Have you ever wondered how farmers protect their crops from volatile prices, or how energy companies hedge against rising fuel costs? The answer often lies in the world of commodity options trading. This unique financial instrument offers a powerful way to manage risk and potentially profit from the fluctuations in prices of agricultural products, energy resources, and precious metals. But navigating the complexities of commodity options requires a thorough understanding of its inner workings, the different strategies available, and the potential rewards and risks involved.

Image: www.plindia.com

This article will serve as your guide to the fascinating world of commodity options trading. We’ll break down the fundamentals, delve into various strategies, analyze potential benefits and drawbacks, and offer practical insights for those considering venturing into this exciting but challenging market.

Understanding the Basics of Commodity Options

Before diving into the intricacies of options trading, let’s first define what commodity options are and how they function:

A commodity option is a contract that gives the buyer the right, but not the obligation, to buy or sell a specific commodity at a predetermined price (the strike price) on or before a certain date (the expiration date).

Imagine you’re a farmer about to harvest a large crop of wheat. You’re worried about plummeting prices, which could drastically cut into your profits. A commodity option can help mitigate this risk. You can buy a “call option,” giving you the right to sell your wheat at a specific price, say $8 per bushel, even if the market price falls below that level. This ensures you’ll receive a minimum price for your crop, protecting you from losses.

There are two types of commodity options:

Call Options

A call option gives the buyer the right to purchase an underlying commodity at the strike price. If the market price rises above the strike price, the buyer can exercise the option and buy the commodity at a lower price than the current market, realizing a profit. If the market price falls below the strike price, the buyer can let the option expire worthless, limiting their losses to the premium paid for the option.

Put Options

A put option grants the buyer the right to sell an underlying commodity at the strike price. If the market price drops below the strike price, the buyer can exercise the option and sell the commodity at a higher price than the current market, realizing a profit. If the market price rises above the strike price, the buyer can let the option expire worthless, limiting their losses to the premium paid.

