In the realm of financial markets, the concept of option trading stands out as a complex yet undeniably rewarding endeavor. Navigating this intricate landscape requires precision, strategy, and a deep understanding of the underlying mechanics. That’s where option trading strategies calculators step into the spotlight, empowering traders with the tools they need to make informed decisions and maximize their potential returns.

Image: www.youtube.com

Delve into this comprehensive guide as we unlock the secrets of option trading strategies calculators, unraveling their versatility, and uncovering the techniques that can elevate your trading game. Let us guide you through a journey of knowledge, shedding light on the intricacies of options trading and empowering you with the confidence to conquer the markets.

Decoding Option Trading Strategies: A Journey into the Unknown

At its core, an option is a contract that grants the buyer the “option,” not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. This contractual flexibility provides traders with a myriad of strategic possibilities, each tailored to specific market scenarios and risk appetites.

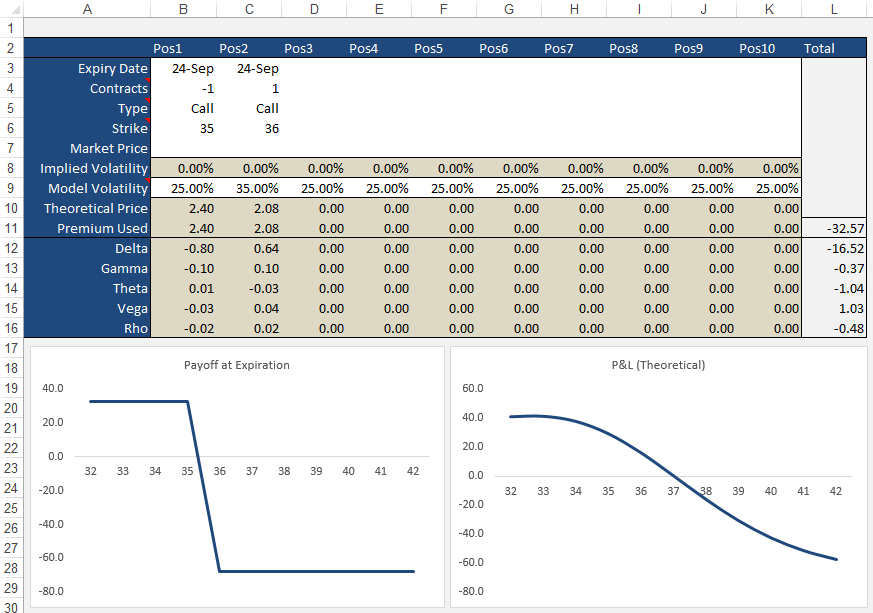

Option trading strategies calculators serve as indispensable tools, aiding traders in navigating the vast array of strategies available. These calculators leverage complex algorithms and market data to assess the potential outcomes of various trading strategies, considering factors such as underlying asset price, volatility, time to expiration, and risk tolerance.

Empowering Traders with a Mathematical Companion: How Option Trading Strategies Calculators Elevate Trading Decisions

The true power of option trading strategies calculators lies in their ability to optimize decision-making. By plugging in relevant parameters, traders can swiftly generate an array of potential outcomes for different strategies, enabling them to:

- Assess the probability of profit and loss for each strategy

- Determine the optimal entry and exit points for trades

- Quantify the potential return on investment

- Manage risk effectively by evaluating potential downside scenarios

Unveiling the Symphony of Strategies: A Glimpse into the Option Trading Toolkit

The world of option trading strategies is a vibrant tapestry, woven with a multitude of approaches tailored to varying market conditions and objectives. Let’s unravel some of the most widely employed strategies:

-

Covered Calls (Selling Calls): This strategy involves selling an out-of-the-money call option while simultaneously owning the underlying asset. The aim is to generate income from the premium received from selling the option.

-

Protective Puts (Buying Puts): This defensive strategy entails buying an out-of-the-money put option to hedge against potential losses on the underlying asset. It provides downside protection while limiting upside potential.

-

Bull Call Spreads (Buying and Selling Calls): This strategy combines buying an at-the-money call option while simultaneously selling an out-of-the-money call option. It offers the potential for limited profit in a bullish market.

-

Bear Put Spreads (Selling and Buying Puts): The inverse of the bull call spread, this strategy involves selling an out-of-the-money put option while buying a deeper out-of-the-money put option. It benefits from a bearish market outlook.

-

Iron Condor (Selling Calls and Puts): A complex yet highly versatile strategy, the iron condor involves selling an out-of-the-money call and put option while simultaneously buying two out-of-the-money options with wider strike prices. It thrives in markets with low volatility.

Image: www.optiontradingtips.com

Harnessing Expert Insights: Unveiling the Wisdom of the Trading Masters

As you embark on your option trading journey, tapping into the wisdom of seasoned experts can prove invaluable. Here are some invaluable tips:

-

Embrace Risk Management: Always prioritize risk management by setting clear stop-loss levels and managing position sizes prudently.

-

Understand Market Volatility: Volatility is a key factor in option pricing. Study it carefully to gauge the potential risks and rewards.

-

Factor in Time Decay: Time is of the essence in options trading. Consider the time value of the contracts and how it impacts profitability.

-

Continuous Education: The financial markets are constantly evolving. Stay abreast of the latest trends and developments to refine your trading strategies.

-

Seek Professional Guidance: If navigating the complexities of option trading feels overwhelming, don’t hesitate to consult with a qualified financial advisor or broker.

Option Trading Strategies Calculator

Conclusion: Embracing Option Trading with Confidence

Venturing into the world of option trading can be both exhilarating and daunting. Armed with the knowledge and tools we’ve shared, you can step into the markets with newfound confidence. Option trading strategies calculators serve as your trusted companions, empowering you to make informed decisions and maximize your potential returns.

Remember, the path to trading mastery is an ongoing journey. Embrace the learning process, seek continuous improvement, and never cease to explore the ever-evolving landscape of financial markets. Trade wisely, manage risk diligently, and let the thrill of option trading ignite your financial aspirations.