When venturing into the realm of options trading, comprehending the concept of strike price is instrumental to navigating the complex financial landscape. A strike price, in essence, serves as the predetermined price level at which an options contract becomes exercisable, offering traders both rights and obligations. Understanding how strike prices work empowers traders to make informed decisions and harness the full potential of options strategies.

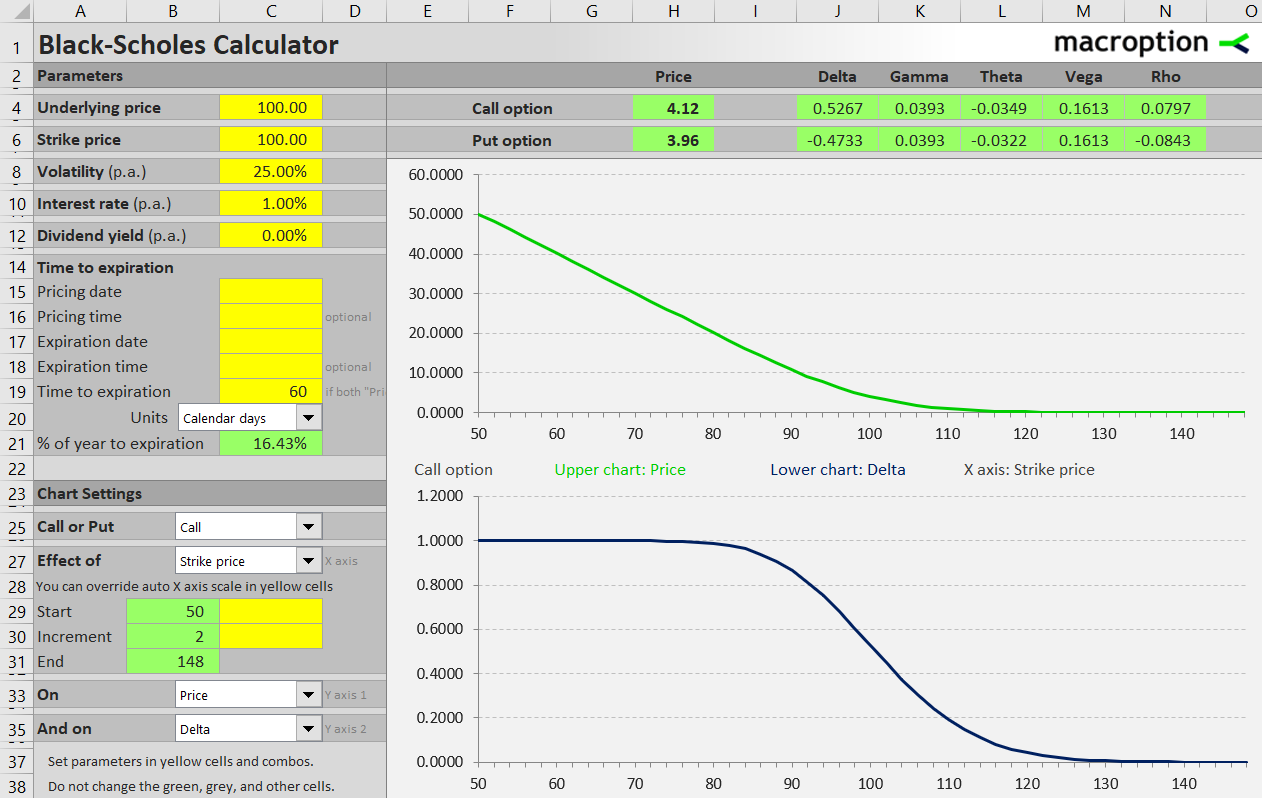

Image: www.macroption.com

Understanding the Dynamics of Strike Prices

Options contracts, unlike stocks, do not represent direct ownership of an underlying asset but rather confer the right to buy (call option) or sell (put option) a specific underlying asset at a specified price, known as the strike price, on or before a predetermined date known as the expiration date. The strike price thus serves as a pivotal element that dictates the potential profitability and risk profile of an options contract.

