As a seasoned options trader, I’ve witnessed firsthand the remarkable power of weekly options. Their versatility and potential for quick returns have captivated me, and I’m eager to share my knowledge and insights to help you unlock their winning potential.

Image: www.insidewallstreetreport.com

In this comprehensive guide, we’ll delve into the intricacies of weekly options, exploring their unique characteristics and empowering you with actionable strategies to maximize your profits. From novice traders to experienced investors, prepare to master the art of weekly options and conquer the markets.

Unlocking the Secrets of Weekly Options

Weekly options, as the name suggests, have an expiration period of one week. This shorter time frame compared to traditional options contracts imparts distinctive advantages and challenges.

First and foremost, weekly options offer a more accelerated trading cycle. The shorter expiration period allows for frequent entries and exits, providing traders with multiple opportunities to capture market fluctuations. By exploiting price movements over shorter timeframes, you can nimbly capitalize on market trends and increase your potential returns.

Navigating the Nuances of Weekly Options

Unlike monthly options, weekly options carry a significant decay rate. As the expiration date nears, their value diminishes more rapidly due to time decay. This accelerated decay presents both opportunities and risks.

For strategic traders, the rapid decay of weekly options can be utilized to their advantage. By opting for options with a short time to expiration, you can benefit from the accelerated value decrease. This approach requires precision timing and a thorough understanding of market movements, enabling you to capitalize on short-lived market trends.

Additionally, weekly options offer enhanced flexibility, which experienced traders can exploit with sophisticated strategies. The shorter expiration cycle grants you the ability to adjust your trading positions more frequently, enabling you to adapt swiftly to changing market conditions. By incorporating a dynamic approach that incorporates rolling and adjustments, you can effectively manage your risk and optimize your profit potential.

Claiming Victory with Weekly Options: Time-Tested Strategies

Consistently profiting from weekly options demands a combination of meticulous analysis, calculated risk-taking, and well-defined strategies:

- Bull Call Spread: This strategy involves buying an at-the-money (ATM) call option while simultaneously selling an out-of-the-money (OTM) call option with the same expiration. As the underlying asset price rises, the value of the purchased call option increases, offsetting the potential loss from the sold call option.

- Bear Put Spread: Similar to the bull call spread, this strategy entails buying an ATM put option and selling an OTM put option with the same expiration. If the underlying asset price declines, the bought put option gains value, compensating for the loss on the sold put option.

- Iron Condor: Designed for low volatility scenarios, this strategy involves selling both a bear call spread and a bull put spread with different strike prices but identical expiration dates. The goal is to capture the premium from both spreads while limiting potential losses.

