on individual trading goals and risk tolerance. Common strategies include covered calls, naked puts, and spreads.

- Q: How much can I make in option trading?

A: Potential returns vary widely depending on factors such as strategy, market conditions, and trading frequency.

- Q: Is option trading risky?

A: Yes, option trading carries inherent risks due to market volatility, time decay, and leverage. Proper risk management is crucial.

- Q: Where can I learn more about option trading?

A: Resources include online courses, books, webinars, and forums dedicated to option trading education.

Average Roi In Option Trading

Conclusion

The average ROI in option trading is influenced by a multitude of factors, making it difficult to provide a definitive answer. However, by comprehending option strategies, evaluating historical performance, and implementing sound trading practices, investors can position themselves to harness the potential of this dynamic asset class. As with any investment, thorough research and proper risk management remain the cornerstones of success.

Are you intrigued by the allure of option trading and eager to delve deeper into this potentially rewarding financial realm? Share your thoughts and questions in the comments section below, and let’s embark on this exciting journey together.