Ever wondered how the price of an option changes as the underlying stock moves? Or how much risk you’re taking when you buy or sell an option? That’s where delta comes in. Delta is one of the most fundamental concepts in options trading, and understanding it can significantly enhance your trading strategy and decision-making.

Image: financhill.com

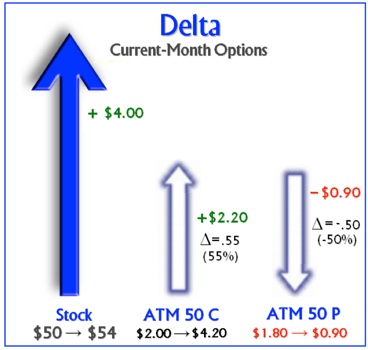

Think of delta as a measure of an option’s sensitivity to the underlying asset’s price. It tells you how much the option price is expected to move for every $1 change in the underlying stock price. This knowledge allows you to estimate the potential profit or loss of your option position based on your expectations about the underlying asset’s price movement. In this article, we will explore the intricacies of delta and its impact on your options trading journey.

Understanding Delta: A Closer Look

In the world of options, delta ranges from -1 to +1, with values closer to -1 indicating a put option and a value closer to +1 representing a call option. A delta of 0.5 for a call option suggests that the option price will rise by $0.50 for every $1 increase in the underlying asset’s price. Conversely, a delta of -0.5 for a put option would mean the option price would decrease by $0.50 for every $1 increase in the underlying asset’s price.

Delta and Time Decay

It’s important to remember that delta isn’t static. It changes constantly throughout the life of an option, influenced primarily by the passage of time and the change in the underlying price. As time goes by and the option’s expiration date nears, its delta tends to move closer to 0. This phenomenon, known as “time decay,” suggests that options lose their sensitivity to movement in the underlying asset as they approach their expiry.

Delta and Option Pricing

Delta plays a crucial role in determining the price of an option. Options with higher deltas, indicating a greater sensitivity to price movement, typically command higher prices. The opposite is true for options with lower deltas, which carry less risk and are generally priced lower.

Image: www.youtube.com

Practical Applications of Delta in Options Trading

Delta is not just a theoretical concept; it has significant practical applications for options traders. Here are some key ways you can leverage delta to fine-tune your trading strategies:

1. Estimating Potential Profits and Losses

By knowing the delta of an option, you can get a realistic idea of how much the option’s price might change for a given movement in the underlying asset’s price. This helps you to establish better trading targets and stop-loss points, minimizing potential losses while maximizing profit potential.

2. Hedging Positions

Delta can be used strategically to hedge against unwanted risk. For example, let’s say you own a stock and want to protect your portfolio from downward price movements. You can sell a call option with a delta equal to your stock holding, effectively hedging your stock position and mitigating risk.

3. Creating Synthetic Positions

Delta is essential in creating synthetic positions, where you create the equivalent of owning or selling an underlying asset using combinations of options and other derivatives. For instance, a combination of a long call and a short put with equal deltas creates a synthetic long stock position, replicating the payoff of owning the underlying stock.

4. Adjusting Portfolio Exposure

Delta helps you to fine-tune the risk profile of your portfolio. By strategically using options with varying deltas, you can adjust your portfolio exposure to different market conditions. For example, if you are bullish on the market, you can increase your delta exposure by buying call options. Conversely, if you anticipate a market downturn, you can reduce your delta exposure by selling call options or buying put options.

Delta in Action: Real-World Examples

Let’s look at some real-world examples to solidify our understanding of how delta can be used in options trading.

Example 1: Managing Risk

Imagine you’ve purchased 100 shares of Apple (AAPL) at $150 per share. To protect your investment from a potential decline in AAPL’s price, you decide to sell 1 AAPL call option with a delta of 0.7. This call option will effectively reduce your exposure to price decreases in AAPL, as the premium you receive from selling the call option partially offsets any decline in the price of your AAPL shares.

Example 2: Profiting from Volatility

Suppose you anticipate increased volatility in the price of Tesla (TSLA). You purchase a TSLA call option with a delta of 0.5 and sell a TSLA put option with a delta of -0.5. This strategy, known as a straddle, positions you to profit from price swings in either direction. If the price of TSLA moves significantly, either up or down, your straddle position will be profitable. If the price of TSLA remains relatively stable, both options will expire worthless, resulting in a loss.

Important Considerations: Delta Limitations

While delta is a powerful tool for understanding and managing options risk, it’s essential to acknowledge its limitations. Delta is a dynamic measure that changes constantly and is only a point-in-time snapshot of an option’s sensitivity to the underlying asset’s price. Other factors, such as implied volatility, interest rates, and time to expiration, also play a significant role in the pricing of options and can impact their performance.

Options Trading Delta

Conclusion: Mastering Delta, Mastering Options

Understanding delta is an essential step in mastering the world of options trading. This pivotal concept provides insights into option pricing, risk management, and portfolio optimization. By incorporating delta into your trading decisions, you can navigate the complexities of options with increased confidence and make more informed trading choices. Remember, delta is a powerful tool for managing risk and maximizing profit potential, but it doesn’t offer foolproof answers. Combine your understanding of delta with other tools and factors in the market to formulate a comprehensive trading strategy.

As you continue your options trading journey, remember, knowledge is power, and a commitment to learning is paramount for success. Keep exploring, keep learning, and keep honing your skills.