Preamble: Unveiling the Enigmatic World of Binary Options

In the fast-paced realm of financial trading, the allure of binary options beckons those seeking to navigate volatile markets with precision and swift execution. Among the diverse strategies employed in this domain, the 60-second trading rapid fire approach stands out as an intriguing and potentially lucrative technique.

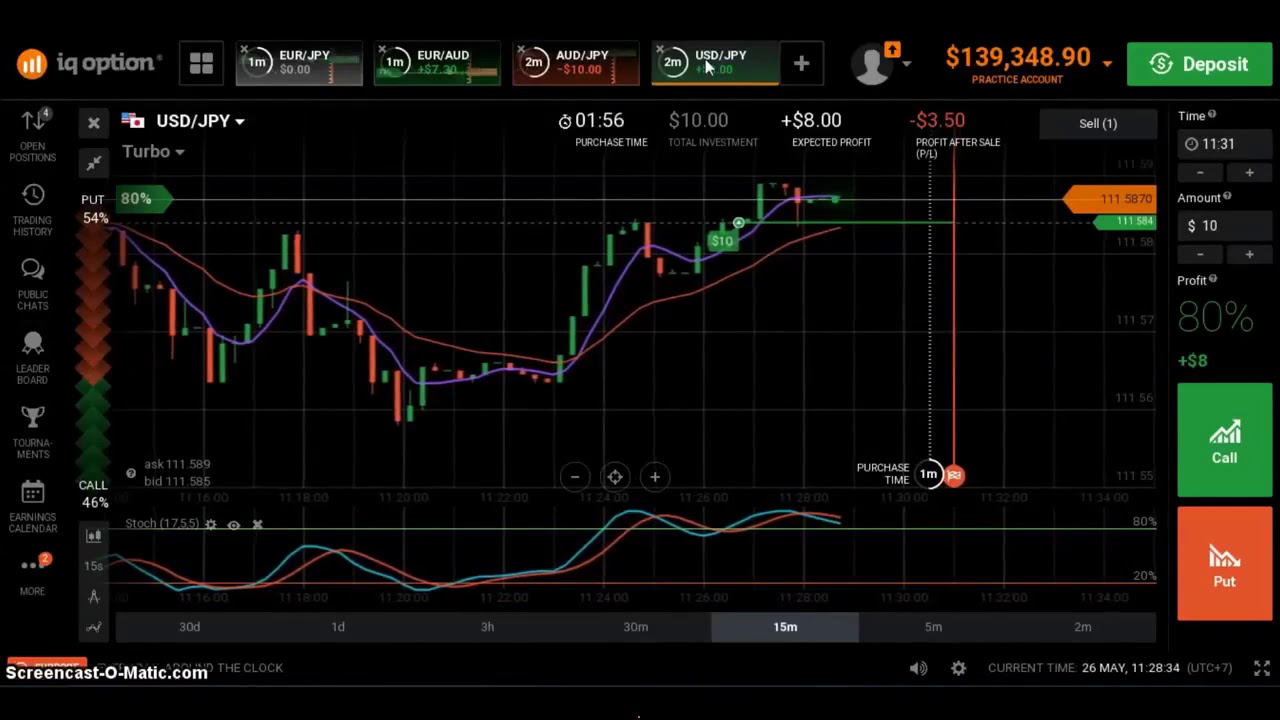

Image: www.youtube.com

Unveiling the Rapid Fire Strategy: A Journey Into High-Velocity Trading

The 60-second trading rapid fire strategy, as its name suggests, centers around executing trades within the fleeting 60-second window. This exhilarating style of trading demands lightning-fast decision-making and a keen understanding of market trends. Traders utilizing this approach aim to capitalize on price fluctuations within the designated time frame, seeking to predict whether the asset’s price will rise or fall. By leveraging technical analysis, market news, and their intuition, traders strive to make informed choices, reaping the rewards of successful predictions while mitigating potential losses.

Delving into the Mechanics: Execution and Execution

The mechanics of the 60-second rapid fire strategy are relatively straightforward. Traders typically choose an asset from a list offered by their chosen binary options broker. Once the asset is selected, they must predict the direction of its price movement within the upcoming 60-second trading interval. They can either opt for a “higher” or “lower” prediction, indicating their belief that the asset’s price will ascend or descend. If their prediction aligns with the market’s actual movement, they reap a profit. However, if their prediction falters, they incur a predetermined loss.

Unveiling the Secrets: Mastering Technical Analysis and Price Action

To excel in 60-second trading, mastering technical analysis and interpreting price action are indispensable skills. Technical analysis involves studying historical price charts and utilizing various indicators and patterns to discern market trends. This approach helps traders identify potential opportunities and make informed decisions. Additionally, understanding price action – the real-time fluctuations in an asset’s price – is crucial. By closely monitoring price movements, traders can gauge market sentiment and anticipate upcoming trends, providing them with an edge in their rapid-fire trades.

Image: www.youtube.com

Embracing the Psychological: Cultivating Discipline and Risk Management

While technical proficiency is undoubtedly important, the psychological aspect of trading holds immense sway. Discipline and unwavering focus are essential in the 60-second rapid fire trading arena. Traders must maintain emotional control, adhering to their trading plan and not deviating from it due to fear or greed. Moreover, rigorous risk management strategies are paramount to safeguard against potential losses. Traders should establish clear guidelines for position sizing and risk tolerance, ensuring that a single losing trade does not result in significant financial setbacks.

The Allure of 60-Second Trading: Unveiling Its Advantages

The 60-second rapid fire trading strategy appeals to a wide range of traders due to its inherent advantages. Firstly, it offers the tantalizing allure of quick returns. With trades being completed within a minute, traders can potentially amass substantial profits in a short span. Secondly, this strategy is well-suited for traders with limited time, as it allows them to engage in market action without dedicating hours to their endeavors. Finally, it fosters a dynamic and engaging trading experience, catering to those who relish the thrill of high-velocity decision-making.

Unveiling the Potential Pitfalls: Weighing the Risks

Despite its allure, 60-second rapid fire trading also carries inherent risks that traders must be aware of. Firstly, the fast-paced nature of the strategy magnifies the impact of emotional trading. Traders may succumb to the temptation of chasing losses or overtrading, leading to significant financial losses. Secondly, without a solid foundation in technical analysis and risk management, traders may find themselves at a disadvantage in the ever-changing market landscape. Lastly, managing risk effectively is crucial in this strategy, as the short duration of trades can lead to rapid fluctuations in profits and losses.

The Path to Mastery: Nurturing Skills Through Practice and Knowledge Acquisition

Becoming adept at the 60-second rapid fire strategy requires a combination of practice and knowledge acquisition. Traders can hone their technical analysis skills by studying historical price charts, experimenting with different indicators, and understanding market patterns. Additionally, familiarizing themselves with risk management techniques, such as stop-loss orders and position sizing strategies, is indispensable. Continuous learning and staying abreast of market trends are also vital for sustained success in this dynamic trading environment.

60 Second Trading Rapid Fire Strategy Binary Options

Conclusion: A Gateway to Quick Returns But A Path Rife with Risks

The 60-second rapid fire trading strategy offers the tantalizing promise of quick returns but simultaneously presents a landscape fraught with risks. Aspiring traders contemplating this approach should meticulously weigh the potential benefits and risks. Those possessing a solid foundation in technical analysis, unwavering discipline, and meticulous risk management practices may find success in this high-velocity trading realm. As with any trading endeavor, approaching the 60-second rapid fire strategy with a prudent mindset and a comprehensive understanding of market dynamics is the cornerstone of long-term success.