The High Stakes of Emotional Trading

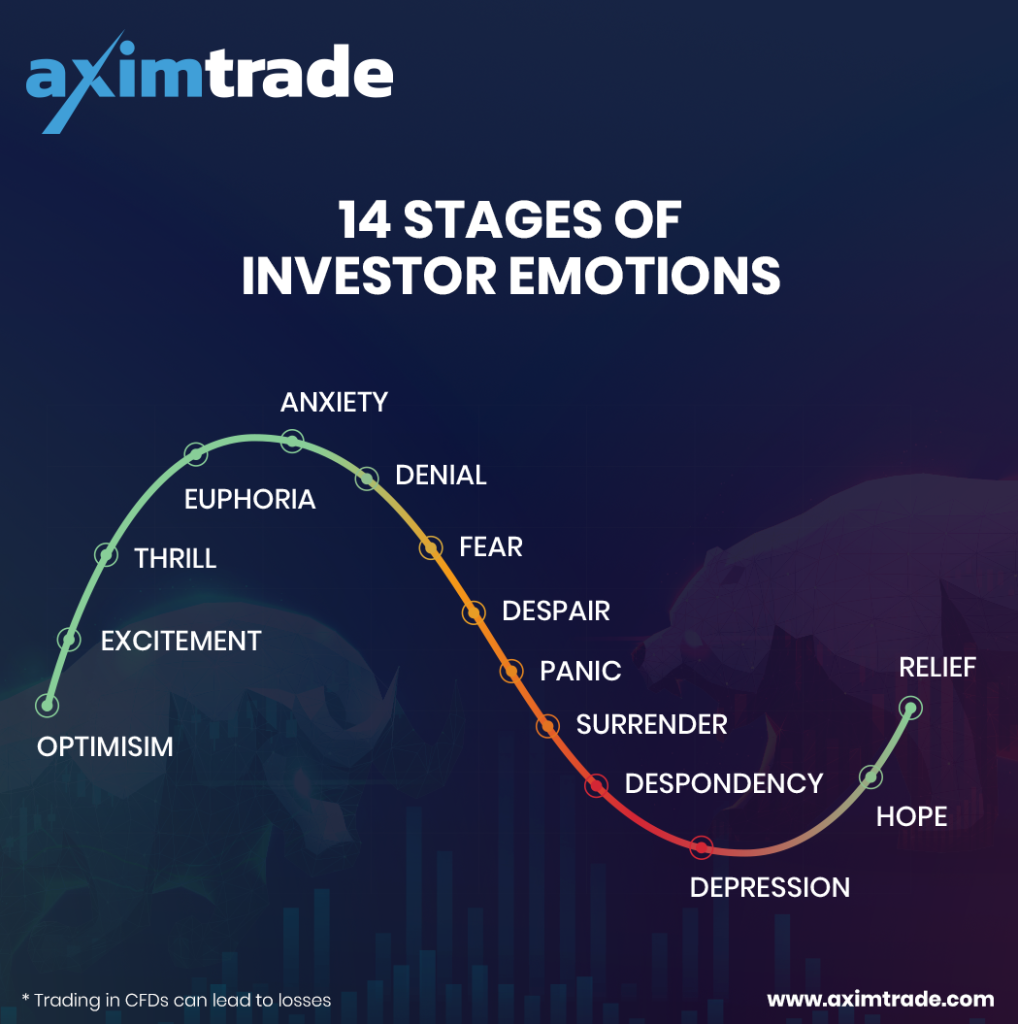

The world of options trading can be exhilarating, a fast-paced arena where fortunes can be made and lost in a blink. But amidst the excitement, a silent enemy lurks – emotion. Human emotions, while a powerful driving force in our lives, are often the trader’s worst enemy. They can lead to impulsive decisions, poor risk management, and ultimately, financial losses.

Image: optionalpha.com

Imagine this: you’ve been watching a stock for weeks, carefully analyzing its trends and putting together a meticulously crafted option strategy. Finally, the opportunity you’ve been waiting for arises. But then, fear creeps in. You hesitate, paralyzed by the possibility of losing money. Or perhaps, you see a small profit and, fueled by greed, you hold on too long, watching your gains evaporate in a market downturn. These are just a few examples of how emotions can sabotage even the most well-planned trading strategies.

Unveiling the Power of Emotionless Option Trading

Understanding the Concept

Emotionless option trading, as the name suggests, is the practice of removing emotions from the trading process. It involves approaching every decision with a detached, logical, and analytical mindset. This isn’t about suppressing your emotions; it’s about recognizing them, acknowledging their influence, and developing strategies to mitigate their negative impact.