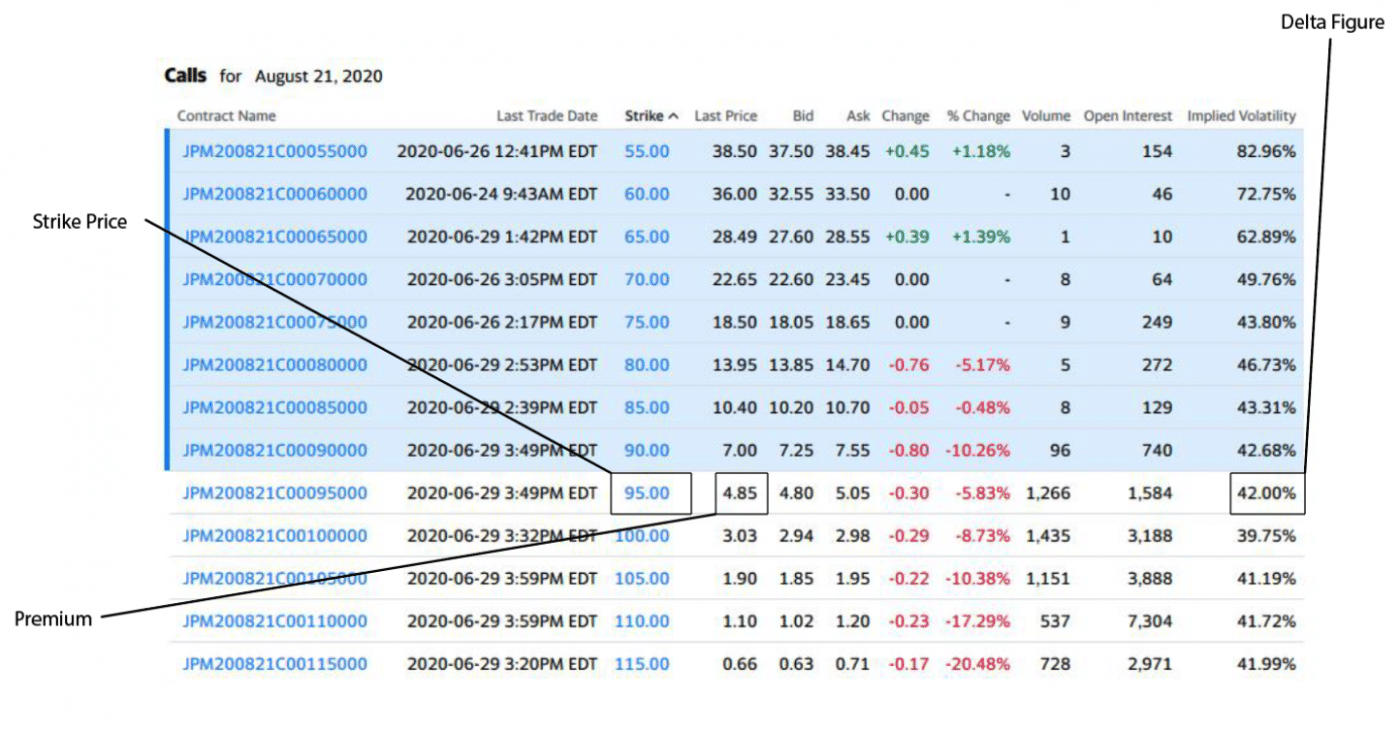

Executing these strategies requires careful consideration of factors such as strike prices, time to expiration, and implied volatility. By understanding the nuances of each strategy and applying sound risk management principles, you can increase your chances of success in the dynamic world of weekly options.

Image: club.ino.com

Expert Insights and Proven Tips to Conquer Weekly Options

To further enhance your weekly options trading prowess, heed the advice of seasoned experts:

Master Risk Management: The cornerstone of successful weekly options trading lies in effective risk management. Determine your risk tolerance and allocate capital accordingly, ensuring that you’re comfortable with potential losses. Employ proper position sizing and consider stop-loss orders to safeguard your trading account.

Scrutinize Implied Volatility (IV): IV plays a crucial role in pricing weekly options. High IV indicates that the market is expecting significant price fluctuations, potentially leading to higher option premiums. Understanding IV and its impact on option prices is paramount for making informed trading decisions.

Embrace Technical Analysis: Technical analysis techniques can provide valuable insights into market trends and potential price movements. Utilize indicators, candlestick patterns, and chart analysis to identify trading opportunities and confirm your strategic decisions.

Frequently Asked Questions: Deciphering the Enigma of Weekly Options

Q: What is the difference between weekly and monthly options?

A: Weekly options have a shorter expiration period of one week, while monthly options expire in one month.

Q: Why do weekly options decay faster than monthly options?

A: The accelerated decay in weekly options is attributed to their shorter time to expiration, resulting in a more rapid decrease in time value.

Q: Are weekly options riskier than monthly options?

A: Weekly options generally carry a higher level of risk due to the amplified impact of time decay and a smaller margin for price movements to materialize.

Options Trading – How To Win With Weekly Options

Conclusion: Embark on the Path to Trading Triumph

The path to consistent profitability in weekly options trading is paved with knowledge, strategic execution, and the unwavering discipline of risk management. Embrace the insights gleaned from this comprehensive guide, master the expert advice and strategies presented, and you will undoubtedly increase your chances of conquering the markets.

Are you ready to unlock the transformative power of weekly options? Let the pursuit of trading mastery commence!