In the fast-paced world of day trading, finding a reliable and effective strategy is paramount. Enter the 13 48 EMA day trading options strategy, an ingenious technique that empowers traders with insights into market trends and helps them make informed decisions.

Image: www.forexfunction.com

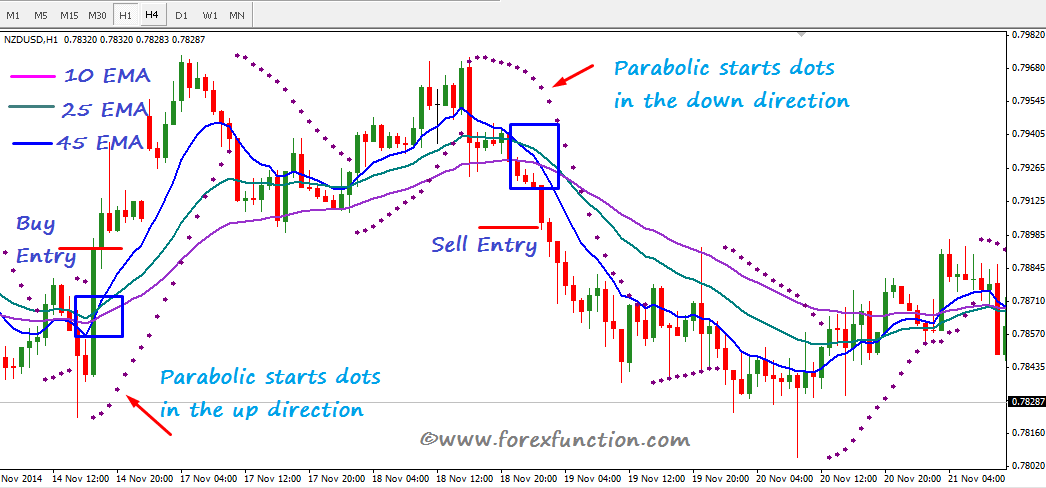

This innovative approach combines two powerful moving averages, the 13-period exponential moving average (EMA) and the 48-period EMA, to provide traders with a clear understanding of short-term and long-term price trends. Ready to embark on a trading journey toward success? Strap yourself in as we delve into the intricacies of this game-changing strategy.

EMA: A Gateway to Market Insight

Exponential moving averages (EMAs) are technical indicators that calculate the average price of an asset over a specific period. Unlike simple moving averages (SMAs), EMAs give more weight to recent prices, providing a more responsive and accurate representation of market trends.

The 13-period EMA tracks short-term price fluctuations, while the 48-period EMA gauges longer-term trends. When combined, these EMAs form a confluence that helps traders identify potential trading opportunities.

The Strategy Unleashed

At the heart of the 13 48 EMA day trading options strategy lies the following key principles:

- Trend Following: Buy when the 13-period EMA is above the 48-period EMA (uptrend) and sell when the 13-period EMA crosses below the 48-period EMA (downtrend).

- Range Trading: If the 13-period EMA and the 48-period EMA are moving sideways, indicating a range-bound market, trade near the support and resistance levels.

- Support and Resistance Zones: Use the EMA crossover points as potential support and resistance levels for price.

By comprehending these principles, traders can harness the power of EMA crossovers to identify trading setups with higher probability of success.

Trading Psychology: The Key to Success

Technical strategies are vital, but trading psychology is equally crucial. Discipline, patience, and emotional control are key ingredients in the recipe for success. Avoid impulsive trading and stick to your strategy.

Remember, trading is a continuous learning process. Stay updated with the latest market trends, refine your strategy, and manage your emotions effectively. The rewards of mastering the 13 48 EMA day trading options strategy await those who embrace these principles.

Image: www.plafon.id

Frequently Asked Questions

Q: What are the best assets to trade using this strategy?

A: The strategy can be applied to a wide range of assets, including stocks, commodities, and currency pairs.

Q: Can I use this strategy in any time frame?

A: Yes, but it is primarily designed for day trading (trading and closing positions within the same trading day).

13 48 Ema Day Trading Options Strategy

https://youtube.com/watch?v=EmA-nbgvK54

Embrace the Challenge, Reap the Rewards

Are you fascinated by the allure of the markets and eager to embark on a transformative trading odyssey? The 13 48 EMA day trading options strategy is your gateway to uncovering the secrets of successful trading. Embrace the challenge, develop discipline, and master the art of riding market trends.

Remember, the path to trading success is paved with footprints of those who dared to challenge the norm, studied relentlessly, and harnessed the power of knowledge. Are you ready to join the ranks of elite traders and unlock the full potential of this groundbreaking strategy?