This approach is based on the idea that emotions can cloud judgment, leading to irrational decisions. The goal is to replace emotional impulses with disciplined, data-driven choices. This helps maintain objectivity, even when faced with market volatility, losses, or temptations to deviate from your trading plan.

Benefits of Emotionless Trading

Adopting an emotionless approach to option trading brings numerous benefits, including:

- Improved Discipline: By removing emotion, you can stick to your trading plan, avoiding impulsive trades based on fear or greed.

- Reduced Risk: Emotionless trading encourages proper risk management, helping you avoid taking unnecessary risks or chasing losses.

- Enhanced Decision-Making: By relying on data and analysis, you can make informed decisions and avoid making emotional mistakes.

- Increased Consistency: Removing emotions from the equation helps you avoid the inconsistency that often results from emotional trading.

- Reduced Stress: By avoiding emotional rollercoasters, you can experience a more relaxed and less stressful trading experience.

Image: www.aximdaily.com

Mastering Emotionless Option Trading: Practical Strategies

1. Develop a Clear Trading Plan

A comprehensive trading plan is your roadmap to success. It should outline your entry and exit strategies, risk management protocols, and specific trading goals. By having a plan in place, you take the guesswork out of trading decisions, reducing the need for emotional reactions.

2. Embrace Data and Analysis

Reliance on data is crucial in emotionless trading. Analyze market trends, technical indicators, and fundamental news, using tools to support your decisions. Data-driven analysis helps you make objective choices, minimizing emotional bias.

3. Practice Mindfulness and Discipline

Mindfulness techniques can be powerful tools for emotional regulation. Developing awareness of your emotions and learning to detach from them is essential. This can be achieved through practices like meditation, deep breathing exercises, and journaling.

4. Control Your Exposure with Proper Risk Management

Risk management is a cornerstone of emotionless trading. Set clear stop-loss orders to limit potential losses and avoid holding onto losing positions out of fear or hope. Define your risk tolerance and stick to it, ensuring that each trade fits within your risk parameters.

5. Seek Support and Feedback

Don’t hesitate to reach out to mentors, experienced traders, or financial advisors for guidance. Regularly review your trading performance and seek feedback to identify areas for improvement in your trading psychology.

Staying Ahead of the Curve: Latest Developments in Emotionless Trading

The field of emotional trading is constantly evolving, with new techniques and strategies emerging. Here are some noteworthy developments:

- AI-Powered Trading: Artificial intelligence (AI) is playing an increasing role in automating trading decisions, further reducing the influence of emotions.

- Behavioral Finance: This branch of finance studies the psychological biases that influence investor decision-making, providing valuable insights for traders seeking to manage emotions.

- Developments in Neuroscience: Research in neuroscience is uncovering how the brain processes risk and reward, providing a deeper understanding of the emotional dynamics in trading.

Top Tips and Expert Advice

1. Recognize Your Emotional Triggers

Identify the specific market conditions or events that tend to elicit emotional responses in you. For example, if you’re prone to panic selling during market downturns, learn to recognize the signs of that panic and implement strategies to avoid selling impulsively.

2. Use a Trading Journal

Maintain a detailed record of your trading activities. This includes your entry and exit points, trade rationale, and emotional state during each trade. Analyzing your journal entries can help you identify emotional patterns and make adjustments to your trading strategy.

3. Practice Patience and Discipline

The market doesn’t always move in your favor. Be patient, wait for the right opportunities, and stick to your trading plan. Resist the temptation to chase returns or make impulsive decisions based on fear or greed.

Frequently Asked Questions

Q1: How do I know if I’m making emotional trading decisions?

Common signs of emotional trading include:

- Panicking and selling after a small loss

- Holding onto a losing position too long, hoping it will recover

- Making impulsive trades based on news or rumors

- Chasing returns and taking excessive risks

Q2: Can I completely eliminate emotions from trading?

While it’s virtually impossible to completely eliminate emotions, the goal is to recognize and manage their impact. Develop strategies to mitigate their negative effects and harness them for positive outcomes.

Q3: Are there any tools that can help me with emotionless trading?

Yes, several tools can assist you:

- Trading journals: Help track your trades and emotions.

- Stop-loss orders: Limit potential losses and prevent emotional trading decisions during downturns.

- Trading platforms with alerts: Provide real-time updates and notifications to minimize emotional reactions to sudden market movements.

Emotionless Option Trading

Conclusion

Emotionless option trading isn’t about becoming a cold, emotionless machine; it’s about harnessing the power of logic and discipline to make informed trading decisions. By recognizing emotional triggers, developing a clear trading plan, and implementing strategies for managing risk and emotional responses, you can position yourself for greater success in the exciting world of options trading.

Are you ready to embrace emotionless option trading and take control of your trading psychology? Tell us what you think about the concept in the comments below!