Traders seeking a reliable and accessible platform may be disheartened to learn that XM Trading, a prominent forex and CFD broker, does not offer its services to the American market. This exclusion can be a significant setback for aspiring American traders, who face limited options when choosing a reputable brokerage. Let’s dive deeper into the reasons why XM Trading has chosen to refrain from operating in the United States.

Image: forextradingbonus.com

Exploring the Exclusion: Reasons Behind XM Trading’s Absence in the US

The absence of XM Trading in the American market can be attributed to two primary factors:

-

Strict Regulatory Landscape: The United States maintains a strict regulatory environment for financial markets, overseen by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). These regulatory bodies enforce stringent regulations to protect investors, including requirements for capital adequacy, risk management, and reporting.

-

Competition and Market Saturation: The American forex and CFD market is highly competitive and saturated with brokerages. This competitive landscape makes it challenging for new entrants to gain a significant market share, especially when faced with established incumbents.

Consequences of Exclusion: Impact on US Traders

The exclusion of XM Trading from the US market has a direct impact on American traders, limiting their access to potentially favorable trading conditions and features offered by the broker:

-

Missed Opportunities: US traders are deprived of the opportunity to utilize XM Trading’s low spreads, competitive leverage, and diverse asset selection. This can hinder their ability to optimize trading strategies and potentially reduce profitability.

-

Reduced Choice: The absence of XM Trading reduces the pool of available brokerages for American traders. This can lead to a lack of diversity in terms of trading conditions, account types, and customer support.

Navigating the American Market: Alternative Options for US Traders

Despite the absence of XM Trading, American traders have access to a range of alternative brokerages that cater to their needs:

-

IG US: A well-established brokerage with a strong presence in the US market, offering a comprehensive suite of trading products and educational resources.

-

TD Ameritrade: A leading American broker known for its reliable platform, low trading costs, and access to a vast array of financial instruments.

-

Interactive Brokers: A globally renowned brokerage that provides advanced trading tools, competitive commissions, and access to international markets.

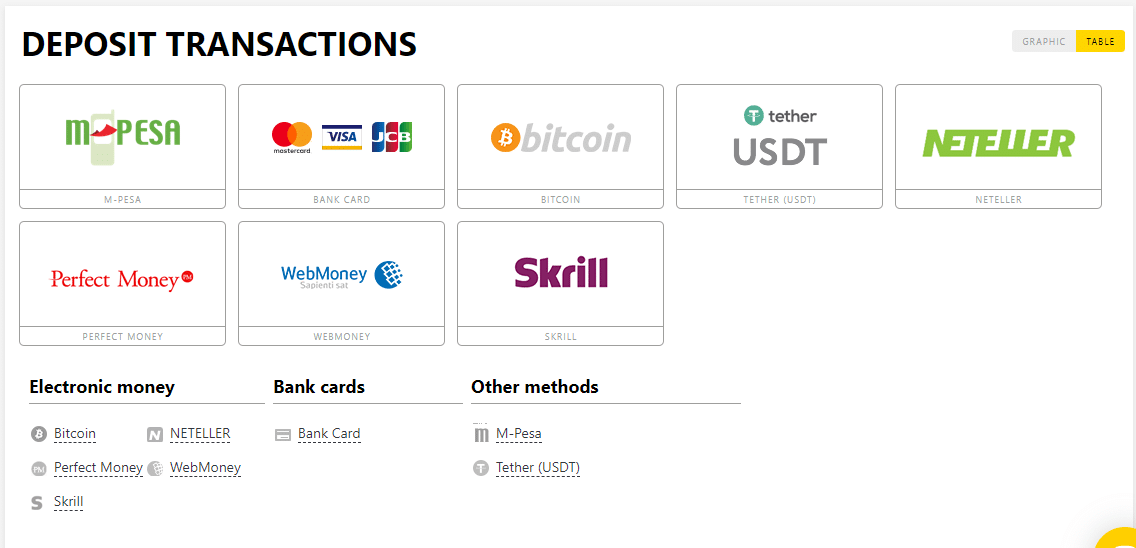

Image: www.tradeforexkenya.com

Choosing the Right Broker: Considerations for US Traders

When selecting a brokerage in the United States, traders should consider the following factors:

-

Regulatory Compliance: Verify that the broker is regulated by reputable agencies such as the CFTC, NFA, or SEC to ensure compliance with industry standards.

-

Trading Conditions: Evaluate the broker’s spreads, commissions, leverage options, and minimum deposit requirements to align with your trading style and capital.

-

Product Offerings: Consider the broker’s range of tradable assets, including forex pairs, CFDs, stocks, bonds, and ETFs, to meet your investment objectives.

Staying Informed: Keeping Up with the Changing Landscape

The brokerage landscape is constantly evolving, and it’s important for US traders to stay informed about changes in regulation, market conditions, and broker offerings:

-

Follow Industry News: Subscribe to reputable financial publications and news sources to keep abreast of developments within the trading industry.

-

Attend Webinars and Conferences: Participate in industry events to hear from experts and gain insights into the latest trends and regulatory updates.

-

Consult with Financial Professionals: Seek guidance from experienced financial advisors or brokers who can provide tailored advice based on your individual circumstances and trading goals.

America Is Not An Option For Xm Trading

Conclusion

While America may not be an option for XM Trading, US traders have access to a plethora of alternative brokerages that meet their trading needs. By carefully considering factors such as regulatory compliance, trading conditions, and product offerings, American traders can select the broker that best aligns with their individual requirements and aspirations. Staying informed about industry developments and constantly evaluating the brokerage landscape is paramount for success in the ever-evolving financial markets.