Introduction

In the enigmatic realm of financial markets, option trading stands as a sophisticated and potentially lucrative strategy for discerning investors. Options, intricate financial instruments, provide the holder with the privilege—but not the obligation—to buy or sell an underlying asset at a predetermined price and time. By harnessing the versatility of Python, a powerful programming language, traders can automate option trading strategies, paving the way for efficient execution and profit optimization.

Image: likecryptobusinesss.blogspot.com

Python’s robust set of libraries and user-friendly syntax empowers traders to create algorithmic trading systems that swiftly navigate market complexities. These systems can analyze market data, identify trading opportunities, and execute trades automatically, freeing traders from the constraints of manual execution and capitalizing on fleeting market inefficiencies.

Essentials of Python-Based Option Trading Strategies

Delving into the intricacies of Python-based option trading strategies reveals a diverse array of approaches, each catering to distinct market conditions and investment objectives.

Covered Calls

A covered call strategy involves selling (writing) a call option while concurrently owning the underlying asset. This strategy is designed to generate income through option premiums while limiting downside risk, as the trader already holds the underlying and is obligated to deliver it if the option is exercised.

Cash-Secured Puts

Similar to covered calls, cash-secured puts entail selling (writing) a put option and maintaining sufficient cash or margin to purchase the underlying asset if the option is exercised. This strategy aims to generate income from option premiums while retaining the potential to acquire the underlying at a discounted price should the price decline.

Image: www.youtube.com

Married Puts

Married puts combine protective strategies by simultaneously holding a long position in an underlying stock and a long position in a put option with the same strike price and expiration date. This strategy hedges against potential losses in the underlying by providing the option to sell at the strike price if the market turns unfavorable.

Iron Condors

Iron condors involve selling (writing) both a call and a put option with the same expiration date but different strike prices. This strategy seeks to profit from a range-bound market, where the underlying asset’s price fluctuates within a predefined range.

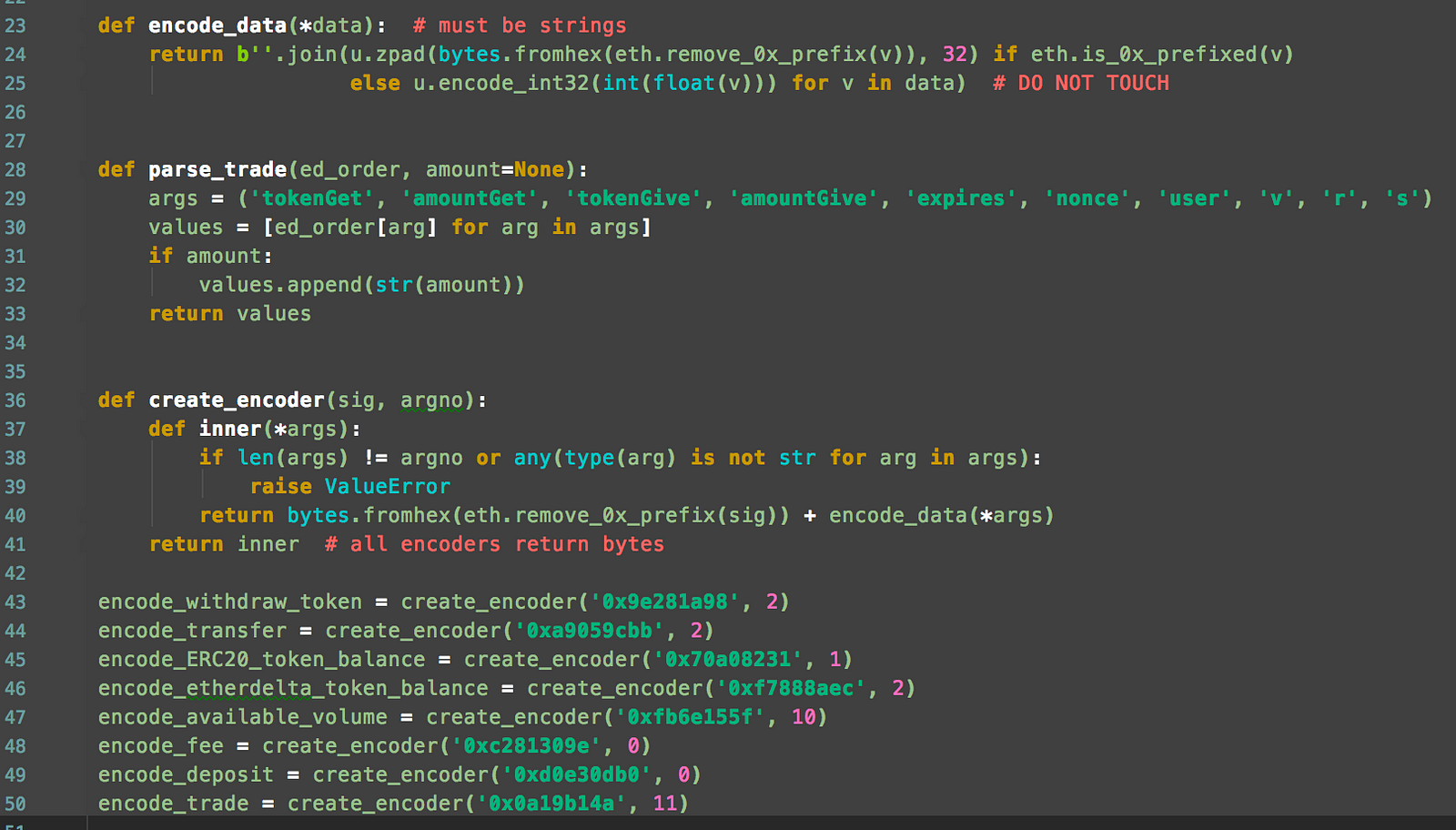

Implementation of Option Trading Strategies in Python

Transforming theory into practice, Python offers a rich ecosystem of libraries and tools for implementing option trading strategies. Notable among these include:

Pandas

Pandas, a library for data manipulation and analysis, enables the efficient handling of large market data sets. Its DataFrame structure simplifies accessing and manipulating financial data, facilitating strategy development.

Numpy

The Numpy library provides sophisticated numerical operations, such as matrix algebra and random number generation, essential for option pricing and risk calculations.

Scikit-learn

Scikit-learn, a machine learning library, empowers traders to analyze market data and identify trading opportunities through statistical modeling and predictive analytics.

Option Trading Strategies Python

https://youtube.com/watch?v=70OoFdyuVxs

Conclusion

By harnessing the power of Python, traders can unlock the full potential of option trading strategies, automating execution and optimizing returns. Embracing this dynamic programming language not only enhances trading efficiency but also empowers traders to explore advanced strategies, gain deeper market insights, and achieve financial success in the ever-evolving landscape of option markets.