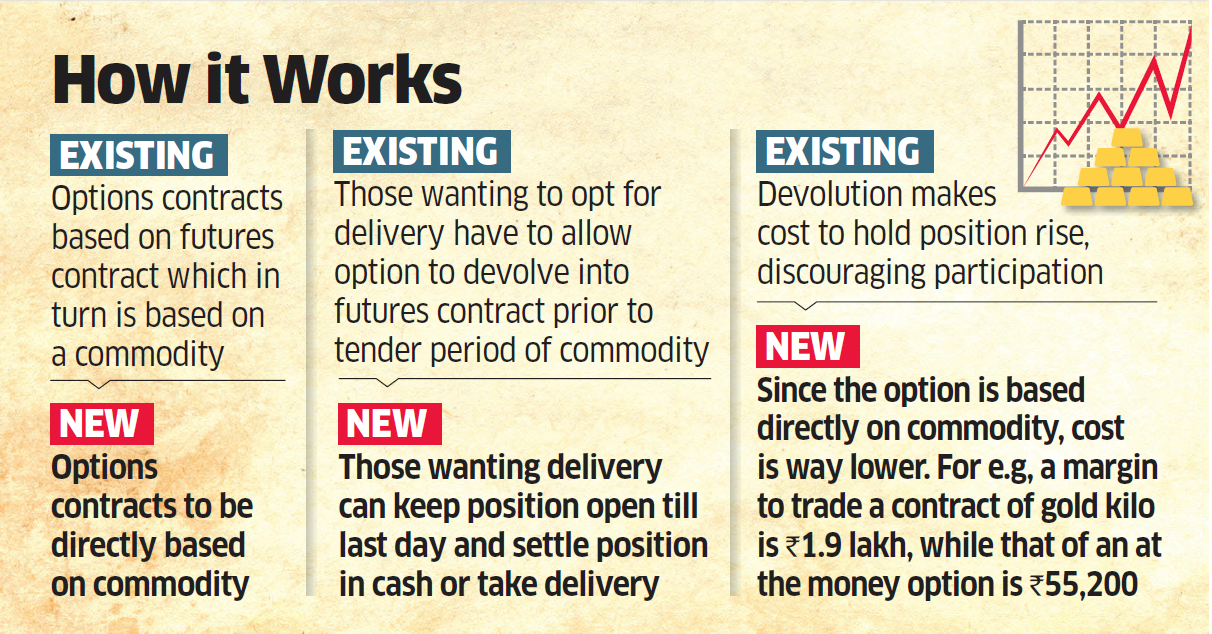

Image: economictimes.indiatimes.com

Key Terms to Keep in Mind

To navigate the world of options trading, it’s crucial to understand some key terms:

- Premium: The price paid for the option. This is the potential profit for the option seller and the potential loss for the buyer if the option expires worthless.

- Strike Price: The price at which the option holder can buy or sell the underlying commodity.

- Expiration Date: The final date on which the option can be exercised.

- Underlying Asset: The commodity that the option is based on, such as oil, gold, or corn.

- Leverage: Options offer leveraged exposure to the underlying commodity’s price movements. This means a small price change in the commodity can result in a larger gain or loss on the option position.

Exploring the Advantages and Disadvantages of Commodity Options Trading

Commodity options, like any investment, come with both potential benefits and inherent risks. Understanding these aspects is crucial for making informed decisions.

Advantages of Using Commodity Options

- Risk Mitigation: Options can act as a hedge to protect against losses due to price fluctuations. For example, a farmer can buy put options on wheat to protect against a decline in wheat prices.

- Limited Risk Exposure: Unlike buying or selling the underlying commodity directly, which exposes you to unlimited losses, options have a limited risk. Your maximum loss is the premium paid for the option.

- Potential for High Returns: Options offer leverage, potentially amplifying gains. A small price move in the underlying commodity can result in a substantial profit on the option.

- Flexibility: Options contracts come in various expiration dates and strike prices, allowing traders to customize their strategy to meet their specific needs and risk tolerance.

Disadvantages of Using Commodity Options

- Limited Timeframe: Options have a limited lifespan, expiring on a specific date. This poses a time constraint for profitable trading.

- Opportunity Cost: The premium paid for the option represents a potential opportunity cost. If the option expires worthless, you lose the entire premium.

- Complexity: Understanding the nuances of option pricing, strategies, and risk management involves a steep learning curve.

- Volatility Risk: Options prices are particularly sensitive to market volatility. This can lead to rapid price fluctuations, exposing traders to significant losses.

Exploring Diverse Commodity Options Trading Strategies

The world of commodity options offers a plethora of trading strategies, each tailored to specific market conditions and risk profiles. Here’s a look at some common approaches:

1. Protective Puts

A protective put strategy is used to protect against price declines in a commodity. Imagine you own a significant amount of gold and are worried about a price drop. Buying a put option on gold allows you to sell your gold at a set price, shielding you from losses if the gold price declines below your strike price. This strategy provides downside protection while maintaining the potential for upside gains if the gold price rises.

2. Covered Calls

A covered call strategy is used to generate income while owning the underlying commodity. You sell a call option on a commodity you already own. If the market price rises above the strike price, the buyer of the call option will exercise their right to buy the commodity from you at the strike price. This allows you to sell your commodity at a predetermined price, limiting potential upside gains but earning a premium for selling the call option.

3. Bull Spreads

A bull spread is a bullish strategy used when you expect the price of a commodity to rise. You buy a call option with a lower strike price and sell a call option with a higher strike price. If the price of the commodity rises, the call option with the lower strike price will become more valuable, offsetting the loss on the call option with the higher strike price. This strategy limits potential losses but also limits potential gains.

4. Bear Spreads

A bear spread is a bearish strategy used when you expect the price of a commodity to fall. You buy a put option with a higher strike price and sell a put option with a lower strike price. If the price of the commodity declines, the put option with the higher strike price will become more valuable, offsetting the loss on the put option with the lower strike price. This strategy limits potential losses but also limits potential gains.

