A Journey into the Lucrative World of UK Options Trading

As a novice in the arena of financial trading, I was drawn to the allure of options trading, lured by its potential to amplify returns. However, the complexities and nuances of options trading left me perplexed. My quest led me to seek guidance from seasoned traders, poring over countless articles and immersing myself in the intricacies of this multifaceted financial instrument.

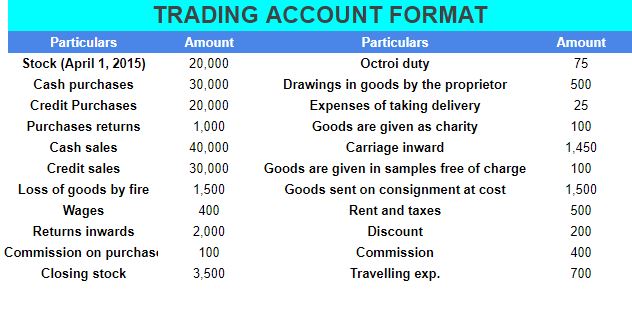

Image: www.toppr.com

Exploring the UK Options Trading Ecosystem

The UK serves as a melting pot for options traders, offering a plethora of options trading accounts tailored to cater to diverse needs and trading styles. These accounts provide a gateway to access a wide spectrum of underlying assets, ranging from stocks and indices to commodities and currencies. However, choosing an options trading account that aligns with your specific requirements is paramount.

Options trading in the UK is characterized by its regulated nature, ensuring that all transactions comply with stringent guidelines set forth by the Financial Conduct Authority (FCA). This layer of regulation instills confidence and safeguards traders against unscrupulous practices.

Delving into the Mechanics of UK Options Trading

Options, in essence, are financial instruments that empower traders to speculate on the future price movements of underlying assets without the obligation to purchase or sell them outright. Options trading opens up a realm of possibilities for traders seeking to enhance their returns, hedge their portfolios, or simply gain exposure to specific market movements.

One key distinction in options trading is the existence of two fundamental types of options: calls and puts. Call options grant the buyer the right to acquire an underlying asset at a predetermined price (strike price) within a specified period (expiry date). On the other hand, put options provide the buyer with the right to sell an underlying asset at the strike price by the expiry date.

Navigating the UK Options Trading Landscape

Before embarking on your options trading journey, it’s imperative to grasp the complexities and risks associated with this instrument. Market conditions are inherently volatile, and the value of options can fluctuate rapidly, leading to significant gains or losses.

Thorough research and due diligence are essential in options trading. To maximize your chances of success, arm yourself with a comprehensive understanding of options terminology, market dynamics, and trading strategies. Consider implementing risk management techniques to mitigate potential losses.

Image: pyvaragbio.blogspot.com

Unlocking the Secrets of UK Options Trading Accounts

The selection of an options trading account in the UK presents a pivotal step in your trading journey. Each account comes with its distinctive set of features and trading platforms, catering to varying levels of experience, trading strategies, and financial objectives.

When selecting an options trading account, consider factors such as:

• Commission and fee structure

• Trading platform and features

• Customer support and educational resources

• Account minimums and withdrawal policies

Harnessing Expert Insights for Options Trading Success

As you progress in your options trading endeavors, seek mentorship from seasoned traders or consider subscribing to reputable news sources and forums. Their insights, coupled with your own experience, will form a formidable arsenal for navigating the dynamic world of options trading.

Stay abreast of market trends and leverage cutting-edge trading tools to optimize your performance. Join online communities and engage in discussions to broaden your perspectives and stay informed about the latest developments in the field.

FAQs on UK Options Trading Accounts

Q: What are the criteria for opening an options trading account in the UK?

A: To open an options trading account in the UK, you typically need to be a UK resident over the age of 18 and have a valid government-issued ID. You will also need to provide proof of income and undergo an assessment to gauge your understanding of options trading.

Q: What are the different types of options trading accounts available in the UK?

A: There are several types of options trading accounts available in the UK, including cash accounts, margin accounts, spread betting accounts, and structured products. Each type of account carries its own set of risks and rewards, so it’s essential to choose the one that aligns with your trading style and risk tolerance.

Uk Options Trading Account

Conclusion

Venturing into the world of UK options trading can be an exhilarating journey, but it’s crucial to approach it with a thorough understanding of the risks and complexities involved. By choosing the right account, harnessing expert guidance, and continuously expanding your knowledge, you can empower yourself to navigate the markets with greater confidence and navigate the dynamic financial marketplace.

Embark on your UK options trading journey today and experience the thrilling potential of this multifaceted instrument. Remember, knowledge is power, and with unwavering determination, you can embark on a path to financial success.