In the realm of financial markets, where the dance of supply and demand dictates the ebb and flow of assets, there exists a sophisticated instrument that enables savvy investors to navigate market uncertainties with precision: Future Option Trading. This article aims to unravel the intricacies of future option trading, deciphering its mechanisms, grasping its benefits, and exploring its nuances to empower you in your financial endeavors.

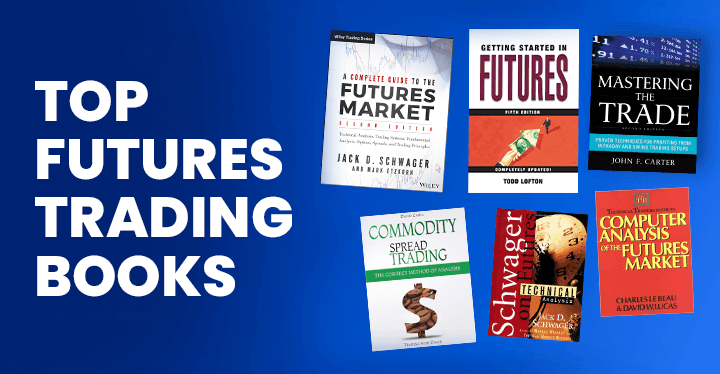

Image: howtotrade.com

A Window into the Horizons of Time: What are Future Contracts?

To comprehend future option trading, one must first delve into the world of future contracts. These agreements serve as legally binding commitments between parties to exchange a predetermined quantity of an underlying asset at a specified price on a future date. Futures contracts find widespread application in various industries, including commodities, currencies, and even stock market indices, acting as essential risk management tools for producers, consumers, and investors alike.

Options, on the other hand, present a different dimension in the financial landscape. Unlike futures, which obligate holders to buy or sell the underlying asset, options provide a right but not an obligation to exercise this choice. This unique attribute renders options instruments of flexibility, offering traders the latitude to adapt their strategies in response to evolving market conditions.

Options on Futures: An Instrument of Sophistication

Future option trading combines the characteristics of futures contracts and options, creating a sophisticated investment vehicle. It grants holders the option to buy or sell a futures contract at a specified price and date. This duality of possibilities empowers traders with the capacity to mitigate risk, speculate on market movements, and pursue unique profit-making strategies, making future options a versatile tool in the hands of knowledgeable investors.

Crucially, future options differ from standard options due to their underlying assets being futures contracts rather than the physical assets themselves. This distinction opens up a wider array of strategies, as traders can take positions on future price fluctuations without directly owning the underlying commodity or security.

The Mechanics of Future Option Trading

To delve deeper into the dynamics of future option trading, let’s explore its key elements. Intrinsic value refers to the difference between the current price of the underlying futures contract and the strike price, the predetermined price at which the option can be exercised. When the intrinsic value is positive, the option is said to be “in the money,” while an option with a negative intrinsic value is considered “out of the money.”

In addition to intrinsic value, extrinsic value also plays a crucial role in pricing future options. This value component encompasses factors such as time to expiration, volatility, and market sentiment, reflecting the potential for future price fluctuations. The interplay of intrinsic and extrinsic values determines the overall premium, or cost of the option.

Image: fadukuvo.web.fc2.com

Strategies for Success in Future Option Trading

Embarking on the journey of future option trading requires a thorough understanding of the various strategies employed by experienced traders. One popular approach is the “buy-call” strategy, where an investor purchases the right to buy a futures contract at a specific strike price in anticipation of a price surge. Conversely, the “buy-put” strategy involves the purchase of the right to sell a futures contract, speculating on a future price decline.

Other strategies include “in-the-money” and “out-of-the-money” options, each with its own set of advantages and disadvantages. The choice of strategy hinges on factors such as market outlook, risk tolerance, and investment goals, necessitating careful consideration and analysis before executing trades.

The Risks and Rewards of Future Option Trading

As with any financial instrument, future option trading carries both potential rewards and risks. Skilled traders can exploit market fluctuations, capitalizing on favorable price movements and generating substantial returns. However, it’s imperative to recognize the potential for losses, which can be equally significant, particularly in volatile market conditions.

To mitigate risks, a disciplined approach to trading is paramount. This includes comprehensive market research, careful strategy selection, and prudent money management practices. Emotional investing and impulsive decisions can lead to financial setbacks, reinforcing the importance of a well-defined trading plan and calculated risk-taking.

What Is Future Option Trading

https://youtube.com/watch?v=izu1tSmmIOs

Conclusion

Future option trading presents a potent tool for investors seeking to navigate market uncertainties, hedge against risks, or capitalize on market trends. By grasping the fundamental principles, various strategies, and potential risks involved, individuals can empower themselves to leverage this sophisticated instrument. Remember, knowledge is the keystone to successful trading, and a thorough understanding of future option trading paves the way for informed decision-making and potentially lucrative outcomes in the financial markets.