What is Trading Options After Hours?

For years, I’ve been fascinated by the world of options trading. The ability to leverage limited capital into a potentially high return, while mitigating risk through carefully constructed strategies, always captivated me. But recently, I’ve been intrigued by a new dimension of the game: trading options after hours. It’s a world of extended trading hours, where savvy investors can capitalize on market movements that happen outside the regular market session, but also comes with a unique set of risks and rewards.

Image: www.youtube.com

For those unfamiliar with the concept, options trading after hours, also referred to as “extended hours trading,” allows investors to buy or sell options contracts outside the standard trading hours of 9:30 AM to 4:00 PM EST. Essentially, it opens up opportunities to trade options contracts during the pre-market session (typically from 4:00 AM to 9:30 AM EST) or after the market closes (typically from 4:00 PM to 8:00 PM EST).

Exploring the Realm of After-Hours Option Trading

Understanding the Basics

First, it’s essential to understand the fundamentals of options trading. Options contracts offer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset (stock, index, etc.) at a predetermined price (strike price) on or before a specific date (expiration date). After-hours trading introduces the element of extended hours, but the core principles of options trading remain the same.

The Appeal of After-Hours Trading

So why do investors venture into the world of after-hours trading? The primary attraction lies in the potential to capitalize on market movements that occur outside the regular trading hours. This could be due to news releases, earnings announcements, or other events happening after the market close. For instance, if a company announces a positive earnings report after the market closes, its stock price could surge before the next trading day. Investors could potentially profit through buying call options on the stock after hours and selling them at a higher price the next morning.

Image: seekingalpha.com

Challenges and Risks

However, this seemingly lucrative opportunity is not without its challenges and risks. Trading options after hours often exhibits lower volume and thinner liquidity compared to the regular trading sessions. This means that it can be harder to execute trades quickly and efficiently, leading to wider bid-ask spreads (the difference between the price a buyer is willing to pay and the price a seller is asking for) and potential price slippage (the difference between the expected price and the actual execution price). Furthermore, volatility tends to be higher during extended hours, increasing the risk of bigger losses for inexperienced traders.

A Guide for Navigating the After-Hours

1. Prioritize Research and Planning

The key to success in after-hours trading lies in thorough research and planning. Begin by identifying potential opportunities for after-hours trading. This might involve keeping an eye on news releases, analyzing earnings reports, and monitoring major market events that could impact the options contracts you’re interested in. Understand the nuances of the market and assess the potential risks and rewards associated with each trade.

2. Master the Art of Risk Management

Effective risk management is paramount in after-hours options trading. Remember, volatility is magnified during extended hours, so you need a solid strategy to mitigate potential losses. Consider using stop-loss orders to limit your downside exposure. You can also define your risk tolerance and allocate a specific portion of your portfolio to after-hours trading, ensuring that potential losses won’t cripple your overall investment strategy.

3. Stick to Proven Strategies

It’s crucial to approach after-hours options trading with a disciplined mindset. Avoid chasing the market or making impulsive decisions. Instead, stick to strategies you understand and have tested during regular trading hours. Remember, the same principles of options trading apply to after-hours trading, so your proven strategies can still be effective.

4. Embrace a Learning Mindset

The after-hours trading landscape is dynamic and constantly evolving. Be prepared to adapt your strategies and stay informed about the latest market trends and developments. As a beginner, consider starting with smaller trades and gradually increasing your position sizes as you gain experience and confidence. Most importantly, embrace a continuous learning approach to improve your understanding of options trading and refine your strategies.

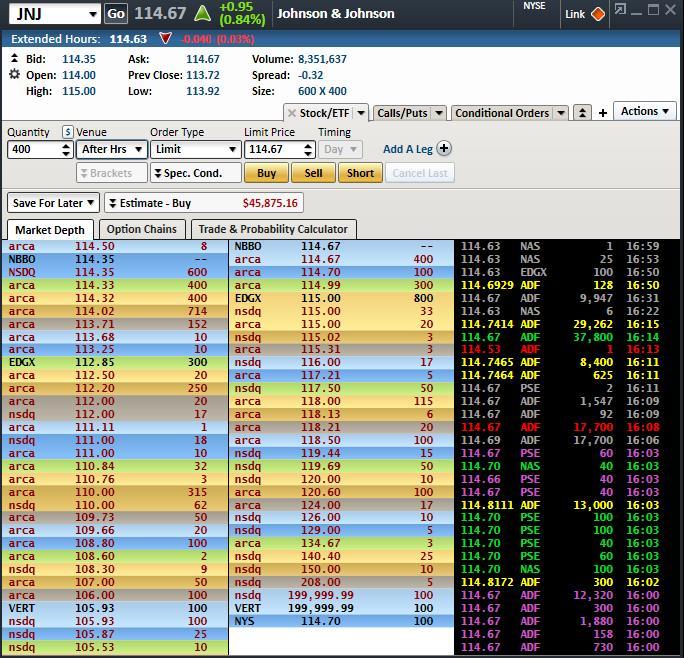

5. Leverage Tools and Technology

In today’s digitally driven world, technology plays a vital role in successful after-hours options trading. Utilize online platforms and trading tools that provide real-time market data, order execution features, and news alerts. These tools can help you stay ahead of the curve and capitalize on emerging opportunities quickly.

FAQ: Unraveling the Inner Workings

Q: Are there any specific types of options contracts that are typically traded after hours?

A: While any type of options contract can be traded after hours, some popular choices include contracts with high implied volatility, which could amplify potential gains and losses during extended hours.

Q: How do I find a broker that allows after-hours trading?

A: Several brokers offer extended trading hours for options. You can research different brokerage platforms and compare their features, commission fees, and trading platforms. Look for platforms that clearly outline their extended hours trading policies.

Q: Is after-hours options trading suitable for all investors?

A: While after-hours trading can offer exciting opportunities, it’s not for everyone. It requires a solid understanding of options trading, a disciplined approach to risk management, and the ability to navigate a more volatile market. If you’re new to options trading or if you’re not comfortable with higher risk levels, it’s recommended to start with regular trading hours and gradually explore after-hours trading as you gain experience.

Trading Options After Hours

Final Thoughts: Dive into the After-Hours

After-hours options trading can be a rewarding experience for those who are willing to put in the time, effort, and dedication to learn and refine their strategies. While it offers potential for significant gains, it also comes with increased risk due to heightened volatility and thinner liquidity. Always remember to prioritize research, manage your risk effectively, and approach every trade with a disciplined mindset.

Are you ready to take your options trading to the next level by exploring the after-hours market? Share your thoughts and experiences in the comments below!