In the realm of finance, trading stock options has emerged as a popular strategy to potentially enhance returns while managing risks. As a former trader, I have witnessed firsthand the transformative power of mastering this skill. Through practice and strategic decision-making, stock option trading offers the chance to capitalize on market fluctuations and build wealth over time.

Image: www.freestockcharts.com

What is Practice Trading Stock Options?

Practice trading stock options provides a simulated environment for individuals to hone their knowledge and skills in option trading without risking real capital. It allows traders to experiment with different strategies, test market theories, and develop confidence in their trading abilities before they venture into live trading.

Why Practice Trading Stock Options Is Important

- Risk-Free Learning: Practice trading eliminates the financial risks associated with live trading, allowing you to gain practical experience without risking your hard-earned savings.

- Experimentation: It provides a platform to explore different trading strategies, experiment with parameters, and assess their effectiveness in varying market conditions.

- Skill Development: Practice trading enhances your decision-making abilities, improves market analysis skills, and fosters emotional control during market volatility.

Key Aspects of Stock Option Trading

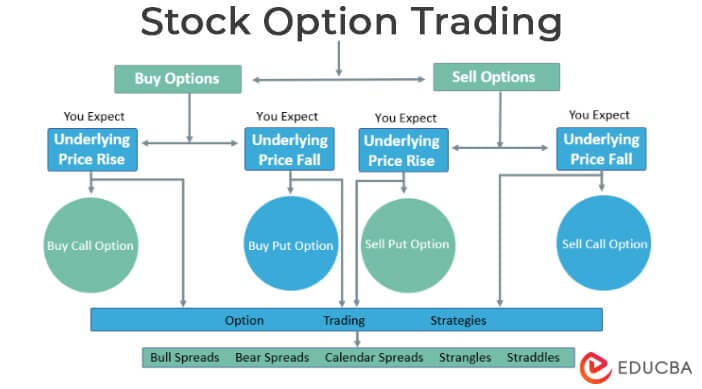

To fully understand stock option trading, let’s delve into its fundamental components:

Image: www.educba.com

1. Options Contract

An options contract is an agreement between two parties that gives the holder (buyer) the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date).

2. Types of Options

Stock options are classified into two main types:

- Call Option: Conveys the right to buy the underlying stock.

- Put Option: Grants the right to sell the underlying stock.

3. Key Option Trading Concepts

Understanding these concepts is crucial for successful option trading:

- Premium: The price paid by the buyer to acquire the option.

- Expiration Date: The date on which the option expires.

- Strike Price: The price at which the trader can buy or sell the stock.

- Volatility: A measure of the stock’s expected price fluctuations.

- In the Money: Option is worth exercising.

- Out of the Money: Option is not worth exercising.

Tips and Expert Advice for Practice Trading Stock Options

Based on my experience and guidance from expert traders, here are some invaluable tips to enhance your practice trading strategies:

1. Start Small and Build Gradually

Begin with smaller trades to minimize potential losses. As you gain experience and confidence, gradually increase the size of your positions.

2. Focus on a Few Strategies

Don’t overwhelm yourself by trying to master multiple strategies simultaneously. Identify a few that align with your trading style and dedicate time to understanding and implementing them.

3. Study Technical Analysis

Technical analysis involves studying price charts, indicators, and patterns to identify trading opportunities. Develop the ability to identify and interpret market trends.

4. Manage Risk Effectively

Practice trading offers a unique opportunity to refine your risk management strategies. Employ techniques such as stop-loss orders, position sizing, and diversification to mitigate potential losses.

5. Stay Informed and Seek Education

The financial markets are constantly evolving. Stay abreast of industry news, market trends, and educational opportunities to continue broadening your knowledge and adapt your trading strategies.

Frequently Asked Questions about Stock Option Trading

Q: What is the difference between a stock and an option?

A: A stock represents actual ownership of a company, while an option grants the right but not the obligation to buy or sell the underlying stock at a specific price within a specified timeframe.

Q: Can I lose more money than I invested in practice trading?

A: No, practice trading emulates real-time market conditions but uses virtual funds to prevent financial losses.

Q: What is the best platform for practice trading stock options?

A: Several reputable platforms offer practice trading, including Thinkorswim, tastylive, and Investopedia.

Practice Trading Stock Options

https://youtube.com/watch?v=XN9LIm6HhSI

Conclusion

Practice trading stock options is an invaluable tool for aspiring traders seeking to enhance their skills while minimizing financial risks. By adhering to the principles outlined in this guide, experimenting with different strategies, and continuously seeking knowledge, you can position yourself for success in the dynamic world of stock option trading.

Are you ready to start your practice trading journey and embark on a path to potential financial success through stock options? Don’t hesitate to explore this exciting opportunity today!