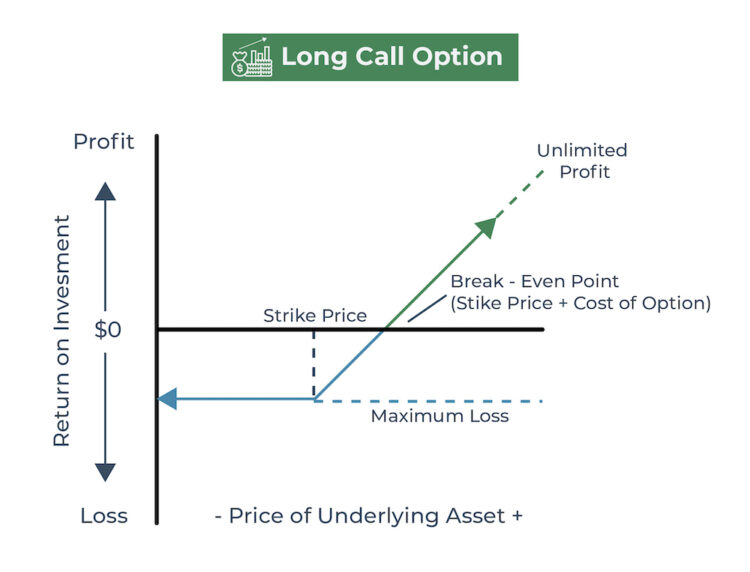

To delve into the significance of strike prices, consider the following real-world scenario: Assume you anticipate a rise in the price of XYZ stock and wish to capitalize on this anticipated appreciation. You could purchase a call option with a strike price of $100, granting you the right to purchase XYZ stock at $100 per share, regardless of its prevailing market price, on or before the expiration date. If the stock’s price indeed surpasses the strike price, you can exercise your right to purchase the stock at a lower price than its market value, potentially generating a profit.

Conversely, if the stock’s price falls below the strike price, your call option becomes worthless, resulting in a loss of the premium paid for the contract. This interplay between strike price and underlying asset price underscores the crucial role of strike prices in shaping the outcomes of options trades.

Types of Strike Prices: In the Money, At the Money, and Out of the Money

Strike prices come in various types, each with distinct characteristics that influence the nature of an options contract. Understanding these types is paramount to making informed strike price selections.

In the Money (ITM) Strike Price: An in-the-money strike price is one at which an options contract holds intrinsic value. For call options, an in-the-money strike price is below the current market price of the underlying asset, while for put options, it is above the current market price. ITM options offer the holder the immediate right to exercise the option and capture the intrinsic value.

At the Money (ATM) Strike Price: An at-the-money strike price is equal to the current market price of the underlying asset. ATM options have no intrinsic value at the time of purchase, but they hold the potential to gain intrinsic value if the underlying asset’s price moves favorably before expiration.

Out of the Money (OTM) Strike Price: An out-of-the-money strike price is one at which an options contract has no intrinsic value. For call options, an out-of-the-money strike price is above the current market price of the underlying asset, and for put options, it is below the current market price. OTM options rely solely on the underlying asset’s price moving significantly in the desired direction to become profitable.

Impact of Strike Price on Options Premiums

The strike price exerts a substantial influence on the premium (cost) of an options contract. Generally, the closer the strike price is to the current market price of the underlying asset, the higher the premium. This is because options with lower strike prices offer greater potential for profit due to their intrinsic value. Conversely, options with higher strike prices typically have lower premiums due to their reduced potential for profit.

Image: investinganswers.com

What Is A Strike In Options Trading

Additional Considerations: Volatility and Time to Expiration

In addition to considering the strike price, options traders should also assess other factors such as volatility and time to expiration. Volatility measures the degree of price fluctuations in the underlying asset, impacting the potential profitability of options contracts. Time to expiration refers to the remaining time until the options contract expires, affecting the decay or increase in the option’s value over time.

By considering these factors in conjunction with strike price, traders can make informed decisions about their options trading strategies, maximizing their chances of success in this dynamic and potentially rewarding financial market.