In the ever-evolving financial landscape, digital options trading has gained prominence as a transformative approach to managing risk and unlocking profit potential. Its accessibility, flexibility, and adaptability have captivated seasoned investors and aspiring traders alike. By delving into the diverse array of digital options trading strategies, this comprehensive guide empowers you with the knowledge and insights to navigate this dynamic realm with confidence.

Image: blog.iqoption.com

Understanding Digital Options: A Foundation for Effective Trading

Digital options, derivatives that derive their value from an underlying asset, offer a unique blend of risk and reward. Their binary nature dictates a fixed payout or loss, hinging solely on the occurrence of a predefined condition. This straightforward structure eliminates uncertainty, making them an attractive option for traders seeking defined outcomes. Unlike traditional options, digital options have no intrinsic value, trading exclusively on speculation of price movements.

Navigating the Spectrum of Digital Options Strategies: Unlock Your Trading Potential

The versatility of digital options manifests itself in the broad spectrum of trading strategies that capitalize on market dynamics. Whether striving to hedge against risk, speculating on price movements, or generating consistent returns, traders have a myriad of options at their disposal. Let’s delve into the most prevalent and effective strategies:

-

Call Options: Tailored for bullish market expectations, call options grant traders the right to purchase an underlying asset at a pre-determined price (strike price) within a specified timeframe (expiration date). If the market price exceeds the strike price, traders can exercise the option and pocket the difference between the market price and the strike price.

-

Put Options: Ideal for bearish market forecasts, put options provide the right to sell an underlying asset at a fixed strike price before the expiration date. If the market price falls below the strike price, traders can exercise the option to sell the asset for the strike price, profiting from the price decline.

-

Long Options: A bullish strategy, long options involve buying digital options in anticipation of an increase in the underlying asset’s price. If the price moves favorably, the value of the options rises, yielding potential profits for the trader.

-

Short Options: A bearish strategy, short options entail selling digital options in anticipation of a decline in the underlying asset’s price. If the price moves as predicted, the value of the options dwindles, allowing the trader to profit from the price drop.

-

Call Spreads: By simultaneously selling a call option with a lower strike price and purchasing a call option with a higher strike price, traders can limit their potential upside while capping their risk.

-

Put Spreads: Put spreads follow a similar principle as call spreads, but with put options. By selling a put option with a higher strike price and purchasing a put option with a lower strike price, traders limit their potential profit while restricting their risk.

Navigating the Nuances: Expert Insights and Actionable Tips

Mastering digital options trading requires a strategic approach, fueled by insights from seasoned experts and actionable advice. Here are some invaluable tips to enhance your trading acumen:

-

Define Your Risk Tolerance: Before venturing into digital options trading, meticulously assess your financial profile and risk appetite. Understand your tolerance for potential losses and tailor your strategies accordingly.

-

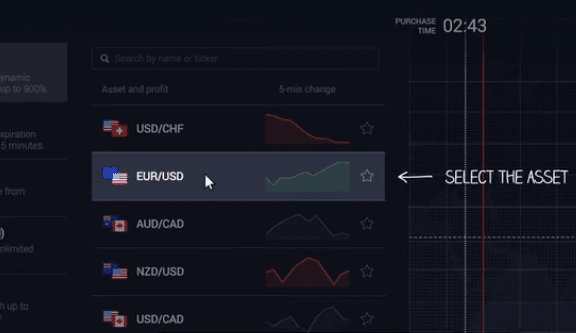

Choose Your Underlying Assets Wisely: The underlying asset’s volatility, liquidity, and overall market sentiment significantly influence digital options pricing. Conduct thorough research to select assets that align with your trading objectives.

-

Set Realistic Goals: Embrace realistic profit targets and avoid the allure of unrealistic returns. Develop a well-defined trading plan that sets forth clear objectives and risk management measures.

-

Stay Informed: Monitor market news, economic indicators, and geopolitical events that could impact the prices of your underlying assets. Timely and accurate information forms the foundation for sound trading decisions.

Image: smallbusiness.co.uk

Digital Options Trading Strategies

Conclusion: Empowering You to Navigate the Digital Options Arena

Digital options trading presents an unparalleled opportunity for traders seeking to capitalize on market movements and hedge against risk. By understanding the fundamental concepts, exploring the diverse range of trading strategies, and leveraging expert insights, you can equip yourself with the knowledge and skills to confidently navigate this dynamic financial arena. Embrace the transformative power of digital options and unlock your trading potential today.