Introduction

Step into the realm of options trading on Robinhood, where the intrigue lies in understanding the intricate woven threads of risk and potential rewards. Options, like ethereal threads, offer flexible financial strategies that can amplify both profits and losses, making them a captivating pursuit for audacious traders. However, venturing into this arena necessitates a firm grasp of the fundamentals, unraveling the complexities that govern options trading on Robinhood. Our comprehensive guide unravels this enigmatic world, providing an overarching view of concepts, strategies, and nuances, equipping you with the know-how to navigate this dynamic market.

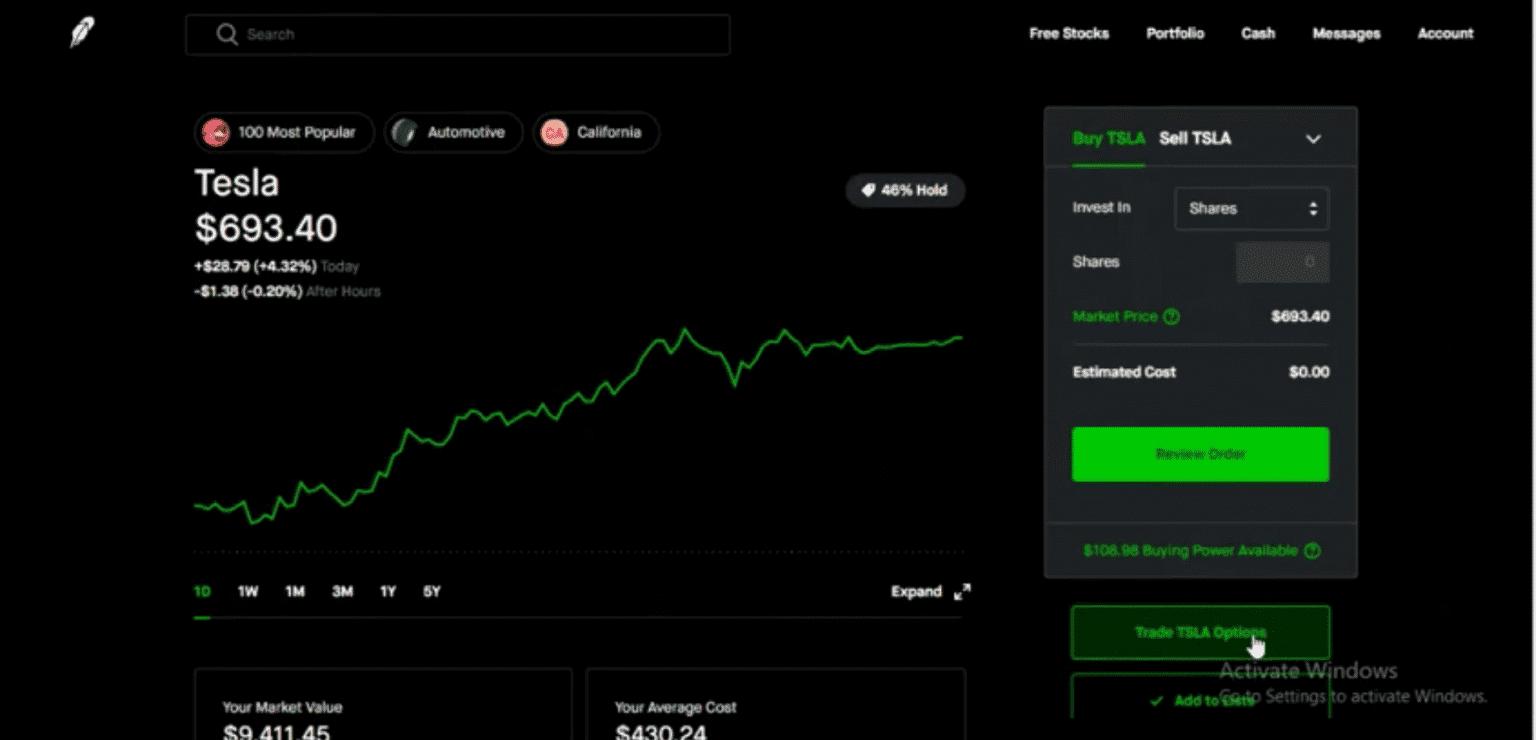

Image: forexscalpingmethod1.blogspot.com

Options Demystified: A Glimpse into Their Nature

Options emerge as contracts that bestow the privilege, not the obligation, to trade an underlying asset, such as a stock or commodity, at a predefined price within a specified time frame. This contract bestows the option buyer with the right to buy (call option) or sell (put option) the underlying asset while the seller of the option bears the responsibility to fulfill that contract if exercised. The contemplation of risk and reward weaves the inherent value of options.

Trading Options on Robinhood: Harnessing the Power of Flexibility

Robinhood stands as a popular platform for options trading, providing traders with an accessible gateway to this dynamic market. Embarking on this journey with Robinhood offers several advantages that cultivate confidence and cater to diverse trading inclinations.

-

Simplicity and Accessibility: Robinhood unveils an intuitive interface, rendering options trading accessible to novice traders. The platform’s user-friendly design simplifies order placement, allowing seamless navigation through the intricacies of options trading.

-

Commission-Free Trading: Unlike traditional brokerages, Robinhood abolishes commission fees associated with options trading, fostering an environment where traders retain a greater portion of their profits, bolstering their potential returns.

-

Educational Resources: Aspiring options traders on Robinhood are not left adrift. The platform provides an array of educational resources, including tutorials, webinars, and articles, cultivating a supportive ecosystem for learning.

Unveiling the Mechanics of Options Trading: A Journey of Possibilities

To masterfully traverse the realm of options trading, a profound understanding of its mechanics is paramount. Options contracts are characterized by two fundamental elements: the strike price and expiration date. The strike price represents the price at which the underlying asset can be bought or sold, while the expiration date dictates the timeframe within which this right can be exercised.

Understanding these elements forms the bedrock of successful options trading. Traders must carefully consider the strike price in relation to the current market price of the underlying asset, while the expiration date dictates the duration of the contract’s validity, influencing the decay of its time value.

Image: marketxls.com

Embracing the Strategies: Exploring the Options Spectrum

Options trading presents a kaleidoscope of strategies, each tailored to specific market conditions and risk tolerance. Covered calls, cash-secured puts, protective puts, and bull and bear spreads are just a few tactics employed by seasoned traders. Mastering these strategies empowers traders to navigate market volatility, capture upside potential, or hedge against downside risks, expanding their repertoire of financial maneuvers.

Understanding Risk and Reward: Navigating the Delicate Balance

Options trading, by its very nature, invites an inherent interplay of risk and reward. The potential for substantial profits must be carefully weighed against the possibility of significant losses. Unbridled enthusiasm can lead unwary traders into treacherous waters, making risk management a paramount consideration. Prudent traders establish clear risk parameters, implement stop-loss orders, and seek appropriate education, ensuring they remain grounded in informed decision-making.

What Is Trading Options Robinhood

Conclusion

Venturing into the world of options trading on Robinhood unveils an arena of strategic possibilities, where informed traders can exploit market fluctuations to their advantage. Understanding the fundamental concepts, mastering trading strategies, and embracing risk management principles empowers traders to navigate this dynamic market with greater confidence. Remember, knowledge is the compass that guides us through the complexities of options trading, and Robinhood offers a welcoming platform for both novice and experienced traders alike to explore this intriguing financial landscape.