In the exhilarating world of investing, options trading has emerged as a formidable tool for savvy investors seeking exponential returns. With its inherent flexibility and potential for substantial gains, options have captivated the minds of countless traders. As a seasoned investor, I have delved into the intricacies of this lucrative landscape, discovering the unparalleled opportunities it offers.

Image: tradingplatforms.com

Options trading on Charles Schwab, a leading brokerage firm renowned for its exceptional platform and comprehensive suite of financial services, has proven to be an unwavering foundation for my trading journey. Through Schwab’s user-friendly interface, I have navigated the complexities of options with ease, harnessing its advanced tools and extensive educational resources to maximize my potential. In this comprehensive guide, I embark on a quest to unveil the multifaceted world of options trading on Charles Schwab, empowering you with the knowledge and strategies to unlock extraordinary profits.

Options Trading: A Gateway to Asymmetrical Profits

At the heart of options trading lies a fundamental concept: the ability to profit from price movements without owning the underlying asset directly. Options contracts grant you the right, but not the obligation, to buy or sell an underlying asset at a predetermined strike price on or before a specific expiration date. This asymmetry provides options traders with immense leverage, enabling them to magnify their returns while minimizing their capital exposure.

Options contracts come in two primary flavors: calls and puts. Calls confer the right to purchase an underlying asset at the strike price, while puts convey the right to sell an underlying asset at the strike price. The intrinsic value of an options contract is determined by the difference between the strike price and the current market price of the underlying asset. Options also possess time value, which diminishes as the expiration date approaches.

Mastering the Art of Options Trading on Charles Schwab

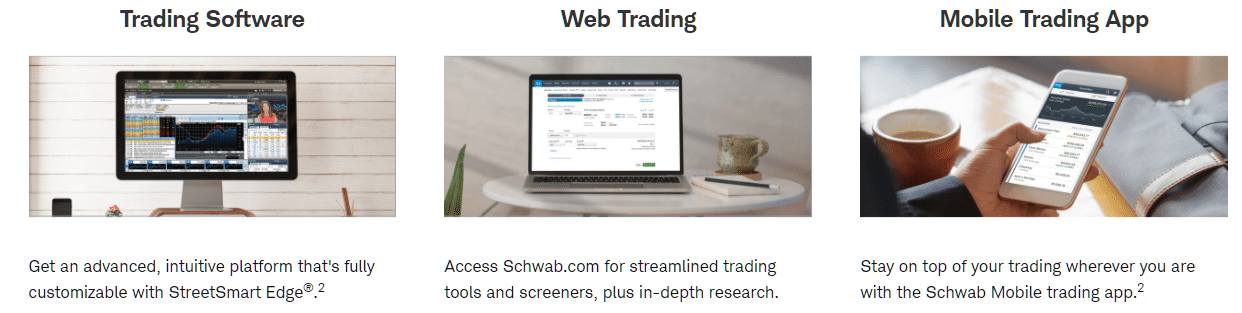

To excel in options trading on Charles Schwab, a comprehensive understanding of the platform and its trading tools is paramount. Charles Schwab provides an array of features designed to cater to the diverse needs of traders, from beginners to seasoned veterans. Its intuitive platform empowers you to swiftly execute trades, monitor market movements, and analyze options strategies with unparalleled ease.

Schwab’s comprehensive educational resources are an invaluable asset for traders seeking to deepen their understanding of options trading. Through webinars, online courses, and downloadable guides, Schwab empowers traders with the knowledge and analytical tools necessary to navigate the complexities of options. By leveraging Schwab’s educational offerings, you can refine your trading strategies, minimize risk, and enhance your overall profitability.

Harnessing the Power of Volatility

Volatility, a measure of price fluctuations, plays a pivotal role in options trading. Elevated volatility amplifies the potential returns of options strategies, as it increases the likelihood of significant price movements. Charles Schwab provides a range of tools to assess and quantify volatility, enabling traders to make informed decisions and adjust their strategies accordingly.

Schwab’s Volatility Index (VIX), a widely recognized indicator of market volatility, is particularly valuable for options traders. By tracking the VIX, traders can gauge the overall market sentiment and identify potential trading opportunities. Additionally, Schwab offers a suite of volatility-based trading strategies, empowering traders to capitalize on market fluctuations and generate consistent returns.

Image: www.stockbrokers.com

Expert Tips for Maximizing Returns

Based on my extensive experience as an options trader, I have distilled a few invaluable tips to help you maximize your returns on Charles Schwab’s platform:

- Thoroughly Research Underlying Assets: Before embarking on any options trade, diligently research the underlying asset’s fundamentals, historical performance, and market sentiment. This in-depth analysis will equip you with a solid foundation for making informed trading decisions.

- Understand the Greeks: The Greeks are a set of metrics that quantify the sensitivity of an option’s price to changes in various factors, such as the underlying asset’s price and volatility. Grasping the Greeks will empower you to fine-tune your trading strategies and manage risk more effectively.

- Manage Risk with Precision: Options trading involves inherent risks. To mitigate these risks, employ prudent risk management techniques, such as setting stop-loss orders, diversifying your portfolio, and hedging positions. A disciplined approach to risk management will safeguard your capital and enhance your long-term profitability.

Options Trading On Charles Schwab

Image: www.schwab.com

Frequently Asked Questions

Q: Is options trading suitable for all investors?

A: Options trading carries inherent risks and may not be appropriate for all investors. It requires a thorough understanding of