Introduction

Have you ever wondered how some investors seem to time the market perfectly, generating consistent profits while others struggle to break even? The answer could lie in the world of futures and options trading, a sophisticated investment strategy that allows savvy traders to speculate on the future direction of various assets. While it may sound daunting at first, understanding the basics of futures and options trading can open up a wealth of opportunities for those willing to embrace the risk and rewards that come with it.

Image: frudgereport363.web.fc2.com

In this comprehensive guide, we will delve into the intricacies of futures and options trading, providing a solid foundation for beginners to kick-start their trading journey. We will cover the key concepts, strategies, and risks involved, empowering you with the knowledge to make informed decisions and potentially maximize your returns.

Understanding Futures Contracts

A futures contract is an agreement between two parties to buy or sell an underlying asset at a predetermined price on a future date. The underlying asset can be a commodity (like oil or gold), a financial instrument (like a stock index), or even a currency. The buyer of a futures contract agrees to purchase the asset at the agreed-upon price, while the seller agrees to deliver the asset on the specified date.

Futures contracts are standardized, meaning they adhere to specific rules and regulations set by the exchange where they are traded. This standardization ensures transparency and liquidity, making it easier for buyers and sellers to find each other and execute trades.

Key Features of Futures Contracts

- Standardized: Contracts adhere to specific rules and regulations based on the exchange.

- Obligation to Buy/Sell: Buyers agree to purchase, while sellers agree to deliver the underlying asset.

- Leverage: Futures contracts allow traders to use leverage, multiplying their potential profits but also amplifying risks.

- Margin Requirements: Traders are required to maintain a certain amount of margin to cover potential losses.

Options Trading: A Primer

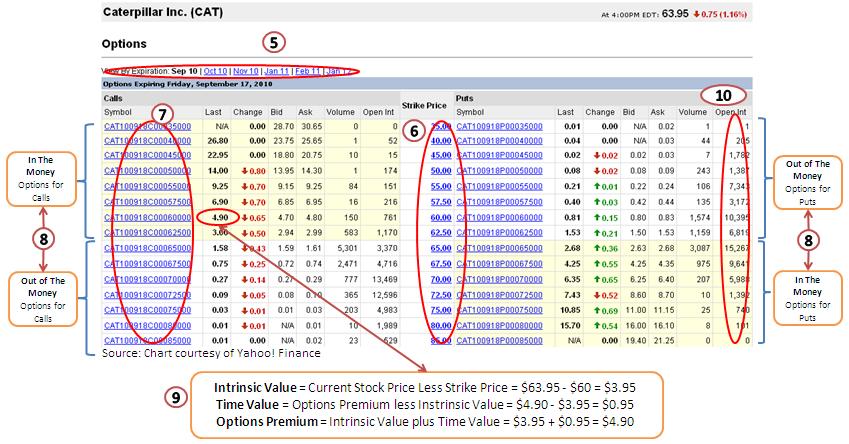

Options contracts provide a different way to speculate on the future direction of an asset without the obligation to buy or sell. An option contract gives the buyer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a specified price (strike price) before a certain date (expiration date).

Unlike futures contracts, options contracts are not standardized and can be customized to suit the trader’s risk appetite and investment goals. This flexibility comes at a cost, as options contracts typically carry a premium, which is the price paid to acquire the right to exercise the option.

Image: s3.amazonaws.com

Key Features of Options Contracts

- Right to Buy/Sell: Buyers acquire the right, but not the obligation, to buy or sell the underlying asset.

- Strike Price: The price at which the trader can buy (call option) or sell (put option) the asset.

- Expiration Date: The date by which the option must be exercised or expires worthless.

- Premium: The price paid to purchase the right to exercise the option.

Strategies for Futures and Options Trading

There’s a wide range of strategies in futures and options trading, each with its unique risk-reward profile. Here are a few common strategies to help you get started:

Long Futures Position

A long futures position involves buying a futures contract, expecting the price of the underlying asset to rise. The trader profits from the difference between the initial purchase price and the selling price when the contract nears its expiration.

Short Futures Position

A short futures position involves selling a futures contract, anticipating a decline in the underlying asset’s price. The trader profits from the difference between the initial sale price and the lower purchase price when the contract expires.

Covered Call Option Strategy

A covered call option strategy involves holding an underlying asset (like a stock) and selling (or writing) a call option on it. The call option gives someone else the right to buy the stock at a specific price. If the stock price rises, the trader can still sell the stock at a profit, albeit lower than they would have if they did not sell the call option.

Risks and Considerations

Before venturing into futures and options trading, it’s crucial to be aware of the risks involved:

Leverage Risks

Futures and options contracts often involve leverage, which can amplify both profits and losses. Traders must carefully manage their leverage exposure to avoid catastrophic losses.

Volatility Risks

The values of futures and options contracts can fluctuate significantly, particularly during volatile market conditions. The price of the underlying asset can move against the trader’s predictions, leading to losses.

Liquidity Risks

Some futures and options markets may have lower liquidity, making it challenging to execute trades quickly at a fair price, especially during periods of high volatility.

Future And Options Trading Basics

Conclusion

Understanding the basics of futures and options trading can equip you with a powerful tool for speculating on the future direction of assets and potentially maximizing your returns. However, it’s essential to approach these markets cautiously, carefully manage risks, and continuously educate yourself. Only by embracing both the opportunities and challenges that futures and options trading present can investors unlock their full potential in this exciting arena.