Navigating the Risks and Rewards of Commodity Options Trading

Commodity options trading presents both compelling opportunities and significant challenges. It’s essential to approach this market with a clear understanding of the inherent risks and potential rewards.

Risks of Commodity Options Trading

- Market Volatility: Commodity prices are notoriously volatile, influenced by factors such as weather, global demand, and geopolitical events. This volatility can lead to rapid and unpredictable price swings, exposing traders to substantial losses.

- Leverage: The leveraged nature of options magnifies both potential gains and losses. While leverage can enhance returns, it can also amplify losses.

- Time Decay: Options lose value as their expiration date approaches. This is known as time decay, and it can significantly impact your potential profits or losses.

- Counterparty Risk: Options are traded through brokers and exchanges. If a broker or exchange fails, you may lose your investment.

Rewards of Commodity Options Trading

- Potential for High Returns: Options offer the potential for significant gains with limited upfront investment, allowing for leveraged exposure to market movements.

- Risk Management Tools: Options can serve as powerful tools to manage price risk for companies or individuals involved in the production, consumption, or distribution of commodities.

- Market Diversification: Commodity options can diversify investment portfolios by offering exposure to assets that are not highly correlated with traditional securities.

- Learning Opportunities: Trading commodity options requires a thorough understanding of market dynamics, financial instruments, and risk management techniques, providing valuable learning experiences in the realm of finance.

Navigating the World of Commodity Options: Tips for Beginners

The allure of high potential returns can make commodity options trading appealing, but it’s crucial to approach this market with caution and a solid understanding of the fundamentals. Here are some tips for beginners venturing into the world of commodity options:

- Start with a Thorough Education: Before investing in commodity options, dedicate time to learning about the underlying principles, various strategies, risk management techniques, and market analysis tools.

- Begin with a Small Account: Don’t risk more than you can afford to lose. Starting with a small account size allows you to practice trading strategies with limited exposure.

- Focus on Risk Management: Implement strong risk management strategies to limit potential losses. This includes setting stop-loss orders, defining position sizes, and diversifying your portfolio.

- Choose a Reputable Broker: Select a reputable broker with a track record of reliability and transparency. Ensure they offer quality trading platforms, educational resources, and responsive customer support.

- Stay Informed: Keep up with market news, economic indicators, and industry trends that can influence commodity prices.

- Start Small and Gradually Increase Your Exposure: As your understanding grows and your confidence increases, gradually increase your trading positions while maintaining disciplined risk management practices.

The Future of Commodity Options: Trends and Developments

The commodity options market is constantly evolving, shaped by technological advancements, regulatory changes, and shifting market dynamics. Here are some notable trends impacting the future of commodity options trading:

- Growth of Exchange-Traded Funds (ETFs): Commodity ETFs provide liquid and accessible access to commodity options, catering to a wider range of investors.

- Advancements in Technology: Artificial intelligence (AI) and machine learning are being adopted to automate trading strategies, optimize portfolio management, and improve risk analysis.

- Increased Regulation: Regulators are focusing on increasing transparency and reducing risks in the options market, leading to stricter guidelines and oversight.

- Focus on Sustainable Investments: The growing interest in sustainable investing is influencing commodity futures and options, leading to the development of new contracts and strategies aligned with environmental, social, and governance (ESG) principles.

Commodity Options Trading

Final Thoughts: Embark on Your Commodity Options Journey

The world of commodity options trading offers unique opportunities for both risk mitigation and potential profit generation. However, success in this market requires a deep understanding of its complexities, diligent research, disciplined risk management, and ongoing learning. This article serves as a stepping stone to equip you with the initial knowledge and insights to navigate the challenging but potentially rewarding world of commodity options. Remember to always approach trading with caution, prioritize education, and be mindful of your risk tolerance. And remember, the journey of learning never ends. Continue to explore, research, and refine your strategies to unlock the full potential of this exciting and dynamic financial market.