In the labyrinthine corridors of finance, where uncertainty reigns supreme, options traders navigate the ever-shifting terrain, armed with their wit and trusted tools. Among these tools, the option trading calculator software emerges as a beacon of clarity, empowering traders with the insights to make precise and informed decisions. Unleash your potential and delve into the world of option trading calculators with this comprehensive guide.

Image: www.bestshareware.net

Option trading calculators have evolved from mere number-crunching machines to indispensable decision-making aids. Whether you’re a seasoned pro or a budding enthusiast, these software programs provide a unique vantage point into the often-complex world of options trading, unraveling its intricacies with ease.

Harness the Power of Modern Calculators

Today’s option trading calculators extend far beyond basic calculations. They integrate advanced algorithms, real-time data, and customizable features, transforming into versatile tools that empower traders at every level.

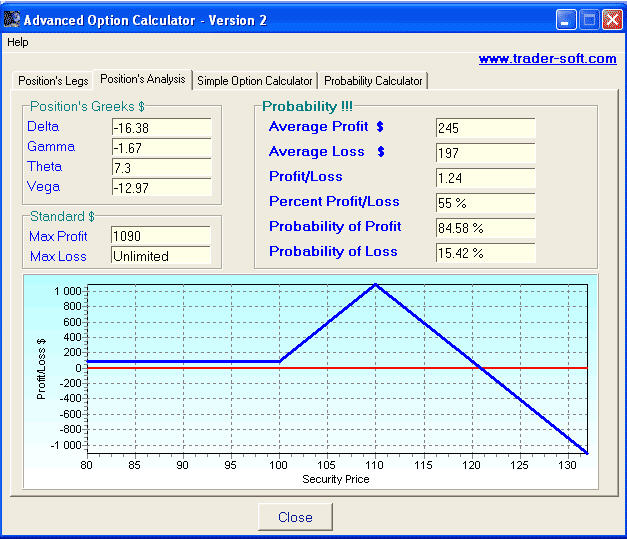

From calculating Greeks and option prices to simulating trades and analyzing risk, these calculators provide a comprehensive toolkit that enhances decision-making processes. By leveraging the latest advancements, traders can optimize their strategies, manage risk, and ultimately maximize their trading potential.

A Comprehensive Guide to Option Trading Calculators

At its core, an option trading calculator is a sophisticated software program designed specifically to assist in the valuation and analysis of option contracts. These contracts, which grant the holder the right but not the obligation to buy or sell an underlying asset at a predetermined price on a specific date, introduce complexities that require specialized calculations.

Option trading calculators simplify these complexities, enabling traders to delve into fundamental concepts such as option pricing models (such as the Black-Scholes model) and the calculation of Greeks, which are measures of option sensitivity to changes in underlying variables.

Unveiling the Secrets of Greeks

Greeks, named after Greek letters, are a fundamental component of option trading calculators. These analytical tools provide traders with invaluable insights into how options react to changes in market conditions, such as the underlying asset’s price, time to expiration, and volatility.

By understanding and interpreting Greeks effectively, traders can assess potential risks and rewards, fine-tune their strategies, and make informed decisions that align with their risk tolerance and financial goals. Delta, Gamma, Vega, Theta, and Rho are among the most commonly used Greeks, each providing a specific facet of option sensitivity.

Image: gajananastroresearchcenter.com

Tips for Maximizing Calculator Potential

To fully harness the transformative power of option trading calculators, consider these expert recommendations:

- Choose a Reputable Calculator: Not all calculators are created equal. Research and select a calculator that is reliable, user-friendly, and aligns with your specific needs.

- Understand the Calculations: It’s not enough to simply plug in numbers and expect accurate results. Take the time to understand the underlying calculations that drive the calculator’s output, ensuring you can correctly interpret the results.

- Verify Results: Don’t rely solely on the calculator’s output. Cross-check results against other sources or use multiple calculators to ensure accuracy and minimize the risk of errors.

- Calibrate to Your Strategy: Tailor the calculator’s settings to match your trading style and risk tolerance. Consider factors such as the volatility of the underlying asset and the time horizon of your trades.

FAQ: Unraveling Common Questions

Q: What types of option trading calculators are available?

A: Option trading calculators come in a variety of forms, from simple online tools to sophisticated desktop software. They cater to different levels of trading experience and offer varying levels of functionality.

Q: How do I choose the right calculator for my needs?

A: Consider your trading style, experience level, and the specific features you require. Evaluate calculators based on their ease of use, accuracy, and the range of calculations they offer.

Q: Can I rely solely on calculator results for my trading decisions?

A: While calculators are a valuable tool, they should not be the sole basis for making trading decisions. Combine calculator output with other market analysis techniques, such as charting, fundamental analysis, and technical indicators, to gain a comprehensive understanding of the market landscape.

Option Trading Calculator Software

Image: warsoption.com

Conclusion

Embark on your option trading journey armed with the precision and insight that option trading calculators provide. These powerful tools empower you to navigate the complexities of options trading confidently, make informed decisions, and maximize your potential. Embrace the power of knowledge and unlock the gateway to successful option trading.

Are you ready to delve into the world of option trading calculators and unlock your trading prowess? Share your experiences and questions below to further explore the transformative power of these indispensable tools.