Master the Art of Options Trading: Maximizing Returns and Mitigating Risks

The world of investing is constantly evolving, offering a plethora of opportunities for those seeking to grow their wealth. Among these, options trading stands out as a sophisticated and potentially lucrative strategy that can be harnessed by investors of all levels. In this comprehensive guide, we delve deep into the realm of options trading, empowering you with the knowledge and strategies to embark on your options trading journey with confidence and success.

Image: www.coursehero.com

Understanding the Fundamentals of Options

An option is a unique financial instrument that grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. They are categorized into two main types: calls and puts. Call options confer the right to purchase an asset, while puts bestow the right to sell. These versatile instruments allow traders to speculate on the future price movements of underlying assets, hedge against portfolio risks, and generate income.

Unveiling the Lingo of Options

Navigating the world of options trading requires familiarity with key terminology. Some essential terms include:

- Underlying Asset: The asset (stock, commodity, or index) upon which the options contract is based.

- Call Option: Gives the buyer the right to purchase the underlying asset at a predetermined price (called the strike price) on or before a particular date (called the expiration date).

- Put Option: Grants the buyer the right to sell the underlying asset at the strike price on or before the expiration date.

- Premium: The price paid to acquire an options contract, representing the cost of the right to exercise the option.

- Intrinsic Value: The difference between the strike price and the current market price of the underlying asset, reflecting the profit potential if the option is exercised.

- Extrinsic Value: The additional value of an option beyond its intrinsic value, influenced by factors such as time to expiration and volatility.

Decoding Types of Options Strategies

The versatility of options trading lies in the diverse strategies it offers. Here are some popular options strategies:

- Covered Call: A strategy involving selling a call option against an underlying asset you own, allowing you to collect premium while capping your potential upside.

- Cash-Covered Put: Similar to the covered call, but selling a put option against cash, enabling you to potentially acquire an asset at a discount if the market price falls.

- Bull Call Spread: Involves buying a call option with a lower strike price and simultaneously selling a call option with a higher strike price, allowing you to profit from moderate price increases.

- Bear Put Spread: Similar to the bull call spread, but in the opposite direction, capturing profits from moderate price decreases.

- Straddle: A strategy where you buy both a call and a put option with the same strike price and expiration date, betting on significant price fluctuations either way.

Image: www.studocu.com

Harnessing Expert Guidance for Success

Mastering options trading requires both knowledge and practical guidance. Seek insights from seasoned experts to enhance your understanding of the strategies discussed above. Attend workshops, read reputable books, and follow trusted online resources to stay abreast of the latest advancements in options trading.

Embarking on Your Options Trading Journey

Options trading, while offering immense potential, also carries inherent risks. Before venturing into this realm, it is crucial to:

- Educate Yourself: Thoroughly understand the concepts and mechanics of options trading to make informed decisions.

- Manage Your Risk: Determine your risk tolerance and allocate funds accordingly, considering the potential for losses.

- Start Small: Begin with modest trades until you gain confidence in your ability to navigate market complexities.

- Practice Discipline: Adhere to your trading plan and avoid emotional decision-making, maintaining objectivity even in volatile markets.

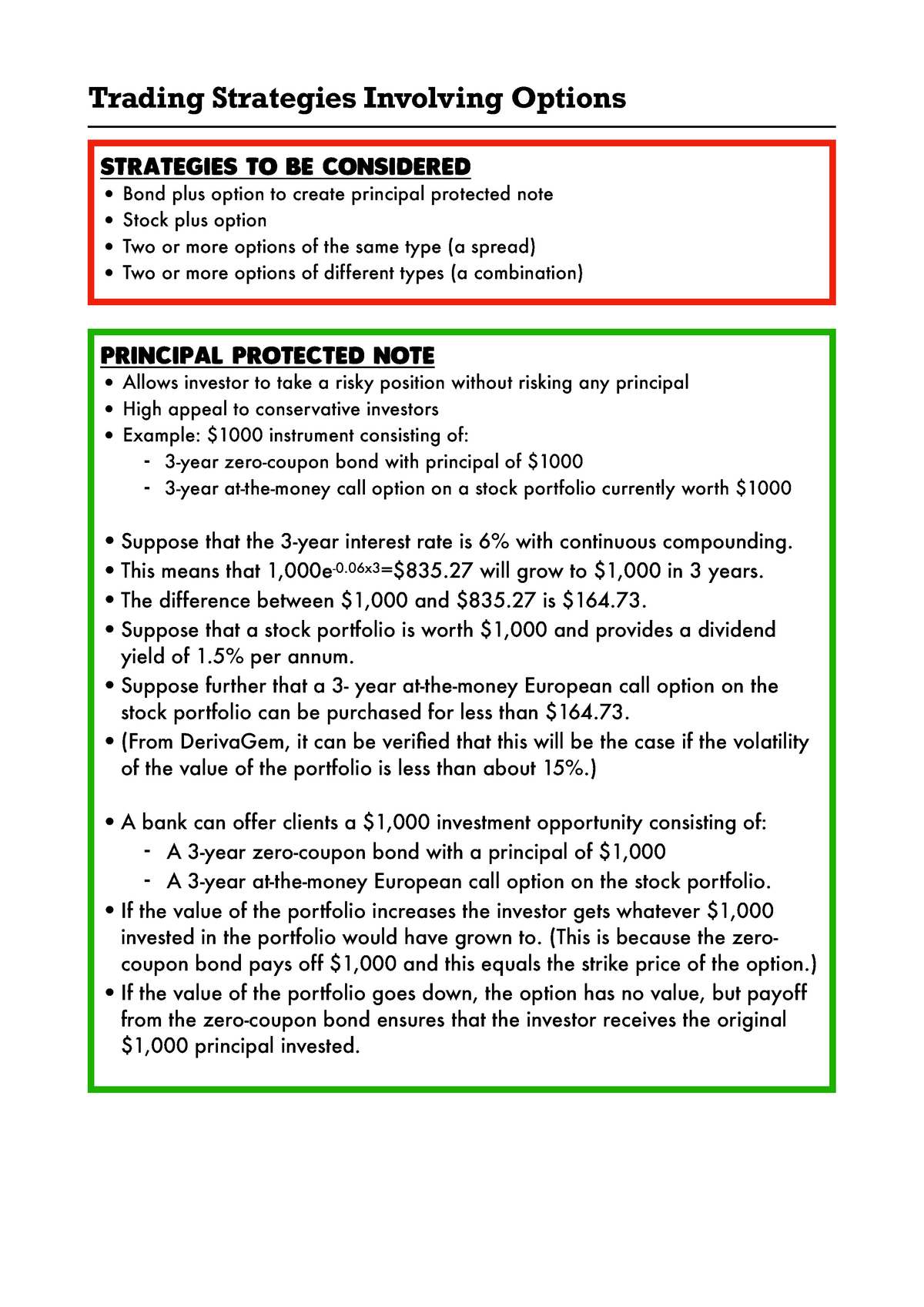

Trading Strategies Involving Options

Conclusion: Empowering Investors with Options Mastery

Options trading offers a powerful toolkit for investors seeking to harness market opportunities while mitigating risks. By grasping the fundamentals, embracing diverse strategies, and seeking expert guidance, you can unlock the full potential of options trading. Remember, investing involves inherent risks, but with knowledge and discipline, you can navigate the markets with confidence and achieve your financial goals. Embrace the world of options trading and witness the transformative impact it can have on your investment journey.