In the fast-paced world of financial markets, scalp option trading has emerged as a lucrative strategy for traders seeking swift profits. As its name suggests, scalp option trading involves executing multiple short-term trades with the aim of capitalizing on minor price fluctuations within a limited time frame, often within a single trading session.

Image: moneyisle.in

Understanding scalp option trading and its intricacies can empower traders to make calculated decisions and enhance their trading outcomes. This comprehensive guide will delve into the fundamentals of scalp option trading, explore its benefits and challenges, and provide actionable insights to navigate this dynamic market successfully.

Deconstructing Scalp Option Trading: A Step-by-Step Approach

Scalp option trading consists of a series of rapid-fire transactions where traders buy and sell options within short intervals, typically ranging from a few seconds to a few minutes. The primary objective is to exploit minor price movements and generate immediate profits by capturing the difference between the buying and selling prices of options contracts.

To engage in scalp option trading, traders require a thorough understanding of option pricing dynamics and a deep understanding of technical analysis techniques. Analyzing historical price data, identifying market trends, and recognizing technical patterns are crucial for making informed trades and maximizing profitability.

Navigating the Nuances of Scalp Option Trading: Strategies and Considerations

Successful scalp option trading demands meticulous execution, discipline, and a well-defined trading strategy. Traders must establish clear parameters, including target profit levels, stop-loss points, and the maximum number of trades per session. Adhering to these parameters is essential for managing risk and safeguarding capital.

Additionally, scalpers often employ advanced trading tools and platforms to expedite their trading decisions and enhance their accuracy. These tools provide real-time data analysis, automated order execution, and sophisticated charting capabilities, enabling traders to stay ahead of the market.

Unlocking the Potential of Scalp Option Trading: Benefits and Challenges

Scalp option trading offers numerous advantages, including:

- Limited holding period: Short trading intervals minimize the exposure to overnight risk and market fluctuations, allowing traders to lock in profits swiftly.

- Amplified profits: Executing multiple trades throughout the trading day can lead to substantial profits over time, particularly in highly volatile markets.

- Enhanced flexibility: Scalp option trading provides flexibility, allowing traders to adjust their trading strategy based on changing market conditions.

However, scalp option trading also presents several challenges:

- High risk: Frequent trading and short holding periods can amplify potential losses, especially for inexperienced traders.

- Significant transaction costs: Each trade comes with associated transaction fees, which can accumulate and diminish profits, especially for low-volume traders.

- Emotional challenges: The fast-paced nature of scalp option trading can provoke emotional decision-making, leading to irrational trades and diminished returns.

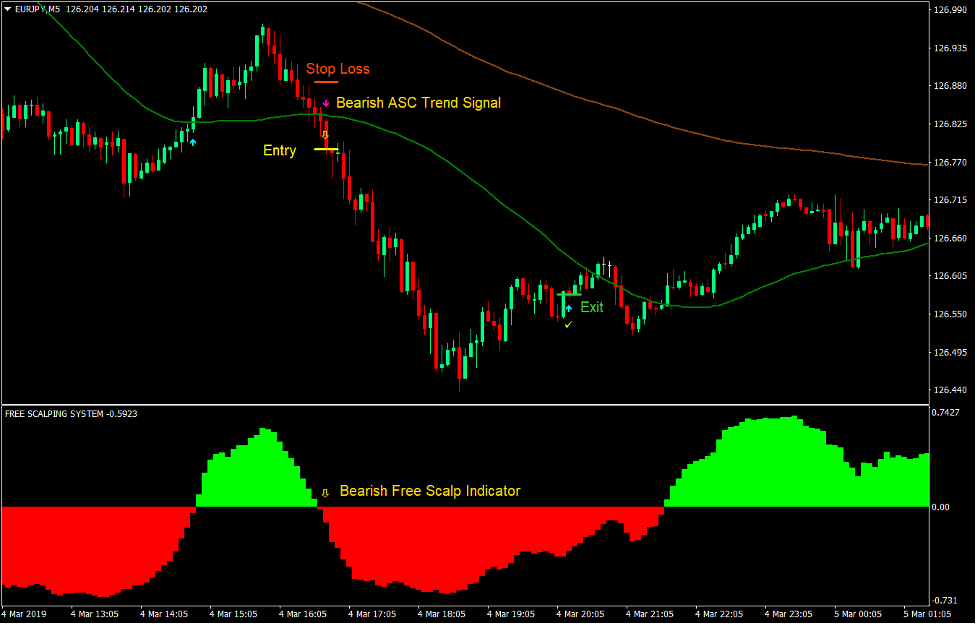

Image: www.forexmt4indicators.com

Scalp Option Trading

Empowering Traders: Actionable Insights for Effective Scalp Option Trading

To capitalize on the opportunities presented by scalp option trading, traders can adopt the following strategies:

- Master technical analysis: Develop proficiency in interpreting charts and recognizing technical patterns to identify potential trading opportunities accurately.

- Practice discipline: Establish clear trading parameters and adhere to them diligently to mitigate risk and optimize profits.

- Manage emotions: Stay clear-headed amidst market volatility and avoid letting emotions cloud trading decisions.

- Embrace continuous learning: Stay updated with the latest market trends, trading techniques, and risk management strategies through ongoing education.

As with any trading strategy, scalp option trading carries its own unique set of advantages and drawbacks. By fully understanding the concepts, navigating the challenges, and implementing effective strategies, traders can harness the power of scalp option trading to achieve their financial goals with knowledge and determination.