Stepping into the exhilarating world of options trading can be a daunting prospect. As a seasoned trader, I’ve witnessed firsthand the transformative power of options, offering lucrative opportunities with manageable risk. Whether you’re a seasoned investor or just starting your journey, navigating the intricacies of options trading requires a strategic approach and a solid understanding of its fundamentals. In this comprehensive guide, I’ll unveil the essential principles, guiding you through each step to empower your options trading endeavors.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Image: www.plafon.id

Options Trading: Unlocking the Possibilities

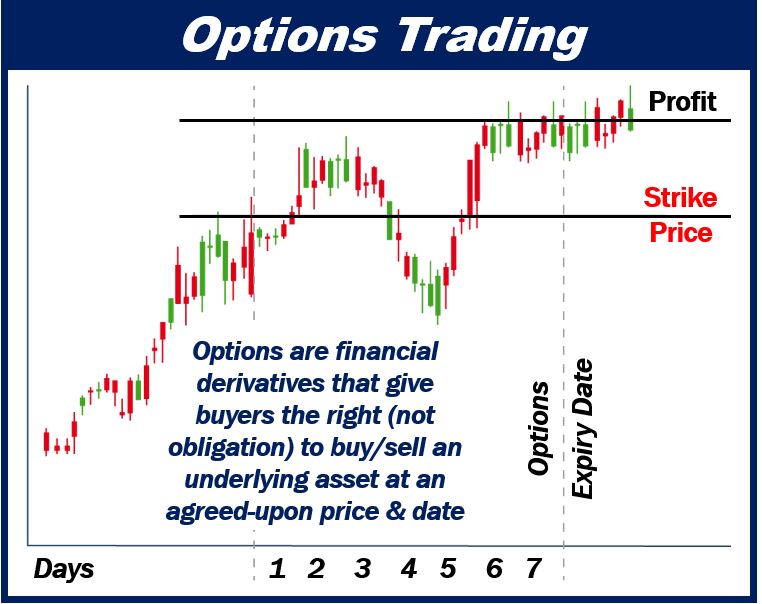

Options trading is an advanced financial strategy that empowers investors to speculate on the future price movements of underlying assets, such as stocks, commodities, or currencies. Unlike traditional stock trading, where investors buy or sell shares outright, options contracts provide the flexibility to benefit from price fluctuations while managing risk through defined parameters. This unique aspect opens up a world of possibilities for investors seeking diversified portfolios and targeted returns.

Options Contracts Demystified

Understanding the anatomy of options contracts is crucial to success in this realm. Each contract represents an agreement between two parties, the buyer and the seller, with specific terms:

- Strike Price: The predetermined price at which the underlying asset can be bought (call) or sold (put) if the option is exercised.

- Expiration Date: The date on which the option contract expires and becomes worthless if not exercised.

- Premium: The price paid by the buyer to the seller for the right to exercise the option, which can vary based on market conditions and the likelihood of the option expiring in the money.

Navigating Options Strategies

Options trading offers a diverse array of strategies, catering to varying risk appetites and investment goals. Understanding these strategies is critical for maximizing returns and mitigating potential losses:

- Call Options: Grant the buyer the right to buy an underlying asset at the strike price on or before the expiration date.

- Put Options: Give the buyer the right to sell an underlying asset at the strike price on or before the expiration date.

- Covered Call: A conservative strategy where the holder sells (writes) a call option while owning the underlying asset, seeking to generate income while limiting potential upside.

- Cash-Secured Put: Another conservative approach where the holder sells (writes) a put option while holding cash equal to the strike price, aiming for income generation with downside protection.

- Iron Condor: A neutral strategy involving buying and selling both call and put options at different strike prices and expiration dates to profit from a narrow range of price fluctuations.

Image: marketbusinessnews.com

Tips and Insights for a Successful Start

Venturing into options trading requires a mindful approach and careful consideration. Follow these expert tips to enhance your trading journey:

- Grasp the Basics: Before diving into the complexities of options trading, ensure you possess a strong foundation in financial markets, including understanding stock trading, risk management, and technical analysis.

- Detailed Due Diligence: Research potential underlying assets thoroughly, analyzing their historical performance, fundamentals, and industry trends to make informed decisions.

- Start Small: Avoid overextending yourself by trading with small positions initially. This allows for a gradual learning curve and minimizes potential losses while gaining experience.

- Risk Management: Options trading carries inherent risk. Establish clear risk parameters, including stop-loss orders to limit potential losses and preserve capital.

- Patience and Discipline: Options trading requires patience and discipline. Don’t let emotions cloud your judgment; stick to your trading plan and avoid impulsive decisions.

Remember, the key to success in options trading lies in continual learning and adaptation. Stay abreast of market trends, study successful strategies, and seek guidance from experienced traders to refine your approach and enhance your trading outcomes.

Frequently Asked Questions (FAQs)

- Question: Is options trading suitable for beginners?

Answer: Options trading involves sophisticated strategies and is generally not recommended for novice investors. It’s essential to acquire a comprehensive understanding before engaging in this advanced financial instrument. - Question: What are the potential risks involved in options trading?

Answer: Options trading carries significant risk, including the potential for substantial losses. Careful research, proper risk management, and adherence to a disciplined trading plan are crucial to mitigate potential drawbacks. - Question: Can I make a living from options trading?

Answer: While it’s possible to generate significant returns from options trading, it requires substantial knowledge, skill, and dedication. Attempting to rely solely on options trading as a primary source of income without adequate experience is highly speculative.

How To Get Started In Options Trading

Conclusion: Embracing the World of Options

Options trading presents a dynamic and rewarding opportunity for investors seeking to diversify their portfolios and potentially enhance returns. However, it’s imperative to approach this realm with a well-informed and strategic mindset. Through rigorous preparation, informed decision-making, and unwavering discipline, you can harness the power of options to navigate market fluctuations and achieve your financial aspirations. So, are you ready to embrace the exhilarating world of options trading and unlock its limitless possibilities?