Introduction

In the dynamic world of financial markets, high volume option trading emerges as a lucrative yet complex strategy that captivates the interest of discerning traders seeking substantial returns. Options, financial instruments granting the holder the right but not the obligation to buy (call) or sell (put) an underlying asset at a predetermined price, offer a potent vehicle for leveraging market volatility and building personalized risk profiles. Understanding the intricacies of this multifaceted strategy is paramount for traders aspiring to navigate this high-stakes arena successfully. This comprehensive guide delves into the realm of high volume option trading, unraveling its essential concepts, strategies, and potential rewards.

Demystifying High Volume Option Trading

High volume option trading entails executing a substantial number of option contracts, typically within a single trading day or a tightly defined time frame. Unlike traditional option buying or selling, which involves smaller lot sizes, this strategy capitalizes on the market’s heightened volatility and liquidity, often associated with significant market events or news catalysts. By harnessing the power of options’ leverage, high volume option traders amplify their potential profits while simultaneously escalating their risk exposure.

Navigating the High Volume Option Trading Landscape

Commencing a high volume option trading endeavor demands a profound grasp of foundational concepts and strategies. Firstly, traders must possess an intimate understanding of option pricing models, comprehending the intricate interplay between factors such as asset price, time to expiration, implied volatility, interest rates, and more. Secondly, familiarity with advanced trading techniques, including hedging and spread trading, is pivotal to managing risk and maximizing returns. A comprehensive understanding of risk management strategies, such as stop-loss orders and hedging techniques, becomes imperative for safeguarding capital during volatile market conditions.

Image: www.pinterest.com

Unveiling the Distinctive Approaches to High Volume Option Trading

Delving into the realm of high volume option trading unveils a myriad of approaches tailored to diverse trader preferences and risk appetites. Scalping, the rapid execution of small option orders to capture minuscule price changes, appeals to traders seeking consistent but modest returns. Speculators, on the other hand, engage in bold directional bets, capitalizing on market momentum or anticipating significant price movements. Arbitrageurs seek to exploit price discrepancies between related options contracts, while income traders generate returns by selling options premiums in anticipation of the underlying asset’s price remaining relatively stable.

Exposing the Allure of High Volume Option Trading

Embracing high volume option trading unlocks a spectrum of potential benefits for savvy traders. Firstly, it offers the enticing prospect of substantial returns, particularly during periods of elevated market volatility. Moreover, the ability to mold customized risk and reward profiles allows traders to tailor strategies to their individual financial objectives and risk tolerances. The flexibility to trade both bullish (call options) and bearish (put options) market outlooks provides traders with the agility to capitalize on market fluctuations regardless of their directional bias.

Unveiling the Perils Inherent in High Volume Option Trading

While high volume option trading holds the potential for significant rewards, it also carries inherent risks that traders must fully comprehend and diligently manage. The substantial leverage associated with options trading magnifies both potential profits and losses, demanding prudent risk management practices. Unfavorable market movements can rapidly erode capital, amplifying the importance of carefully calculated trading decisions and strict adherence to risk management principles.

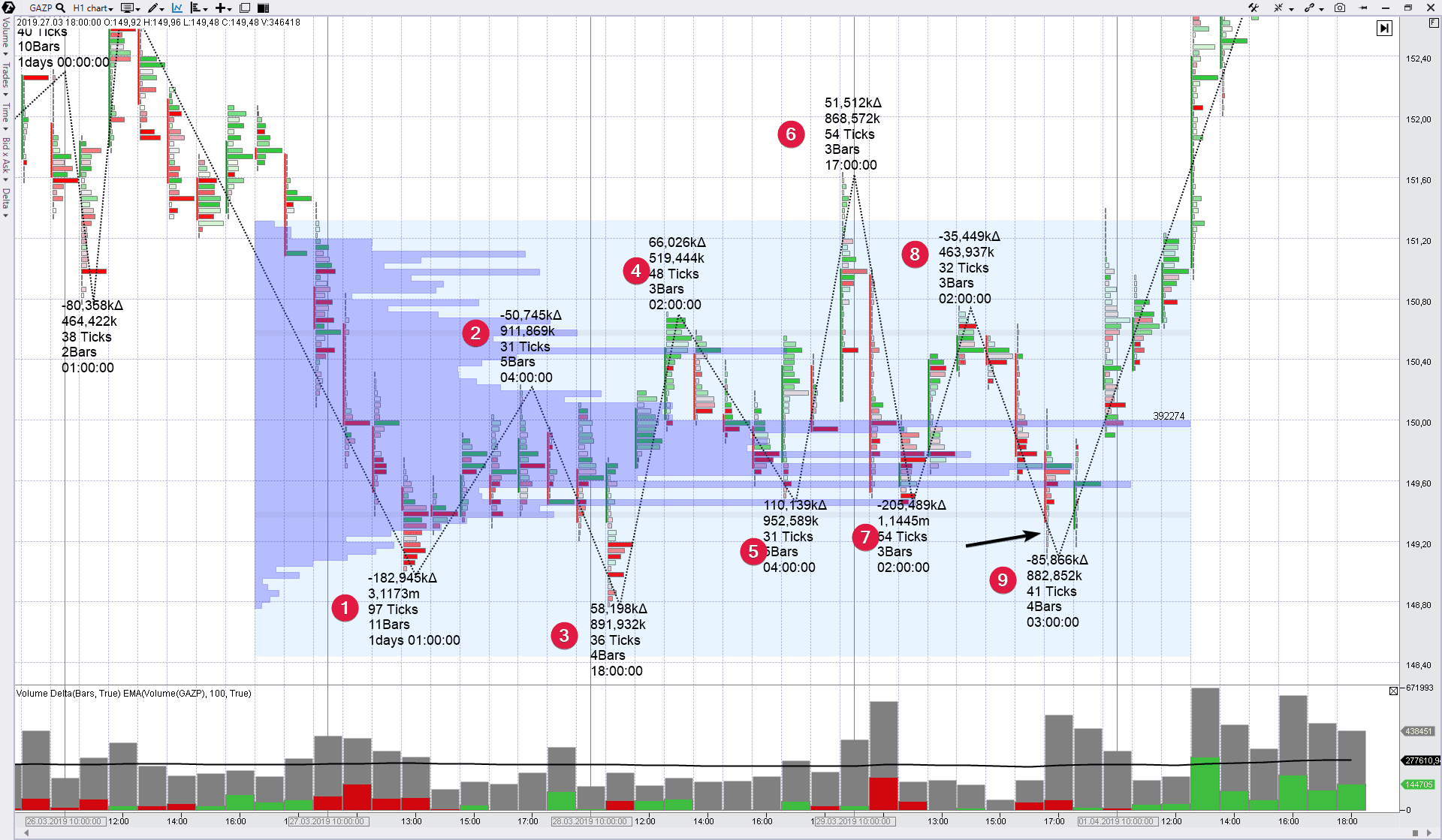

Image: atas.net

High Volume Option Trading

Conclusion: Embracing High Volume Option Trading with Prudence and Precision

High volume option trading presents a potent yet intricate strategy for traders seeking substantial returns. Thoroughly understanding its nuances, mastering advanced trading techniques, and implementing robust risk management practices are paramount for successful navigation of this high-stakes arena. Embracing this strategy demands a blend of analytical prowess, adept risk management, and the fortitude to navigate market volatility. By equipping themselves with the requisite knowledge and skills, traders can harness the potential rewards of high volume option trading while mitigating associated risks, paving the path toward financial success in this dynamic and challenging market environment.