Options trading, a dynamic and lucrative financial strategy, offers traders the opportunity to capitalize on market movements while managing risk. Our weekly options trading list provides a comprehensive overview of compelling opportunities and market insights. Join us as we navigate the options market, identifying high-potential trades and empowering you to make informed decisions.

Image: www.researchgate.net

Navigating the Options Trading Landscape

Options, financial instruments derived from underlying assets, grant traders the right but not the obligation to buy or sell the asset at a predetermined price on a specific date. This flexibility empowers traders to speculate on market movements, hedge against potential losses, or generate income. The options market presents a wide range of options contracts, each with unique characteristics and risk-reward profiles.

Decoding Options Contract Strategies

Understanding the different types of options contracts is paramount for successful options trading. Call options provide the right to buy an underlying asset, while put options grant the right to sell. Options are further classified as American or European, with American options exercisable at any time before expiration and European options exercisable only on the expiration date. Grasping these concepts empowers traders to tailor their strategies to specific market conditions.

Expiration Dates and Strike Prices

Every options contract has an expiration date, which denotes the last day it can be exercised, and a strike price, which is the pre-determined price at which the underlying asset can be bought or sold. Traders must carefully consider the interplay of expiration dates and strike prices when selecting options contracts. Timing is crucial, as options lose value as they approach expiration. Similarly, strike prices significantly influence profitability; contracts with strike prices close to the underlying asset’s current price offer greater potential for profit but also carry higher risk.

Image: db-excel.com

Assessing Risk and Reward

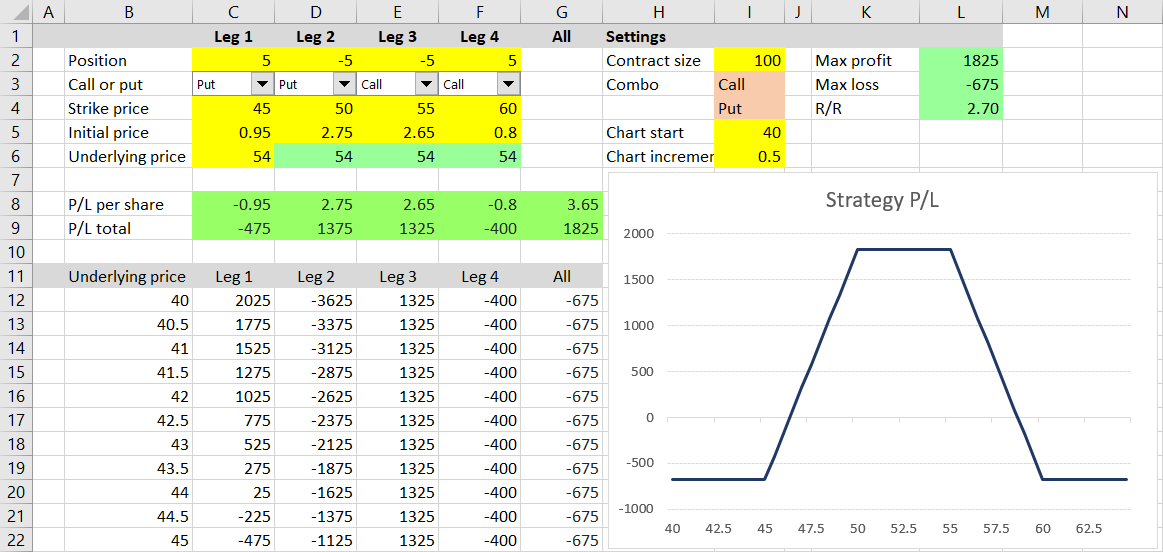

Options trading, like any financial endeavor, involves both risk and reward. The potential for profit is theoretically unlimited, but so is the potential for loss. Traders must meticulously evaluate the risks associated with each options contract and calibrate their positions accordingly. Effective risk management strategies, including stop-loss orders and position sizing, are essential for safeguarding capital and enhancing profitability.

Identifying High-Potential Trading Opportunities

Our weekly options trading list meticulously curates promising trading opportunities across a diverse range of underlying assets, including stocks, indices, and commodities. Each recommendation is backed by thorough analysis of market trends, technical indicators, and fundamental data. We present both bullish and bearish opportunities, catering to various market scenarios and risk appetites. By leveraging our insights, traders can streamline their research, stay abreast of market movements, and identify high-potential trades.

