Igniting the Fire with Curious Embers

Step into the vibrant world of options trading, where swift decision-making and an unwavering resolve converge to fuel financial freedom. With a humble $1000, embark on a journey that transcends mere speculation and embraces strategic wealth creation. As you venture into this uncharted territory, let me, your humble narrator, guide you through the labyrinth of options trading, illuminating the path to financial empowerment.

Image: www.youtube.com

Embarking on the Optionology Odyssey

In the realm of finance, options emerge as potent instruments that confer upon investors the hallowed right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a designated price (strike price) on or before a stipulated date (expiration date). By exploiting these versatile tools, you can craft your financial destiny, navigating market fluctuations with precision and unlocking boundless opportunities for profit.

Decoding the Intricacies of Options Trading

A thorough understanding of options trading requires an unwavering commitment to peeling away its complexities. Strap yourself in for an intellectual adventure as we dive deep into the core concepts that govern this exhilarating domain:

-

Call Option: Bestows upon you the privilege to buy an underlying asset at a predetermined strike price, irrespective of prevailing market conditions.

-

Put Option: Empowers you to sell an underlying asset at a predefined strike price, providing a safety net against market downturns.

-

Strike Price: Dictates the exact price at which you can exercise your option contract.

-

Expiration Date: Determines the immutable deadline by which you must execute your option.

-

Premium: The price you pay to acquire the option contract, representing your investment in this financial escapade.

Navigating the Options Trading Arena

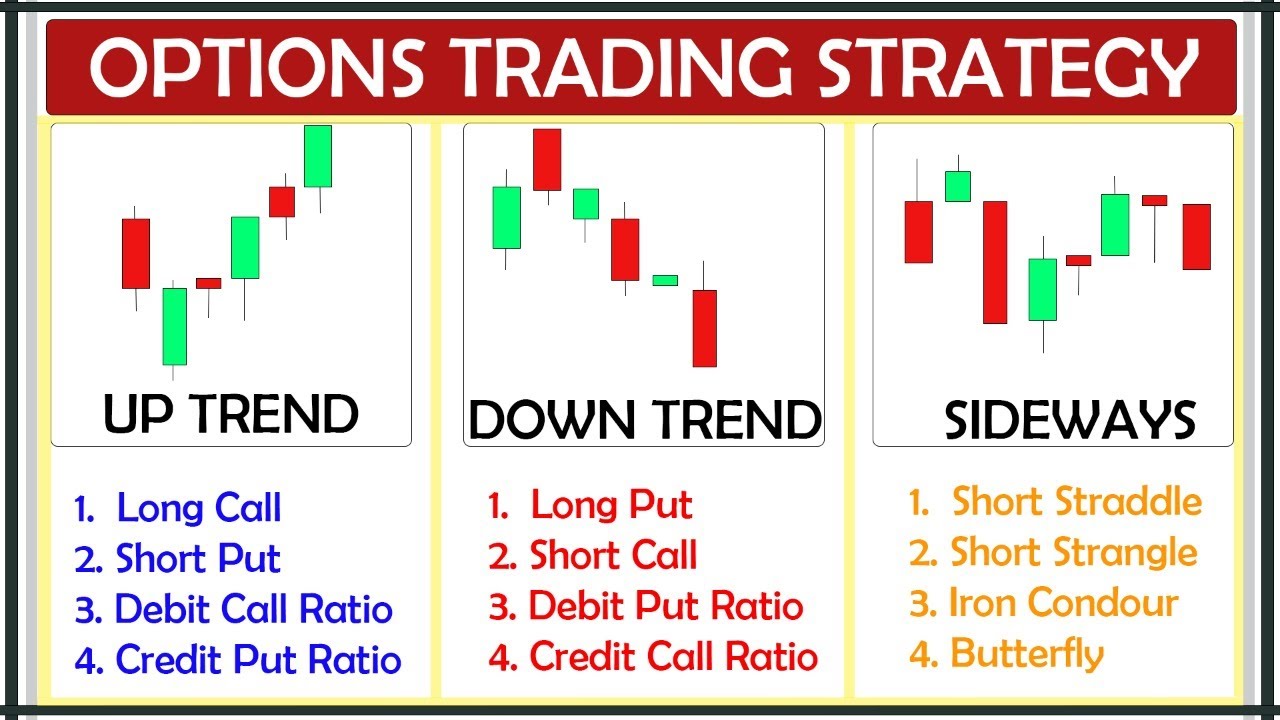

To emerge victorious in the options trading arena, you must master the art of strategy. Let’s delve into the most popular options trading strategies, meticulously crafted to harness market dynamics and amplify your earning potential:

-

Covered Call: Simultaneously sell a call option while holding the underlying asset, generating income from the premium while retaining ownership of the underlying asset.

-

Cash-Secured Put: Sell a put option while holding cash in your account, providing downside protection and the potential to acquire the underlying asset at a discounted price.

-

Bull Call Spread: Purchase a call option with a lower strike price and sell a call option with a higher strike price, profiting from a sustained or moderate rise in the underlying asset’s price.

-

Bear Put Spread: Implement this strategy when anticipating a decline in the underlying asset’s value. Purchase a put option with a higher strike price and sell a put option with a lower strike price to benefit from a downtrend.

Image: moneypip.com

Unveiling the Secrets of Successful Options Trading

As you embark on your options trading odyssey, embrace these invaluable tips and expert counsel, culled from years of experience and unwavering market observation:

-

Thoroughly Research: Diligently study market trends, company fundamentals, and industry news. Knowledge is your ally in the turbulent waters of options trading.

-

Choose Your Battles Wisely: Identify underlying assets with robust liquidity and volatility. These characteristics enhance your chances of executing successful trades.

-

Manage Your Risk: Never risk more than you can afford to lose. Risk management is the cornerstone of sustainable investing.

-

Strike a Balance: Diversify your portfolio by selecting options with varying strike prices and expiration dates. Diversification reduces overall risk exposure.

-

Stay Nimble: Monitor your trades diligently and be prepared to adjust your strategy swiftly as market conditions evolve.

Frequently Asked Questions: Unveiling the Enigma of Options Trading

Q: Is options trading suitable for beginners?

A: Options trading can be a complex endeavor, especially for those lacking prior experience in financial markets. As a beginner, it’s prudent to tread cautiously and acquire foundational knowledge before making any substantial trades.

Q: How much can I earn from options trading?

A: Your earnings potential hinges on several factors, including your capital allocation, trading strategy, risk appetite, and prevailing market conditions. While options trading has the allure of lucrative returns, it’s essential to maintain realistic expectations and engage in prudent risk management.

Q: Can I lose money in options trading?

A: Absolutely. Options trading carries inherent risks, and you stand to lose your invested capital if trades turn against you. It’s imperative to approach this domain with a clear understanding of the risks involved.

Start Option Trading With $1000

Image: www.youtube.com

Conclusion: Empowering Your Financial Future with Options Trading

As you draw near the conclusion of this comprehensive guide, remember that options trading presents an extraordinary avenue for financial empowerment. With a judicious approach and unwavering dedication to continued learning, you can harness the enigmatic power of options to unlock your financial aspirations and forge a path towards financial freedom.

Are you ready to ignite the flame of options trading within you? Embark on this extraordinary adventure today and witness the transformative potential of this exhilarating financial instrument.