Are you ready to unlock the potential of stock market investing and take control of your financial future? If so, trading long call options is an opportunity worth exploring. Long calls, as they’re commonly known, are a powerful financial tool that can amplify your returns while hedging against potential downsides. In this comprehensive guide, we’ll delve into the world of long call options, empowering you with the knowledge and confidence to navigate this potentially lucrative investment strategy.

Image: www.chittorgarh.com

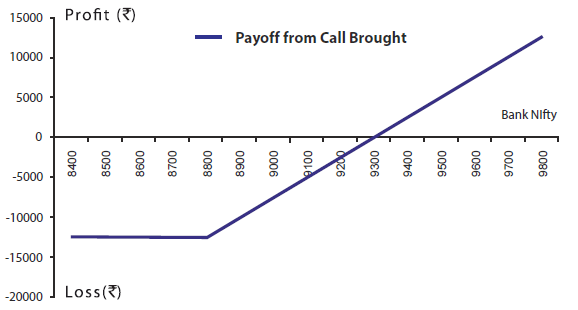

Let’s start by understanding the basics. A call option is a contract that grants you the right, but not the obligation, to buy a specific number of shares of a given stock at a predetermined price, known as the strike price. When you buy a long call option, you’re essentially placing a bet that the stock’s price will rise above the strike price before the option expires. If your prediction holds true, you have the potential to profit handsomely from the increase in stock value.

Benefits of Trading Long Call Options

Long call options offer several compelling advantages for investors:

- Geared Returns: Long calls have the ability to magnify your profits if the stock price rises significantly. This leverage can potentially generate outsized returns compared to traditional stock investments.

- Downside Protection: Unlike owning the stock directly, long call options provide limited downside risk. Your maximum loss is capped at the premium you paid for the option, unlike stocks, which can potentially lose their entire value.

- Flexibility: Call options offer flexibility in terms of timing and investment horizon. You can choose to exercise your right to buy the stock anytime before the option expires or simply sell the option to realize your profits.

How to Trade Long Call Options

Trading long call options involves the following steps:

- Identify a Stock: Choose a stock that you believe has the potential to rise in value. Consider factors such as the company’s financials, industry outlook, and market conditions.

- Set the Strike Price: Determine the strike price at which you want to buy the stock. The strike price should be above the current stock price but within a realistic range that has a reasonable chance of being reached.

- Choose the Expiration Date: Specify the date when the option contract expires. The expiration date influences the premium you pay for the option.

- Buy the Call Option: Once you have defined the parameters of the option, you can purchase it through a licensed broker. The premium you pay will depend on factors such as the strike price, expiration date, and the stock’s volatility.

Understanding Key Concepts

To succeed in long call option trading, it’s crucial to grasp essential concepts:

- Delta: Delta measures the sensitivity of the option’s price to changes in the underlying stock’s price. A higher positive delta indicates a stronger correlation between the option’s value and the stock’s movement.

- Theta: Theta represents the time decay associated with an option. As the expiration date approaches, the value of an option decreases, all else being equal.

- Volatility: Volatility measures the fluctuations in the stock’s price. Higher volatility generally leads to higher option premiums and increased potential for profit but also greater risk.

Image: www.youtube.com

Risk Management and Best Practices

While long call options can be a lucrative investment strategy, it’s essential to manage risk prudently:

- Diversify Your Portfolio: Avoid concentrating your investments in a single long call option. Diversify your portfolio across multiple stocks and options to mitigate risk.

- Set Stop-Loss Orders: Stop-loss orders can automatically sell your option if it falls below a predefined price, limiting your potential losses.

- Monitor Market Conditions: Stay informed about market news and events that could impact the stock’s price. Timely adjustments to your position may be necessary.

Trading Long Call Options

Conclusion

Trading long call options offers a powerful opportunity to potentially enhance your returns while hedging against downside risks. By understanding the key concepts, implementing sound risk management practices, and leveraging the benefits of long calls, you can harness the power of these financial instruments to achieve your financial goals. Remember, investing always involves a degree of risk, but by approaching long call option trading with knowledge and a disciplined mindset, you can increase your chances of success.