Economic Calendar and Market Events

Staying informed about upcoming economic events and market happenings is pivotal for successful options trading. Macroeconomic data releases, central bank announcements, and political events can significantly impact market volatility and influence option prices. Our weekly options trading list integrates a comprehensive economic calendar, highlighting key market events and their potential implications. By monitoring these events, traders can anticipate market reactions and adjust their strategies accordingly, maximizing their chances of profitability.

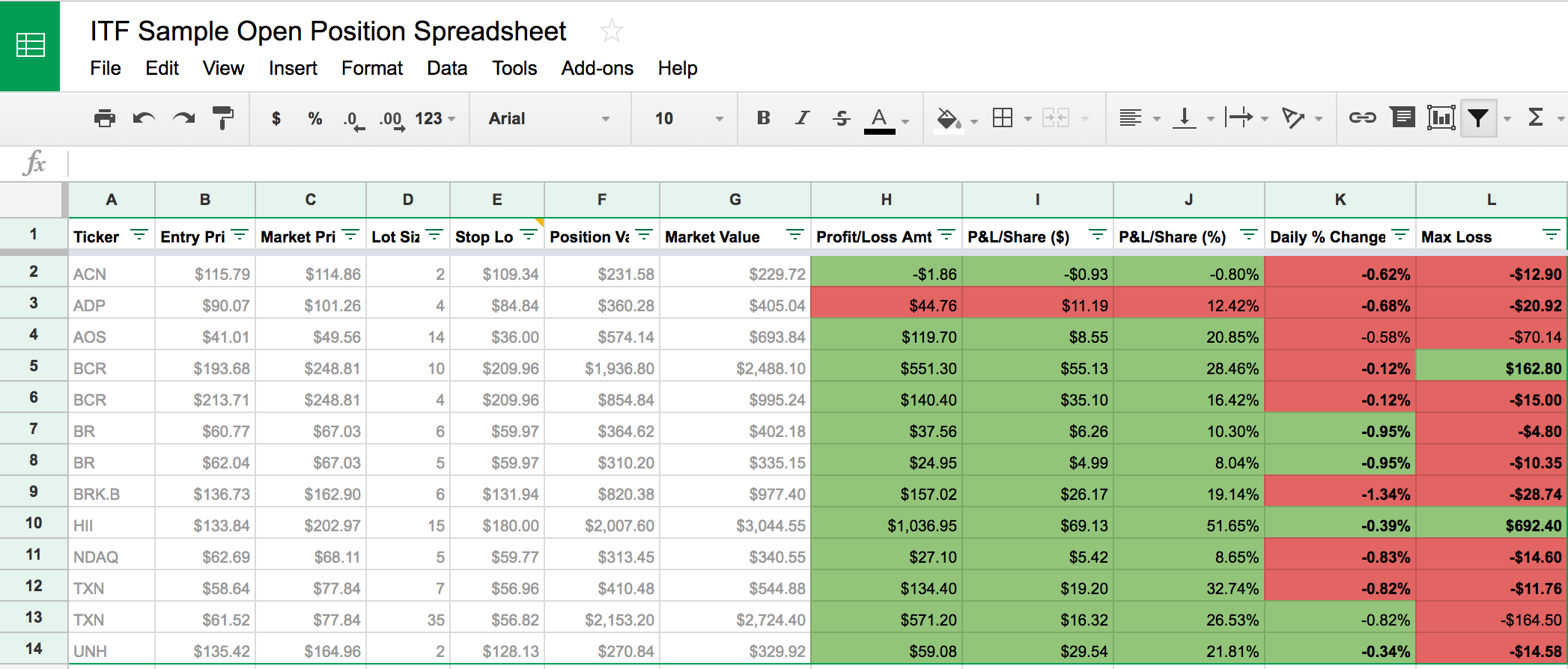

Options Trading Weekly List

Image: www.macroption.com

Conclusion

Options trading presents a powerful avenue for generating profits and managing risk. However, navigating the options market effectively requires a firm grasp of options contract types, risk management techniques, and market analysis. Our comprehensive weekly options trading list equips traders with the essential knowledge, tools, and insights to make informed decisions and capitalize on market opportunities. Join us each week as we delve into the dynamic world of options trading and guide you towards financial success.